A drop in the price of gold and silver — besides fears of a recession and an economic downturn amid the coronavirus outbreak — has created a demand spike for the metals so large that bullion dealers around the world are selling out!

Spot gold closed yesterday at $1,496 per ounce, a 9% decline over the last 30 days. Meanwhile, spot silver closed yesterday at $12.57 an ounce, down 32% over the past month.

Gold/Silver Spot (at last look)

Source: Barchart.com

Source: Barchart.com

The plunge in metals has created buying interest so strong that dealers, distributors, even the U.S. Mint can’t keep up with demand.

A week ago, the Mint announced it had temporarily sold out of American Silver Eagle bullion coins. It wrote to its bullion distributors:

Our rate of sale in just the first part of March exceeds 300% of what was sold last month. West Point is working diligently to produce additional inventory and once additional inventory is produced, we will again begin allocations.

According to the Mint’s data, sales of one-ounce American Silver Eagle coins for the month sits at 3.18 million compared with total sales of 850,000 in March of last year.

Meanwhile, the Mint’s sales of gold Eagles are also very strong. According to its sales data, the Mint has sold a total of 152,500 ounces of American Gold Eagle coins in March so far. That’s over five times higher than March 2019 sales of 28,500 ounces.

Putting an additional strain on bullion supplies, the Royal Canadian Mint (producer of the popular Gold and Silver Maple Leaf bullion series) announced on Friday that it was closing for two weeks because of the coronavirus pandemic.

Meanwhile, Australia’s Perth Mint (another major bullion producer) has also suspended silver bullion sales.

Dana Samuelson, president of bullion dealer American Gold Exchange, was quoted in MarketWatch saying:

With both the U.S. Mint and the Royal Canadian Mint on back order for the most popular one-ounce gold and silver coins in the North American market, dealers have scrambled to buy anything that remains available to buy, driving bids substantially higher for all physical gold, silver…coins and bars that are immediately available.

As a result, there are now shipping delays of between three and 15 days from every major metal bullion dealer in the industry.

And most have temporarily enacted a purchase minimum of $300.

Apmex, for example, has a note on its homepage that reads:

Provident Metals, JM Bullion, SD Bullion, Silver.com, and Kitco — every one of them has similar statements on their homepages.

They’re so busy, they won’t even answer the phone. JM Bullion recently wrote:

Over the last few weeks, we have seen record order volume, with yesterday being our largest sales day of all time. We are on pace for another record day today. As a business, we are doing everything we can to keep up, but with a 3-7x increase in order volume, we are unable to answer our phones and ship orders as quickly as usual.

Beyond shipping delays and purchase minimums, a lot of physical bullion is out of stock.

Much of the “cheap” silver (that’s silver bullion that sells for the lowest premium over spot) such as random-date Silver Eagles, random-date Maple Leaves, generic silver rounds, and silver bars have sold out.

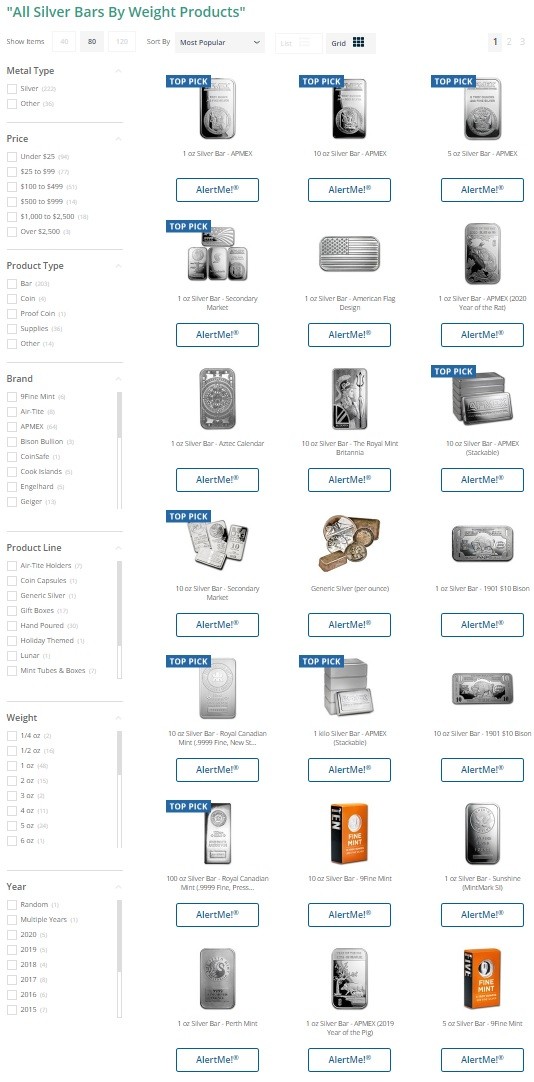

In fact, as of writing this, I couldn’t find a single major bullion dealer with any silver bar of any weight available; one-ounce, 10-ounce, 100-ounce, 1,000-ounce bars… all out of stock. Buyers have simply cleaned them out. (This is just from the major bullion dealers I’ve mentioned here. Silver bars from smaller dealers can be found on eBay and Amazon; however, they likely won’t be cheap).

Here’s a screengrab from APMEX’s website searching all silver bars by weight:

In a statement regarding shipping delays, purchase minimums, and inventory, Provident Metals wrote:

Our website is sold out of almost all bullion products across all metals. We have secured several million ounces of silver and tens of thousands of ounces of gold to arrive in the coming weeks. We are being conservative about preselling these future deliveries, given the current uncertainty in the supply chain. As products arrive to our vault, we will relist them on our website.

Some silver bullion products, like graded silver Eagles and junk silver coins, are still available. However, graded silver Eagles (generally those that come in a hard plastic case from PCGS or NGC) are priced for numismatic collectors, not investors looking for silver bullion that sells closed to spot.

And junk silver coins don’t have a good resell value. They can’t be legally melted down, and their purity is only 90%. Typically, when you go to resell junk silver coins, you will get lower than the spot price. So junk silver coins aren’t the best for investment purposes.

Bullion dealers have sold out of many gold products as well. Fractional Gold Eagles, Gold Maple Leaf, and other small coins and bars are harder to find right now. Even ungraded, random-date American Gold Eagles aren’t easy to find. But there are more gold products available than silver right now.

Do you own gold or silver already? Tried to buy some recently? Let us know on Twitter.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.