What keeps a billionaire 274 times over awake at night?

At first thought, it doesn’t seem like much would have tech magnates like Elon Musk burning the midnight oil while anxiety and dread sink in.

Care to see it for yourself?

Believe it or not, it’s one simple chart that’s haunting Elon Musk. It’s a chart that immediately puts Tesla’s head honcho into panic mode.

You see, it’s not the first time he’s come face-to-face with a very real threat to his dream of putting an electric car in every garage in America.

In fact, history is repeating itself all over again.

And it’s going to be even more fruitful to individual investors the second time around.

Before I show it to you, let’s hop in a DeLorean and rewind the clock seven years.

2015 was pivotal for both Elon Musk and Tesla. That year, Tesla built its first Gigafactory in Storey County, Nevada.

By January 2016, Gigafactory 1 went into operation, with six more being built since. As you now know, Gigafactory 1 was essential to churning out Model 3 electric motors and battery packs.

Make no mistake: Musk’s $274 billion fortune today was built on this moment.

But it wasn’t all fun and games for the billionaire.

You see, lithium prices were rather subdued when Gigafactory 1 became a fully armed and operational battery station.

And unfortunately for Musk, lithium prices soared over the next two years.

That’s putting it lightly too.

The cost of lithium carbonate — the key component in Tesla’s EVs — suddenly surged roughly 180% higher.

Fortunately, that price spike was relatively short-lived. After all, the market had gotten ahead of itself over the short-term demand for lithium.

Couple that with the fact that oil prices collapsed from a spat between OPEC and U.S. tight oil drillers, and lithium prices soon came back down to earth.

But not for long…

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Chart Haunting Elon Musk

So you want to see the chart that can give one of the wealthiest humans on the planet nightmares?

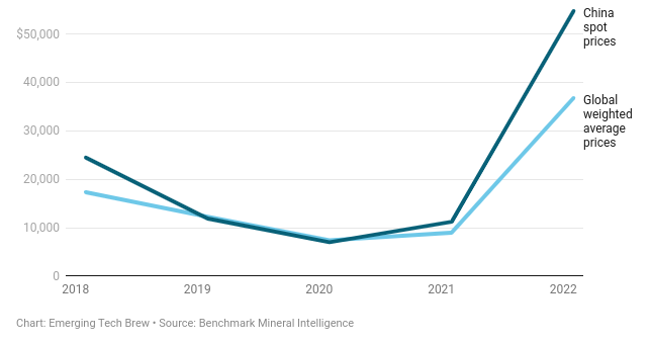

Take a look at lithium prices recently:

Like I said, history is repeating itself.

Except this time, Musk knows he’s in a much different situation.

Love him or hate him, Elon Musk understands his predicament all too well.

Back in 2015, he knew there would be a lithium crunch. That’s why he inked a lithium supply deal with a JV between Bacanora Minerals and Rare Earth Minerals.

Last year, Musk had to sit by powerlessly while the world’s largest metals producer, Jiangxi Ganfeng Lithium, scooped up Bacanora Minerals for a cool $391 million.

Soon after that, Musk was forced to secure his lithium supply with Ganfeng.

Well, it didn’t take a full 280-character tweet to announce that Tesla may have to get into the mining business.

Between his dependence on Chinese lithium sources and the fact that Tesla’s domestic deal with Piedmont Lithium has been delayed until as late as July 2023, does Musk have any other choice?

Well, it turns out he does.

Although it’s going to take years to kick-start lithium projects in the United States, there’s already a company producing battery-grade lithium that can help solve Tesla’s crisis.

And the best part is that these guys are doing it without operating a single mining project.

Instead, they’re using a proprietary technology that is changing the lithium game in North America.

Let me show you exactly how they’re doing it here.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.