In the spring of 1901, the small East Texas town of Beaumont found itself at the center of something that felt like a miracle and looked like a disaster.

A well called Spindletop erupted with such force that it shot a column of crude oil 150 feet into the air and flowed uncontrollably for nine straight days. The gusher wasn’t just a spectacle — it was the beginning of the U.S. oil age.

Before the Spindletop gusher, which spewed 100,000 barrels per day into the air before it was brought under control, the idea that the United States could dominate global oil markets was laughable.

Afterward, it became inevitable.

But like all booms, the initial frenzy created as much confusion as it did wealth. Everyone saw the bubbly crude, but no one understood the limits — or how fast it could vanish.

Today’s oil market carries that same tension, with plenty of noise and very little clarity. Prices are hanging out in the low-$60s, and the usual suspects are back with their favorite bedtime story — that the world is oversupplied.

Goldman analysts are sketching out scenarios where Brent crude drops to the low $50s by late 2026. The IEA is parroting forecasts of plentiful supply and cooling demand.

Is it me, or does this sentiment feel more like a recycled sitcom plot that worked once and just keeps getting re-aired.

But here’s the quiet part no one’s amplifying: crude oil output in the United States isn’t growing.

Truth is, it’s stuck.

The most reliable oil reports from the EIA come from its Monthly Petroleum Report, which showed U.S. crude oil output clocking in at 13.46 million barrels per day as of April 2025.

For the record, that’s almost exactly where it was in January.

No spike or production surge in sight… yet that doesn’t stop the mainstream headlines from flashing the “All IS WELL” sign by using production numbers that include more than crude oil.

Whenever you see overly optimistic rhetoric dismissing any notion of flat output by reporting that U.S. oil production comfortably climbed to 20.8 million barrels per day, keep your skepticism in place. Then calmly point out that using total liquids production only strengthens our case that U.S. oil wells are getting gassier as drillers run through their Tier 1 acreage.

This bait-and-switch is everywhere, mind you.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Meanwhile, the real growth story is disturbingly narrow… and it’s absolutely shocking at how few oil regions are truly putting up good results.

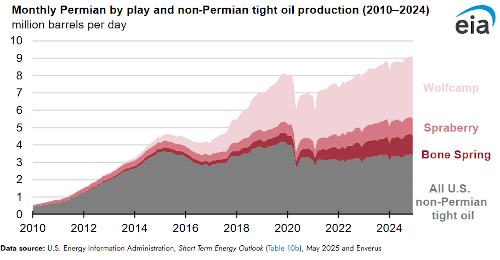

Just ten counties in the Permian Basin (yes, ten!) are responsible for 40% of all U.S. crude oil and lease condensate production.

In fact, those same counties have accounted for 93% of U.S. production growth since 2020.

And within that, it’s mostly just three rock formations — the Wolfcamp, Spraberry, and Bone Springs — that have done all the work.

If Brent does fall into the low $50s as Goldman forecasts, that’s the end of the road for new production; rigs around the world will go quiet, capital budgets will be slashed, and new exploration activities will dry up.

Even now, with WTI prices in the U.S. barely treading water above $60 per barrel, the number of rigs actively drilling for oil are hitting a four-year low.

These aren’t growing pains — they’re signs of a machine slowing to a crawl, propped up only by engineering ingenuity and cost discipline.

To be fair, U.S. petroleum engineers have done one hell of a job keeping the taps open.

New drilling and completion technologies have extended the life of the shale boom, allowing those E&P companies to do more with less.

But efficiency is not a replacement for reinvestment. And if prices stay low, even the smartest shale players can’t outrun geology forever.

Why does this matter at all? Well, because global demand isn’t going anywhere.

Even the IEA itself admits that oil consumption will hit 104 million barrels per day by 2026.

That’s not bearish, dear reader, it’s a marching order. And while Brazil, Guyana, and Canada are contributing new barrels to the supply mix, they’re in no position to make up lost barrels in the case of a major slowdown in U.S. output.

And make no mistake — without steady growth from the U.S., the world will have to get reacquainted with price spikes.

This leaves us in an awkward place, doesn’t it? Headlines say one thing, while the data says another.

Yet buried inside that contradiction is a very real opportunity.

You see, the Permian Basin still holds tens of billions of recoverable barrels, but only in its most productive core regions. The players operating there — especially the ones marrying efficiency with acreage quality — are the ones best positioned when the market wakes up.

And one hidden investment gem in the Permian has quietly been building its case for years. It isn’t a household name… not yet, at least; nor does it make the rounds on cable news like Exxon and Chevron.

However, it has been operating deep within those same ten counties, using new technologies to keep costs low and production rates high.

When the oil tide turns — and it always does — it’s these kinds of companies that become irresistible to the majors looking to shore up their portfolios.

For now, prices are subdued and sentiment is sour, with the IEA still mistaking shadows for substance.

But as history has shown — from Spindletop to the shale wells dotting the Texas horizon — markets have a way of forgetting just how quickly the ground can shift.

Those who remember are often the ones who benefit most.

Perhaps it’s time you take a look at how the smart money is positioning itself right now.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.