One of the worst-kept secrets inside OPEC is that members love to fudge the numbers to suit their needs.

For decades, output quotas were more of a running joke to the industry.

Back in the 1980s, OPEC discovered a loophole worthy of a Dickens novel: the larger the reserves a country claimed, the larger the production quota it could demand.

You can guess what happened next…

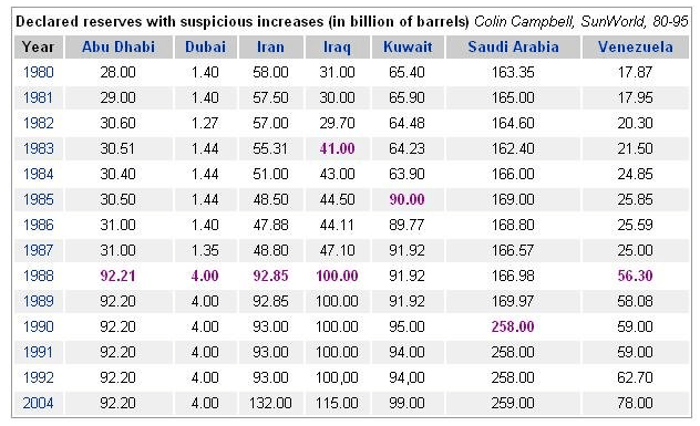

Over the course of a few years, seven OPEC members — none of whom had stumbled upon miraculous new fields — suddenly announced that their proven reserves had risen dramatically.

In some cases, reserves were doubled virtually overnight. Iraq went even further by boosting its declared reserves by 244% within a period of five years!

Go ahead and take a look at those shady reserve increases for yourself:

The rest of the world just sat and took it. We had to accept these revisionist numbers without so much as a well log or a seismic image.

And here’s the kicker — because OPEC kept its field data locked away as state secrets, no one could challenge the theater.

The result was an oil cartel whose numbers shaped global oil prices and lost all their credibility.

Even decades later, when Saudi Aramco’s pre-IPO disclosures revealed that Ghawar — long believed to pump 5 million barrels per day — was actually closer to 3.5 million; that revelation felt less like a surprise and more like confirmation of what skeptics already knew.

So, after forty years of inflated claims and opaque reporting, you’d have to wonder how OPEC would ever regain the world’s trust.

Well, it may just happen next year.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Saudis are now calling bullshit… on everything.

Maybe the House of Saud is tired of the back and forths against bearish forecasts calling for absurd oversupply (thanks to the IEA). Or, perhaps the Saudis were frustrated by other members claiming production capacity that simply wasn’t there, fueling even more bearish sentiment over global supply.

Well, playtime is over, and the drama is about to get juicy inside OPEC.

At its most recent meeting, OPEC members approved something for 2027 that is nothing short of revolutionary.

No, I’m not referring to the group’s decision to suspend oil production increases during the first quarter of 2026 — taking 1.65 million barrels per day that would have been added to global supply.

As if that isn’t enough…

After decades of allowing members to declare whatever production potential suited their political needs, the cartel will now anchor its entire quota system to something verifiable: Maximum Sustainable Capacity (MSC) — the highest level of crude output a country can reach after a 90-day ramp-up and maintain for a full year.

No longer could members count on reservoir miracles or creative math… just barrels that exist, wells that flow, and engineering that can be inspected.

This means that OPEC’s new mechanism for establishing future production baseline levels will be far more transparent than in the past.

Why? Well, this time OPEC won’t be the judge of its own numbers.

An independent third-party auditor — not national ministries — will evaluate what each member can actually produce. That means the long-standing habit of treating oil capacity like a negotiable suggestion is over.

A country either has the infrastructure, drilling inventory, reservoir pressure, and field integrity to sustain higher production… or it doesn’t.

And for the first time in the cartel’s history, that distinction won’t be buried behind closed doors!

Make no mistake, dear reader, this is a structural shift with enormous consequences.

The new MSC assessments begin in January 2026 and will run through September, after which the first audited production baselines for 2027 quotas will be set.

Then the process becomes annual, updating capacities each year. It introduces a level of transparency the cartel has never allowed before… or possibly ever wanted!

Why? Because once the audits are released — even in summary form — the world will gain something it has lacked for generations: a realistic understanding of OPEC’s true supply ceiling.

That ceiling may be lower than policymakers assume.

In fact, the Saudi energy minister has already hinted that the new system “rewards those who invest in their upstream,” which is diplomatic language for something far more blunt — that some members have been claiming capacity they cannot sustain.

We know the historical record supports that suspicion. Between aging fields, underinvestment, political chaos, and years of deferred maintenance, several OPEC producers — from Venezuela to Iran — are more fragile than their quota demands suggest.

Could this be why OPEC forecasts always seem to lean toward a “far more balanced” global oil market than others? Maybe.

If the audits confirm that real capacity across the cartel is tighter than advertised, the entire oversupply storyline collapses. And with OPEC already holding output steady through the first quarter of 2026, the market may discover it has less spare capacity than the spreadsheets have assumed.

The new audit regime doesn’t just clarify the present, it’ll redefine what the word “capacity” will mean for the next decade of oil markets.

U.S. Oil Stocks Just Got More Attractive

As we watch this unfold, you can bet U.S. oil stocks from Texas to North Dakota are watching with close scrutiny.

It’s tempting to treat OPEC’s internal politics as just distant noise. After all, bickering among the production doves and hawks within the oil cartel have been under the global spotlight for decades.

However, the consequences of this transparency experiment will land squarely on the balance sheets of U.S. oil producers.

For years, inflated OPEC capacity figures have served as a psychological anchor on global prices.

Anytime the market tightened, analysts would point to imaginary barrels — phantom spare capacity that could supposedly flood the system if demand rose too fast. These ghosts kept valuations for U.S. shale, Permian drillers, and integrated majors below their real-world market value.

But these ghosts won’t survive an independent audit — certainly not one every year, either!

If even a handful of OPEC members fail to meet their declared Maximum Sustainable Capacity — or if the audits reveal structural declines in fields long assumed stable — the market will reprice the entire supply landscape.

Real barrels become more valuable, and reliable producers become increasingly more important.

Look, this isn’t about predicting a price spike.

Truth is, I don’t think we’ll see triple-digits again for a long, long time — at least not without another sudden geopolitical catastrophe like the one in 2022 after Russian tanks rolled onto Ukrainian soil.

It’s about recognizing what happens when uncertainty is removed from one side of the global supply equation.

A verified, audited understanding of OPEC’s true capabilities will expose which countries can actually raise production and which have been bluffing for years.

And if the group extends its pause on output increases beyond Q1 2026 — something that now looks increasingly likely — the ceiling for oil prices will move higher simply because the floor has shifted.

For U.S. oil stocks, this is leverage disguised as geopolitics.

Higher long-term price expectations improve cash flow visibility, encourage drilling programs, and lift valuations for the most efficient independents and majors.

OPEC’s move toward transparency may be historic, but the real opportunity lies outside the oil cartel — the ones that don’t need to rewrite their reserves, invent capacity, or hide field data to earn the market’s trust.

The world is about to learn who can deliver barrels on demand, perhaps it’s time you see the answer.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.