Everyone wants control.

It’s been that way throughout history, and when that power is attained, rarely does one wish to give it up.

In the oil industry, it was the “seven sisters” that dominated and controlled the world’s supply of crude. You may not recognize some of the names like the Anglo-Persian Oil Company, Texaco, or Standard Oil of New York.

But believe me, you know them better than you think…

Except today you’ll recognize them by their contemporary names like BP, Chevron, and Exxon Mobil.

Together with companies like Royal Dutch Shell, Standard Oil of California, Gulf Oil, and Standard Oil of New Jersey, these massive entities made up a powerful cartel of oil companies that ruled over the global oil industry in the early 20th century.

Then one day in 1938, one of them struck oil in Saudi Arabia after drilling the Dammam No. 7 well that changed everything.

It wasn’t until the 1970s that Saudi Arabia increased its stake in Aramco, a company previously known as California-Arabian Standard Oil that had concessions to explore for oil in Saudi Arabia.

I can’t say I blame the House of Saud for wanting to control the country’s oil resources, and the company was fully nationalized by 1980.

In fact, it wasn’t long before the original “seven sisters” gave up control over global oil reserves. And while the international oil companies that you know today, such as BP, Chevron, and Exxon mobil, are still quite large in their own right, their size pales in comparison to the world’s national oil companies.

And now Chile is taking a page from Saudi Arabia’s playbook… Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Lithium Profits 101: Beware the Hype

Last week, we talked about the announcement made by Chile’s president regarding the nationalization of his country’s lithium industry.

But rather than seizing projects and expelling foreign companies like what happened in Venezuela, President Boric’s plan to work SQM and Albemarle is sound.

The wheels are now in motion, and you have to wonder how long it will be until “LiPEC” is formed.

But I digress…

One of the more interesting parts of President Boric's announcement wasn’t that Chile was bringing the lithium industry under the government’s control.

Rather, it was the hint he dropped regarding HOW they’ll be extracting lithium from the ground.

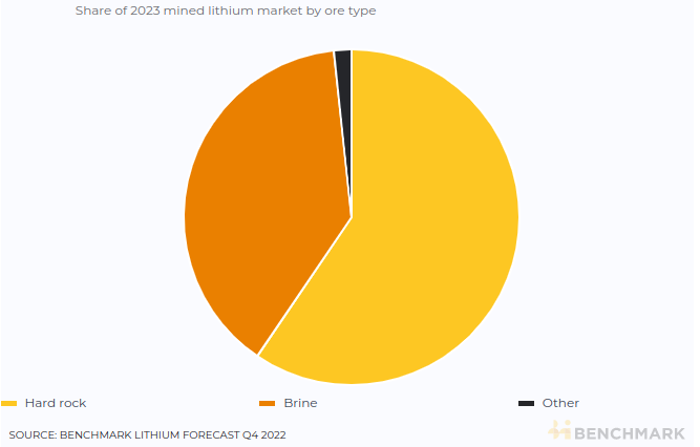

Look, when it comes to lithium extraction, there are only two primary ways you do it: traditional hard rock mining or lithium brine extraction.

The first is exactly what you think it is.

Conjure images of massive open mining pits, where tons upon tons of rock is mined, crushed, milled, and then sent off so the minerals can be separated.

That’s how the world gets roughly 60% of its lithium supply currently.

The latter method involves giant evaporation ponds that are filled and then sit for up more than a year before the lithium can be separated. It’s an intense process, and for the most part it's how lithium is extracted in countries like Chile.

However, President Boric has other plans to get the valuable lithium locked underground. He touted a newer method known as direct lithium extraction (DLE), which can remove the metal from a brine without the need to evaporate.

And that, dear reader, is where the red flags started appearing to me.

Don’t get me wrong, DLE is certainly a promising technology.

In the United States, we actually have a large base of lithium reserves, but you won’t see evaporation ponds anywhere here. That’s because a lot can go wrong, and we simply don’t have the climate to support those operations.

And the only active lithium mine is located in Silver Peak, Nevada.

Perhaps calling DLE a game-changer right now is a little premature… at least, not yet..

You see, while DLE is a proven technology, we haven’t seen it scale commercially yet. All that's out there right now are a few pilot programs, one of which has gone through two or three iterations as the technology is tweaked.

Was President Boric just offering a bit of hope to keep environmentalists at bay and hype up the ESG crowd?

Perhaps. But what is crystal clear to everyone is that it’s only a matter of time before Chile fully nationalizes its lithium industry — they’ll just wait till they’re good and ready.

That brings us to where the lithium profits will be found in the market today.

That’s easy — just look next door to Argentina.

But interestingly, you don’t have to stick to the lithium triangle in this market.

Just as DLE technology offers us a peek into the lithium industry’s future, there are other technologies that are commercially viable RIGHT NOW that will be grabbing more of the spotlight going forward.

If you give me just a few moments, I’ll show you one of them right here.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.