Elon Musk is an enigmatic billionaire at best. He is a big, bold thinker who produced some incredible technology, from flamethrowers to boring machines.

But his bread and butter, Tesla, Inc. (NASDAQ: TSLA), is failing.

The electric car tycoon warned us that he might have a bad quarter, but the market was shocked by the size of the loss.

Tesla’s net loss of $4.10 per share was below the lowest estimate, a loss of $0.69 per share.

Of course, Elon made like this was just a bump in the road and that the company would be back to profitability in the second half and cash flow positive this quarter.

However, as I’ve been saying for years now, Tesla’s lead in technology has shrunk to nothing. Every car brand in the world is coming out with a luxury electric car.

Porsche has an all-electric sedan called the Taycan that is purported to run a sub-eight-minute Nurburgring lap. It is due out next year and will be priced around $75,000.

Deliveries

In Q1, Tesla delivered 63,000 vehicles, which was down by 31% from Q4. For comparison, GM delivered 665,000, or 10 times as many vehicles.

Tesla has now dropped back below GM and Ford in terms of market capitalization.

Musk: “We’ll Be Back”

The company thinks it will sell between 360,000 and 400,000 cars this year, including 90,000 to 100,000 in the second quarter.

To hit these numbers, it would have to deliver 76% above its Q1 numbers. That’s unlikely. Everyone who really wanted a Model 3 was on the waiting list and already bought one.

Moreover, prices will jump by $1,875 after July 1, when the federal electric vehicle tax credit falls by 50%.

And many buyers are waiting for the Model Y crossover that was hyped last month. You can order now, with prices starting at $43,000 and a delivery date in 2021.

Here’s a marketing tip, Elon: Don’t hype a car two years in the future when you are trying to move your current product.

This is a five-year chart of TSLA:

The shorts were right eventually. The share price has given up over 140 points since December. It has sliced through support and is in a serious downtrend.

The next support line is $180. Tesla has a market cap of $41 billion and no earnings. Price to book is 8.99. In the first quarter, Tesla’s automotive segment’s revenues fell 41.1% sequentially. The company’s gross margin fell to 12.5% compared to 20% the previous quarter.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Build Your Dreams

The largest electric car company in the world is in China and goes by the name BYD (OTC: BYDDF). It rises while Tesla falls.

In its latest quarter, the company’s profits rose 632% to about 750 million yuan ($111 million), compared to 102 million yuan a year ago.

BYD sold 73,172 new energy vehicles in the quarter. That was up 147% from the same period a year ago.

Including conventional fuel cars, it sold 117,578 vehicles in the quarter, up 5% from last year. BYD expects to sell 655,000 cars in 2019.

That said, BYD might not be the best way to play the increasing market share of electric cars. There is plenty of competition and thin margins.

And with a P/E of 48, it still seems overvalued. Toyota, arguably the best car company in the world, has a P/E of 7.8 and pays a 3% dividend.

One thing I do know is that China is increasing its electric grid to power all these new cars. And it’s importing a lot of coal to do so. The U.S. currently exports 1.1 million mt of coal per year.

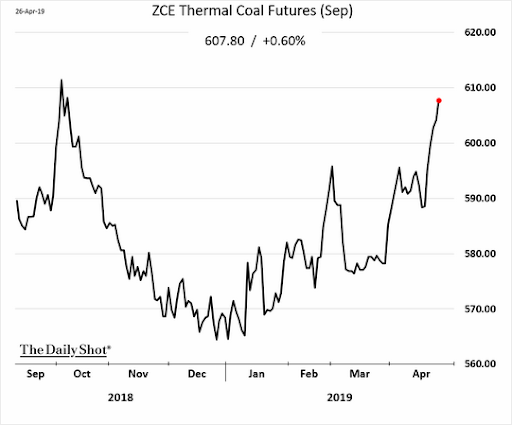

Coal prices in China are jumping:

I’ve found one forgotten coal company that pays a 10.41% dividend.

And get this: A U.S.–China trade deal that eliminates the 25% tariff on coal could bring U.S. exports up to 2 million mt to 3 million mt per year versus the current 1.1 million mt per year.

This deal could be announced at any moment — and when it is, U.S. coal exporters will jump overnight.

Click here — you don’t want to miss it.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.