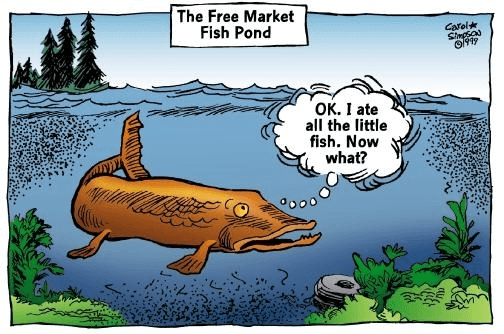

My parents always claimed the "free market" would solve any and all problems.

If a business or new form of technology didn’t succeed, it's because the judge, jury, and executioner of the market deemed it unworthy.

If solar doesn't succeed, it’s because coal and oil are just better. If electric cars fail to catch on, it’s because gasoline engines are what nature intended. In their perfect world, everything that exists does so because of pure economic fairness.

I wish I shared that optimism, honestly.

Anyone familiar with economics knows that’s not usually the case. The 100% free-market mindset completely ignores one of the most powerful principles of economics: venture capitalist distortion.

Thanks to deep-pocketed investors, companies can afford to operate at a loss for years without going under.

This gives them an obvious advantage over other established businesses that succeeded on merit alone. More than a few mom-and-pop shops have met their end thanks to these vampires.

That concept brings us to the main point of this article: F*** Uber!

Ride-Sharers Need to Share the Wealth or GTFO

It sounds cynical, but Uber was designed as a Wall Street takeover of the transportation industry.

Venture capitalists with more money than sense provided a nearly limitless stream of funding, allowing Uber to swell far beyond sustainable size. That guaranteed revenue stream allowed prices to stay low, attracting more riders.

There’s just one catch, though: Uber can’t survive like this forever. And company executives are well aware.

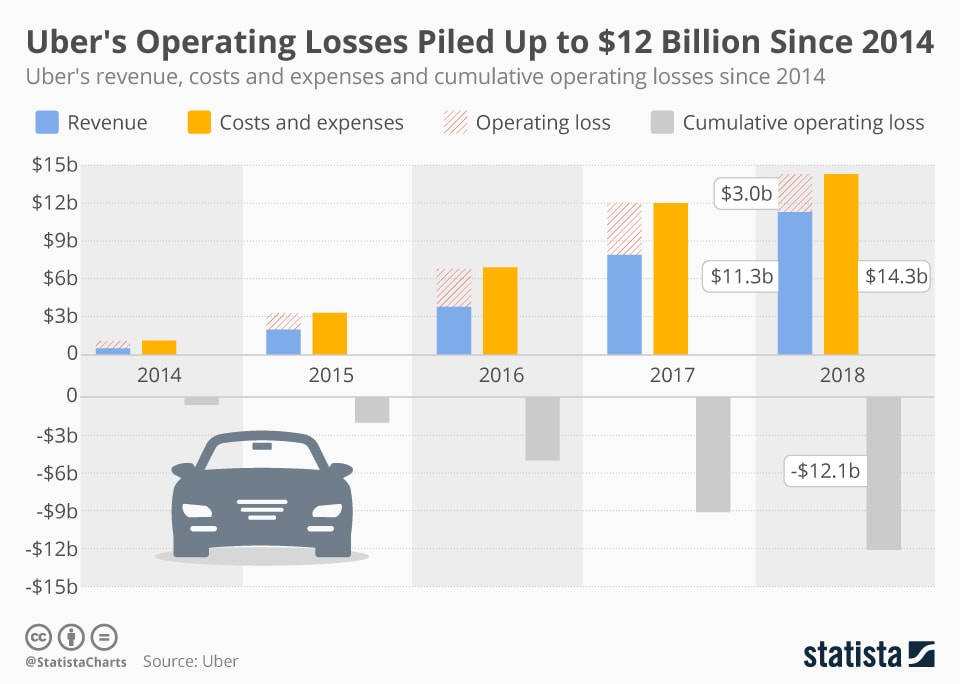

You see, Uber doesn't technically make much money. Revenue is often in the $5 billion–$7 billion range, but the company has been operating at a loss for nearly all of its 13 years.

To date, Uber has only reported a few profitable quarters. Yet the company continues to grow at an incredible pace, adding more supported cities every day.

Does that seem fair to you? Big-wig investors are essentially propping up a business that should’ve died long ago.

A free-market purist like my father would claim that this is just the market at work. Uber offered a better service at an attractive price, so taxis and public transit were left in the dust.

But is that really the case here? If investors decided Uber wasn't worth their time, the company would fold overnight. There’s something else keeping this shell of a company alive.

It’s a Gamble That Just Might Pay Off

Capitalist gambling is essentially keeping Uber running at this point. But investors aren't burning money just for fun.

At its core, Uber’s business plan has always been to artificially lower prices with VC funding, kill off competing forms of transportation, and then raise prices and enjoy its new monopoly.

This isn't a new play. Netflix and rest of the streaming services offered low prices and no ads to drag viewers away from cable TV. Once they had a captive audience, there was no longer an incentive to keep prices low.

In Uber’s case, taxis and public transportation were the targets. A few recent studies showed that ride-sharing decreased overall bus traffic in cities by as much as 12%, and taxis almost completely went extinct.

In less than 10 years, these vampire capitalists used their financial power to completely change the way the world travels.

If that doesn’t terrify you, I’m not sure what will.

Companies like this are the exact opposite of what we look for at Angel Publishing. Our editors can spot this particular brand of market trickery from a mile away. It’s one of the oldest tricks in the book.

Don’t get me wrong, Uber may still yet hand its investors a significant payday. But it will only happen after the destruction of our current public transportation system.

That’s not exactly a recipe for long-term sustainability — one of the biggest factors we consider for our stock picks.

Our editors use a proven methodology that filters out the Ubers and Netflixes of the world, leading individual investors to small-cap companies with huge potential.

Right now, one of the fastest-growing industries on Earth is waking up from a long COVID slowdown. That means incredibly talented companies are priced way below their true value.

You don’t need to be an expert yourself — that’s what we're here for.

You don’t even need a credit card. This presentation is absolutely free. To see exactly what I’m talking about, check out the details here.

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital