We all take things for granted.

You, me, everyone around us, and you know what? Most of the time, we don’t even realize we’re doing it, whether we like it or not; only rarely are some people able to step out of the bubble, peer back over their shoulder, and recognize what’s going on — fewer still are able to understand the situation enough to take advantage of it.

This is precisely what’s happened when it came to U.S. energy dominance.

But I’m not even referring to oil today, despite the fact that our domestic crude production hit an all-time high in March.

No, I’m talking about natural gas.

And now it’s time we take a step outside of the bubble and look back to see what’s ahead.

More importantly, it’s time we see the opportunities for what they truly are.

Consumption Junction, What’s Your Function

The veteran members of our investment community know that the most powerful driver for energy prices, be it a cubic foot of natural gas or a barrel of crude oil, are the supply and demand fundamentals taking shape in the market.

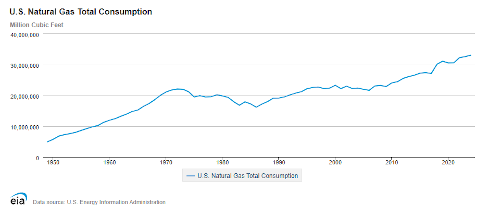

So it’s with this in mind that we’ll kick off our outlook for natural gas over the short, medium, and long term. If there’s one truth nobody can deny right now, it’s that our demand has been growing strong for almost 40 years!

Go ahead and take a quick look at U.S. natural gas demand since 1949:

If you’ll notice, our gas consumption started to level off after the year 2000, and even declined through 2008. The reason why is pretty simple, too. Production during that period was relatively flat, and we actually started building a dependence on LNG imports more than doubled.

Then everything changed as the tight oil and gas boom kicked off around 2008. Within a decade, our natural gas imports were cut by nearly 50% as tight gas output from areas like the Marcellus Shale surged higher.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

As you might expect, the higher supply put intense pressure on prices; it was only a matter of time before natural gas at the Henry Hub were trading below $2 per MMBtu:

That ultra-low commodity price environment is what caused a demand to grow, as well as the death of the coal industry. Yes, strong growth in wind and solar generation helped move us away from coal, but the true culprit has always been cheap and abundant natural gas.

The thing is, our demand for more natural gas will continue rising in 2025 and 2026. In fact, we’re coming off back-to-back record consumption years for gas, primarily driven by our increased thirst for electric power. U.S. electric power demand grew 4% year over year in 2024.

But here’s where it gets a little sticky…

You see, 2023 and 2024 were two record years for heat, and although current forecasts aren’t projecting record-setting temperatures, this summer is still expected to be hotter than average.

In other words, weather will help shape short-term demand for natural gas, and we don’t expect much demand relief as Americans start blowing that A/C to escape the heat — if they haven’t already!

However, the situation grows more bullish over the medium and long term. The EIA’s numbers show that higher demand from U.S. LNG exports will offset the warmer-than-average spring we’ve had so far.

You know as well as I do that U.S. LNG exports have become a critical energy source for EU countries ever since the Russian-Ukrainian war kicked off in 2022.

If you think that countries like Germany want to go back to importing natural gas after any peace is reached, I have some bad news for you. The fact that Putin completely shut out Germany from natural gas pipeline exports is proof that Europe desperately needed to diversify their energy supply.

Looking even further out, further demand strength will come from the rapidly growing power needs to fuel tomorrow’s data centers. President Trump’s $500 billion push for Project Stargate is leading us down a path of massive infrastructure buildouts to support the feverish AI arms race taking place right now.

The future demand from those data centers alone are enough to keep investors bullish, especially considering the fact that natural gas will account for 40% of our electric power demand over the next two years.

Yet this is just one side of the equation, isn’t it?

Tomorrow, we’re going to delve into the supply side of this sector. And here’s a bit of a spoiler: It’s not as rosy as you might think!

Stay tuned.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing's Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.

P.S. Trump just signed a historic executive order that could spell the end of federal income tax — replacing it with direct payouts from a $1 trillion national investment fund. Everyday Americans may now be eligible to collect checks worth up to $21,307… but only if they act before the first round goes out. Claim your stake before it's too late.