What is the future of natural gas?

At first glance, it’s an easy answer: It’s LNG, isn’t it?

That’s probably the first thing that pops into the head of any investor looking to get a jump on natural gas investments… and it should.

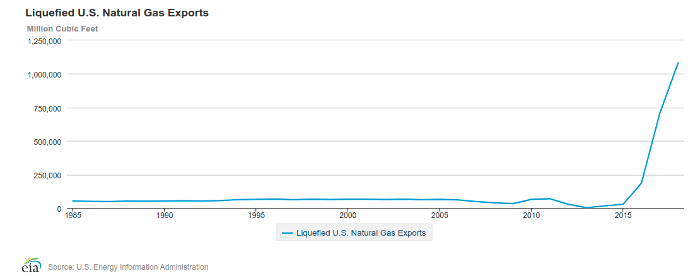

Just consider the growth.

The first application to export liquefied natural gas out of the U.S. arrived on the Department of Energy’s doorstep back on August 11, 2010.

It took less than four weeks for it to get the green light.

Then Cheniere Energy became the first U.S. LNG exporter after a shipment left its Sabine Pass terminal in February 2016.

That year, approximately 187 billion cubic feet of liquefied natural gas was exported from the United States.

Two years later, our LNG exports had grown nearly six-fold to more than 1 trillion cubic feet:

In 2019, we surpassed that amount in the first eight months of the year.

Shell’s “LNG Outlook 2019” painted a very bullish picture for us, reporting earlier this year that global LNG demand will reach 384 million tonnes by 2020.

Of course, LNG exports that would tap into strong Asian demand would immediately pop into anyone’s head as the best natural gas investments going forward.

But what if they aren’t?

What if I told you that just ONE country bought more U.S. natural gas than all of our LNG exports combined?

Not only did this premium customer buy up 1.7 trillion cubic feet of U.S. natural gas in 2018, but its thirst for natural gas is climbing at an alarming rate.

And no, I’m NOT talking about China.

Who is this mystery shopper?

Take a look south of the border, and you might be surprised to find that Mexico is buying a staggering amount of our natural gas:

Now, here’s the catch…

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Locking up LNG Profits in 2020

You might think companies are restricted to a certain amount of natural gas they can send to Mexico.

That’s true for the most part, since there’s only so much pipeline capacity that flows into Mexico.

But that may not be the case for much longer.

Right now, the Department of Transportation is weighing the decision to allow companies to transport LNG by rail.

For areas with pipeline constraints — areas, say, like the Permian Basin, where pipeline bottlenecks have become common — this would be a game-changer for the U.S. LNG market.

Think it’s crazy? Well, keep in mind that this won’t be the first time it’s been done.

Truth is, we’ve already tried it out in Alaska.

Back in 2015, Alaska Railroad was granted a two-year permit that would let it ship a dozen LNG cars per train during this pilot project.

Although the final decision won’t come for another few months, approval would be a boon for major rail players.

If Trump green-lights LNG-by-rail, perhaps the biggest winner might just be Union Pacific (NYSE: UNP), one of the largest providers of rail transportation between the U.S. and Mexico.

More importantly, Mexico’s reliance on our natural gas will grow even higher as more of its gas-fired power plants come online.

Now, Trump is about to open up another door for exporters.

Will you be ready?

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.