Be careful what you wish for.

Believe me, I know things feel great when energy is cheap. According to AAA, gasoline prices are averaging about $3.10 per gallon.

Granted, we’ll have to give my California readers an exemption. They’re paying an average of $4.66 per gallon thanks to a brutal set of taxes and regulations. Besides, California has its own energy crisis to worry about, so let's give them a bit of a break this time.

If you want to know just how good we have it right now, just consider that when adjusted for inflation — and with the exception of 2020, when COVID decimated demand — prices at the pump haven’t been this cheap since 2016.

But hey, relief at the pump for U.S. consumers is a good thing, no matter how you slice it; years of shelling out more and more to fill up your tank can turn into quite a burden on a household budget.

And by all accounts, prices may be headed lower, too!

Not only are we heading into the colder months, when demand is seasonally at its weakest, but U.S. domestic oil production has been astonishingly resilient. I’ll admit that I never thought we’d see operators successfully overcome the low-price environment they’re currently stuck in.

Looking at the EIA’s most recent Monthly Supply Report, it appears that U.S. output hit a new record of 13.6 million barrels per day last July. But what’s even more impressive are that preliminary reports are leaking out now that output has topped 14 million barrels per day this month.

Everyone needs to understand just how significant that is, because it’s going to give us a better understanding of what’s to come in 2026.

Then, you’ll get a clearer picture of why things could go terribly wrong.

When I told you earlier this month that the U.S. shale business was broken, those weren’t my words. No, they were coming right from the same people that are pumping those millions of barrels to the surface each and every day.

Remember, earlier this year we learned just how much oil needed to trade for companies in Texas (which accounts for roughly 40% of our total crude production right now) — $65 per barrel.

Let that sink in as WTI crude traded for under $59 per barrel last Friday.

Right now those drillers are begging for help. It’s just that nobody is listening because we’re all too busy smiling on our way to the gas station.

Just be careful what you wish for.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

My veteran readers may remember a time before the U.S. production was on life support. Maybe some people don’t want to remember those days, preferring to stay optimistic that our tight oil production will climb forever (spoiler: It won’t.),

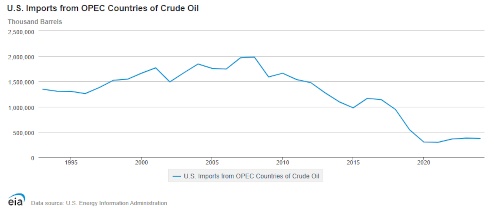

And I’d like everyone to burn one chart in your mind as you’re filling up your tank this weekend. It’s a simple chart that shows how much we relied on OPEC for our oil supply before the shale boom took off:

In 2008, right before tight oil plays like the Bakken became a household name, we were buying up almost 5.4 million barrels of oil from OPEC every day — more than five out of every ten barrels of crude we imported that year.

People forget just how shackled we were to OPEC supply. Today, most people don’t even bat an eye as they take our oil output for granted. After all, our shale patch is a never-ending carousel of energy, isn’t it?

Not exactly.

Now that WTI crude has fallen back into the $50/bbl range, I can’t help but think of how many members in the House of Saud are grinning ear-to-ear.

I once told you that $50 oil was a myth — I was wrong. There’s no denying that production growth in the lower-48 states has been nothing short of incredible.

The fact that drillers are extracting and surviving on drilling efficiencies alone is a testament to the U.S. oil industry.

Whenever oil gets this cheap, it becomes a screaming buy for individual investors like us. Remember, $50 oil today is like $30 oil back when the shale boom began. All the prayers and wishful thinking in the world won’t let companies ignore economics forever.

As we watch the entire sector sell-off with plummeting oil prices, it comes down to finding the true investment gems in regions like the Permian Basin that will not only survive low prices — they’ll be among the biggest winners when reality comes calling.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.