You’ve never heard of “Linglong One” before… but you soon will.

Better known as ACP100, Linglong One is the first advanced small module reactor (SMR) to be approved by the International Atomic Energy Agency, which happened about five years ago.

Due to regulatory delays, construction wasn’t able to begin until recently. Once completed, the unit will have a generating capacity of 125 megawatts.

Well, better late than never.

Now, we may not be talking about a mountain of power here. The Three Gorges Dam holds a generating capacity of 22,500 megawatts.

However, this is a sign of things to come.

And China is ready to go nuclear.

Let me show you why…

The Last Energy Transition

I don’t think any of you would ever mistake the energy dynamic of China with that of the United States.

Ever since the tight oil and gas revolution radically transformed the U.S. energy landscape, the difference between ourselves and China has been like night and day.

You know just as well as I do that the combination of horizontal drilling and well stimulation techniques like hydraulic fracturing unlocked a vast wealth of oil and natural gas resources within the lower 48 states.

Within a few short years, we even reconfigured our LNG import facilities to ship U.S. LNG across the world. In fact, the U.S. exported a record amount of LNG during the first half of 2021.

It was a true game-changer in the U.S. industry.

And our veteran readers here at Energy and Capital have known for years that the U.S. coal industry has been in an irreversible death spiral.

But that makes sense, doesn’t it?

With the sudden availability of a massive supply of cheap natural gas from areas like the Appalachia region, coal simply couldn’t keep up.

And that’s a good thing!

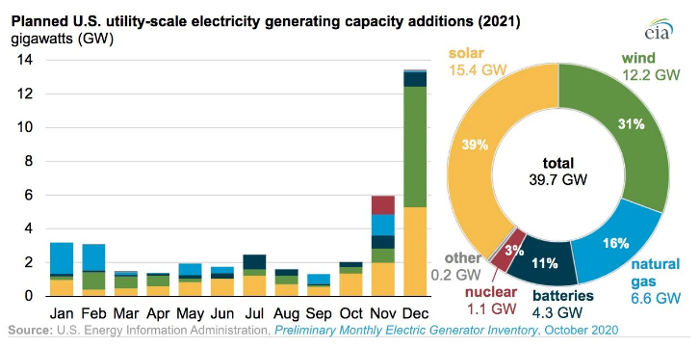

Not only is coal one of the dirtiest sources of energy on the planet (which admittedly too many people have taken for granted), but those coal plants are reaching a critical age where they’ll need to be decommissioned — yet virtually ALL of the new electricity-generating capacity being built in the U.S. involves wind, solar, natural gas, batteries, and nuclear.

Take a look for yourself:

Ahh, but China has taken a much different path.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

And for all the bluster and pledges the Chinese government has made insisting that the Middle Kingdom would be carbon-neutral by 2050, it’s hard to take its commitment seriously without nuclear power.

Current projections are that China’s population will peak at around 1.45 billion people in 2030.

And although the country’s population is expected to decline slowly after that year, the urbanization rate will rise dramatically.

By 2050, China’s urban population will hit 1 billion people, with an urbanization rate of 72%.

That’s why the Chinese government is more than happy to stick with coal power for the time being.

Unfortunately, the massive shale gas resources beneath China’s soil are still locked, and the same technology and drilling techniques that have opened up our own wealth of natural gas here at home hasn’t been able to do the same there.

Imagine being desperate for a source of power that’s cleaner than coal and having 1.1 quadrillion cubic feet of technically recoverable shale gas just out of reach!

Their frustration must be maddening.

So in spite of all the promises and boasts of a carbon-neutral China by 2050, the country is building an army of coal-fired power plants right now, and the country’s coal imports soared during the first half of 2021.

Today, nearly two-thirds of China’s electricity comes from coal power. Hydro power accounts for roughly 20% of its power, with wind and solar making up almost 9%.

So where will the Chinese look to displace the enormous amount of coal the country uses today?

That’s easier than you might think… which brings us right back to Linglong One.

You see, China isn’t the first country to realize the vital role that nuclear energy will play in a carbon-neutral world.

These compact nuclear stations will be embraced by every country with the right technology and desire to rid itself of the shackles of coal.

In the United Kingdom, NuScale Power is looking to start the regulatory process for its mini-nuclear plants within the next few months.

Here in the United States, the SMR market is in its infancy, which is precisely what individual investors like us can capitalize on.

Even more intriguing is that my readers have already uncovered one stock still flying under Wall Street’s radar, and it doesn’t have to build a single reactor to rake in a small fortune for its shareholders.

Go ahead — check out all the details for yourself firsthand.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.