I was shocked, were you?

The moment the news started filtering out that the U.S. military pulled off such a daring operation to arrest Nicholas Maduro, I’ll confess that I didn’t believe it at first. I thought that maybe April Fool’s Day had come early, or perhaps the clickbait headlines had gone a little too far again.

But it wasn’t long before President Trump’s bold move was confirmed.

I also knew it was just a short matter of time before the media narratives would start running wild with inaccurate information.

And believe me, some of the headlines I’ve seen have been a poison pill for people to swallow.

Perhaps the misinformation was on purpose, or just plain ignorance.

So today, let’s dispel the biggest myths behind Venezuela’s oil riches, focus on the facts, and then maybe together we’ll be able to sort out what comes next.

As you’ll see, this story will take a long time to unfold.

Let’s start at the top…

300 Billion Barrels Or Bust?

Look, we all know that President Trump loves his Venezuelan oil.

On paper, what’s not to love? Most people (including our President) can take one look at the reported 300 billion barrels of proven reserves and salivate at the thought of selling those barrels.

Except, there are quite a few misconceptions behind this oil fortune.

The biggest misconception is that there are 300 billion barrels of oil just sitting at our fingertips right now; the current economics just don’t support that.

Don’t get me wrong, it’s true that Venezuela is blessed with one of the largest amounts of oil resources on the planet, but also remember one crucial detail — Not every barrel is created equal!

When it comes to the quality of crude oil, there’s light vs. heavy, and sweet vs. sour. The API gravity will tell us where a grade of crude oil falls: the higher the number, the lighter the oil is.

Generally speaking, oil is considered light if the API gravity exceeds 38°, and considered “heavy oil” with an API gravity below 22°.

Here in the U.S., most of our oil production comes out of the Permian Basin. The quality is of the light, sweet variety and this Western Texas Intermediate (WTI) oil typically has an API gravity of a little over 39°.

Our Texas Tea flows easily, and is highly sought by refiners that can easily turn into products like gasoline and jet fuel.

Then we have Venezuela’s oil reserves.

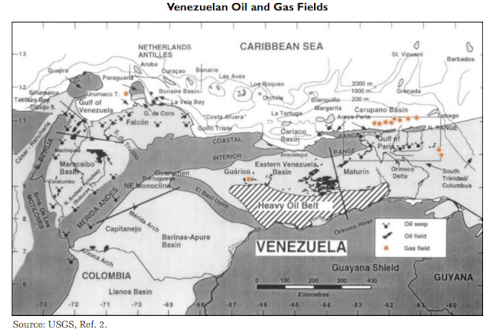

Go ahead and take a look:

See that heavy oil belt there? Well, that’s what all the hubbub is about right now.

In an unfortunate twist of geologic fate, more than 75% of Venezuela’s 300 billion barrels of oil reserves comes from the Orinoco Belt and consists of far poorer quality.

We’re talking about extra-heavy oil that holds an API gravity of about 8°… and yes, this matters! I say “unfortunate” because if this oil resource was buried a little deeper and had a few more million years to cook, it would’ve been a veritable ocean of light oil.

Fate, it seems, is not without a sense of irony, eh?

Venezuelan oil also happens to be sour, which simply means that it has a high sulfur content. Refining it is more expensive, and the refining facilities need to be specially geared to crack those hydrocarbons.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The good news is that (as our investment community here knows full well) U.S. refineries along the Gulf of America were made to process this heavy oil. In fact, roughly 70% of U.S. refining capacity is geared more for heavy oil.

Compared to the light, sweet crude in the Permian Basin, the heavy oil buried under Venezuelan soil is more like asphalt.

Whenever you see someone telling you that we’re going to swoop into Venezuela and steal their oil is drowning in fantasy — whether from pure dishonesty or just straight ignorance.

But things get worse for the “we’re coming to steal your oil” crowd… because now that we know there’s a ton of poor quality heavy oil underground, the real problem comes from extracting it.

You see, the other unfortunate factor is that extra-heavy oil is very difficult to extract, and also quite expensive. It also trades at a hefty discount to WTI grade oil, so you can immediately disregard the hyperbolic value that a lot of headlines suggest.

This problem is a lot bigger than most realize.

My veteran readers know that PDVSA, Venezuela’s state-run oil company, has fallen into total disarray ever since Hugo Chavez was at the reins.

Between ousting major oil companies like Exxon and Chevron from the country (and flat-out stealing every rig and truck out he could) and the extensive corruption that plagued PDVSA, Venezuela’s oil output has plummeted.

Mind you, this isn’t just from a few years of missteps, but rather decades of mismanagement.

So to think that President Trump can just send in Big Oil to turn things around is again — pure fantasy.

At best, we’re talking years of rebuilding infrastructure, which comes with a cost in the billions.

In other words, if everything goes perfect, we may see Venezuelan output rise over the course of a few years — not months!

We’re talking about substantial time and money to get Venezuelan barrels flowing, and perhaps the most important factor to consider is that it would also require something else — geopolitical stability.

But hey, I’m not going to be the doom-and-gloomer right now.

If the tide truly has turned for Venezuela’s oil industry, the clearcut winners over the long-term will be the U.S. refiners, such as Valero Energy (NYSE: VLO) that will take full advantage of the cheap feedstock.

And to take it a step further, the other oil stocks that will capitalize (aside from Exxon and Chevron, of course) will be found in the service sector, the Haliburtons and SLBs that will be the ones on the ground in the Orinoco Belt turning things around right alongside Big Oil.

However, oil is just one aspect of this situation.

Next time, we’ll delve deeper dive into less obvious consequences that come with Maduro’s downfall.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.