Imagine the year is 1999.

You’re connected to a Wall Street insider who tells you he has two new opportunities for you:

- A company that makes a stylish and sleek cordless phone. And it has distribution deals with all the major retailers, including Walmart, Circuit City and Radio Shack.

- A computer company, Apple (NASDAQ: AAPL), which would seek to develop a new type of “mobile phone” that would allow you to not only make phone calls, but send emails, watch videos and even check your stock quotes.

The first would’ve seemed like a no-brainer. But the second would’ve seemed like a very risky bet.

After all, the only thing relevant to the iPhone in 1999 was a trademark that was registered for the iPhone. Unless, of course, you were an insider that spent your time networking with young tech gurus, Stanford-educated computer engineers, and telecommunications experts. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

You see, in 1999, conferences were held all over the world where visions of mobile phones serving as handheld computers directly connected to the Internet (something in itself that was still relatively new to most people) were discussed openly amongst tech entrepreneurs, venture funds, and deep-pocketed angel investors.

These were events where the smart money did its due diligence. And had you been there too, you would’ve known that the second option was the smartest option.

In 1999, you could’ve bought 10,000 shares of Apple for as little as $4,400.

Today, those shares would be worth $1.7 million.

Now imagine the year is 2009, and that same Wall Street insider clues you in on a new opportunity that he warns you is a bit risky, but could be a grand slam.

It’s a car company that makes highway capable electric cars.

This insider says there’s never been anything like it before, but he had done his research.

He met with the CEO, a young tech entrepreneur that hit it big in online payment processing as the CEO of PayPal.

He met with various industry analysts, transportation fuel consultants, and research firms. And he concluded that if the cars proved to be viable alternatives to the internal combustion vehicle, it would be the most disruptive car company since Ford started pumping out the Model T in 1908 – more than a hundred years ago!

Looking at the data, it was a no-brainer, despite the pushback the company would likely get once it went public.

That company was Tesla (NASDAQ: TSLA). And you could’ve bought 10,000 shares on the open market shortly after its IPO for just $20 a share.

Since Tesla did two forward stock splits, the split-adjusted IPO price is around $1.15 per share. Which means today, those 10,000 shares would be worth $2.17 million.

Of course, opportunities like Apple and Tesla don’t come along everyday.

In fact, these types of opportunities are rarities.

So when they do come along, you have to pounce.

And that’s why I’m writing to you today.

Now unless you’ve been living under a rock, you know the AI market has been on a tear, with some AI stocks delivering gains in excess of 3,000%.

And while that’s incredibly impressive, every single AI stock today is reliant upon something that only one company has: advanced, high-performance microchips.

To date, Nvidia has been the primary supplier of these chips.

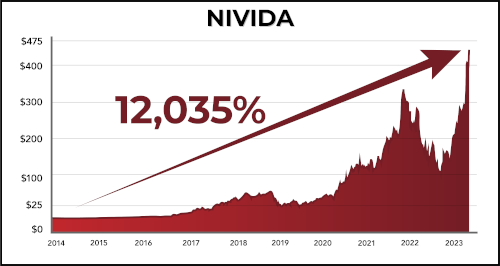

And this is how Nvidia has performed …

But Nvidia is about to get kicked to the curb, because a new high-performance microchip manufacturer has just entered the scene. This AI company's microchip will make Nvidia’s chips about as useful as typewriters and rotary phones.

You see, AI apps require almost infinite data-crunching. And this new manufacturer’s chip outperforms other microchips by a factor of 100.

And they consume far less power than other chips.

Take Nvidia’s A100 chip, for instance. It devours 400 watts of electricity.

This new chip that's manufactured right here in the U.S., however, runs on only 60 watts. That’s 85% less power consumption!

This kind of performance slashes the cost of running AI systems radically and unleashes AI’s true potential.

Now the company making these new microchips already has deals with Lockheed Martin, Cisco, General Dynamics, Honeywell, Nokia, Raytheon, and Rockwell.

But hardly any retail investors know this company’s name because it just came out of stealth mode.

Which means it won’t be long before an avalanche of cash pours into this stock.

I want you in before that happens, so I’m including this recent investment note from my good friend and colleague Keith Kohl. He not only discovered this stock, but is already making money hand over fist from it.

I would encourage you to do the same.

And the sooner the better.

Preferably, before tomorrow.

Here’s a link to all the juicy details.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter