Are you looking at the oil sector the wrong way?

I know it looks ugly from the outside.

And I certainly wouldn’t blame anyone for being cautious, especially when your eyes turn toward a chart of oil prices in 2020.

I should warn you, it’s about as bad as it gets:

But just because the bears are in full control doesn’t mean you can’t turn low prices to your advantage. No matter how low oil goes from here, there’s always an opportunity that’s ripe for the picking.

I’ve bought three new oil stocks since oil prices took a running jump off a cliff a few weeks ago.

It was the first in a series of trades that I’ve been waiting a long, long time to pull the trigger on.

Look, I know it’s easy to see the blood in the streets.

In the oil and gas sector, a lot of very difficult decisions are going to be made as companies slash spending across the board and hunker down for the long haul.

Some of those companies learned their lessons from the last price crash and will be able to weather this storm. Others haven’t and are hurtling towards bankruptcy.

That’s what happens when prices fall more than 60% in less than three months.

And despite the bloody waters in the market, all three of those trades are running in the green.

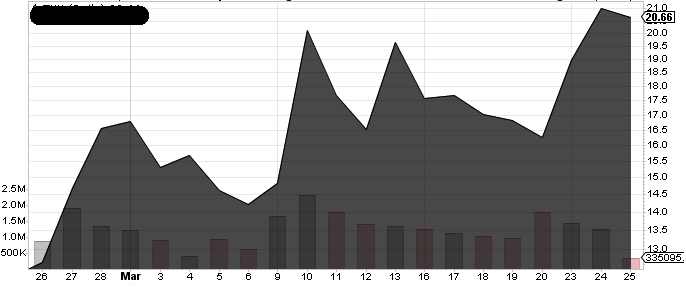

Here’s a look at how just one of those oil stocks has performed over the last four weeks:

How many stocks do you know that have jumped nearly 70% throughout this mess?

That success wasn’t based on luck, and it certainly wasn’t a secret, either.

In fact, I’ve told you exactly where my trading focus will be during a period of low commodity prices.

If there’s one thing we’ve learned by now, it’s that there’s always money to be made in oil… crash or no crash.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Crude Realities: From Bad to Worse

Don’t get me wrong, dear reader, things are about to go from bad to worse for oil prices.

Not only has the global economy ground to a halt over this pandemic, but this all but ensures that one helluva oil glut is looming ahead.

Rystad Energy recently projected that the greatest supply glut we’ve ever seen in a single quarter is right around the corner, creating a supply/demand imbalance of around 10 million barrels per day.

Its analysis also shows that roughly 76% of the world’s oil storage is at capacity.

Throw in a little production war between Russia and Saudi Arabia, and things look even more grim.

Fortunately, history has a little knack for repeating itself.

The only difference is that this time around, you’ll be prepared.

Like I said, it’s not random luck that certain stocks are able to weather oil price crashes better than others.

Last week, I told you about the growing strength in the tanker markets. If Rystad’s ominous projections come true, and we’re faced with an unprecedented supply glut, those VLCCs will become wildly profitable for large producers that need a place to park their crude.

In the meantime, there are other actions that individual investors like us should be taking right now — finding those hidden gems.

Specifically, we should be identifying those value-priced companies whenever they pop up.

Two weeks ago, I mentioned Valero, one of the largest oil refiners on the planet.

After the 2008 financial crisis, when oil prices plummeted to $26 per barrel, investors were given the opportunity to pick up shares of Valero for under $15.

The availability of cheap crude helped push shares 726% higher over the next decade!

Today, the stock is trading at under seven times its trailing 12-month earnings, offers us an 11% annual yield, and will be poised to make a monster comeback when the world’s economy gets kick-started again.

The first rule in energy profits is to always think long term.

Although we haven’t hit bottom yet, we’re close.

Don’t make the same mistake that many investors made during the last oil crash. The smart money will be perfectly positioned for the next leg up.

I can only open the door… the next step is up to you.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.