Michael Bloomberg is worth $96.3 billion, and his greed could make you a small fortune.

And if you were paying close attention, you would’ve known this more than a decade ago.

Back in 2011, the Bloomberg Philanthropies and Sierra Club joined forces to create a national campaign called Beyond Coal with one single goal in mind — destroy the U.S. coal industry at any cost.

It was a war of attrition, one plant at a time.

Fortunately for Bloomberg and his ragtag crew of environmental superheroes, they had an unlikely ally that did most of the legwork.

I won’t begrudge their efforts too much, but there has been one thing that has played a far larger role in their endeavor: natural gas.

The advent of cheap, abundant shale gas that emerged after 2008 did more to damage the coal industry than anything else on this planet. That’s not to discredit the role that renewables played, mind you, but if we're going to hang our hat on something, it's certainly natural gas. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

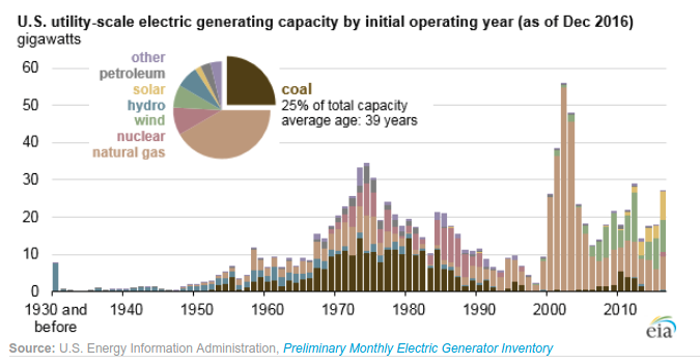

After all, we built a tremendous amount of natural gas generation capacity leading up to the shale boom:

Coupled with the fact that the average age of our coal plants is about 45 years old, something had to pick up the slack. Even the plants built in the 1980s and 1990s are starting to make plans to retire.

More importantly, we’re not building any new ones.

For Bloomberg and friends, it was like shooting fish in a barrel.

So they set a new goal to finish the job of killing every last coal plant in the United States by the end of the decade.

Well, there are about 372 of them left, and I guarantee they won’t put up much of a fight.

In fact, Bloomberg just announced this past Wednesday that he was committing another $500 million to his anti-coal efforts…

Except his greed to annihilate the coal industry is going to make some investors a veritable fortune.

You see, love him or hate him for his efforts, there are some harsh realities that most people don’t realize — the biggest of which is that renewables are nowhere near ready to take on America’s energy burden.

Killing the coal industry is an inevitability.

Look, I know — and agree — that sources like wind and solar have made significant progress over the past decade; those two energy sources account for 65% of planned additions to electricity capacity in 2023.

Thing is, it would be utterly impossible to displace natural gas from its throne atop the U.S. electric power sector:

But I want you to look past wind and solar for a moment and instead focus on another up-and-comer that is picking up steam — batteries. Batteries for stored energy will account for 17% of new capacity this year.

However, there’s one major hurdle that must be overcome first.

You know just as well as I do that the U.S. is sorely dependent on foreign sources of key ingredients for battery technology, especially lithium.

Without a strong domestic supply of lithium, we might as well hand our wallets over to China, which controls over half of the world’s lithium refining capacity.

Well, that situation may have just taken a turn for the better, with one lithium stock looking to change the game entirely.

This is something you absolutely have to see for yourself.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.