In July 2025, the U.S. quietly shattered its all-time record for electricity demand.

Of course, most people didn’t realize this because of the myriad of distractions in our everyday lives. The headlines blamed heat waves and air conditioners — but beneath the surface, a different current surged through the wires.

The real culprit didn’t come from the sky, it came from racks of humming silicon buried inside Virginia’s newest boomtowns, where hyperscale data centers are rising faster than fast-food franchises.

In Northern Virginia, Amazon and its rivals had just pulled 54 new data center construction permits, most of them “hyperscale” facilities capable of devouring power at a rate that makes steel mills look quaint.

One of OpenAI’s newest sites — codenamed Stargate 4 — will require more electricity than the entire city of Charlottesville!

And just keep in mind that that’s just ONE building, too.

The company is pouring through a multitude of proposals, each one hoping to land the next Stargate data center.

In fact, 20 sites are already in advanced stages of development, and you can bet each one will be draining the grid. Then again, it doesn’t hurt having the largest chipmaker on the planet inject OpenAI with $100 billion to help the company’s data center buildout.

The reality is that we’re entering an era where artificial intelligence doesn’t just compute like a superhuman… it consumes like one. Elon Musk’s “Colossus” supercomputer project alone will siphon off 260 megawatts — nearly a quarter of a traditional nuclear reactor’s output — just to run its models.

Welcome to the age where machines aren’t just learning, they’re lighting up our power grid like industrial giants.

The only unfortunate part is that our 20th-century grid simply isn’t ready for that.

At least, not yet.

The cold, hard truth is this: We don’t get to choose our energy saviors.

Sure, in a perfect world — the one sketched on glossy ESG brochures and the echo chambers on social media — the sun would shine 24/7, the wind would blow on schedule, and every AI cluster from Phoenix to Ashburn would be powered by pixie dust and solar panels.

However, reality has no place in this utopia right now.

Data centers don’t sleep, and neither does AI. You know as well as anybody that these data centers will be running full-tilt every hour of the day, often across thousands of GPUs working in parallel.

What this means is that you’ll need a consistent, reliable source of baseload power that shows up on time. Intermittency isn’t a technical quirk when it comes to powering today’s AI boom — it’s a fatal flaw.

If you try to run a hyperscale AI facility on wind and solar alone, you’re essentially gambling the most powerful computing systems in history on the weather.

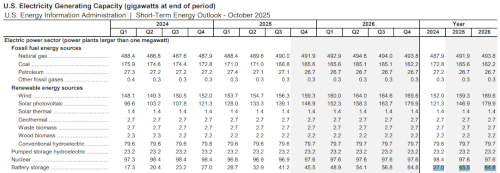

Unfortunately, our battery storage is far from adequate for the task. In the latest Short-Term Energy Outlook by the EIA, we can see just how lopsided our electricity generating capacity is currently:

So where does that leave us?

Well, right back in the arms of two power sources we’ve spent the last two decades trying to downplay, defund, or dismantle: natural gas and nuclear.

We’ll leave coal out of the picture for now, given the fact that the industry is in a death spiral and no new generating capacity is being added to the grid (or the fact that the average age of our coal plant fleet is right around 45 years old and nearly one-third of our existing fleet will retire by 2035).

That makes things a little more complicated, doesn’t it?

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The good news is the picture looks a lot brighter with our largest energy source — natural gas. It’s abundant, dispatchable, and — especially in places like Texas — so cheap and plentiful it’s practically a nuisance. So when demand spikes, gas-fired plants can fire up in minutes, not hours.

Consider them the workhorses of the American grid. They already supply us about 40% of electric power as is. In fact, the Permian Basin alone could power every AI server rack in the country if someone bothered to build the pipelines and transmission lines to carry it.

Instead, those electrons are stranded in the desert while data centers beg for capacity in places like Virginia, where they’re already on the edge of blackouts.

That leaves us with a true nuclear option — a perennial underdog that keeps refusing to die.

You see, traditional nuclear plants, for all their regulatory headaches and cost overruns, have one supreme virtue: They deliver round-the-clock, carbon-free baseload power at industrial scale.

No intermittency or weather risks, just pure, unflinching gigawatts, day after day, decade after decade. The average U.S. nuclear reactor has been running for over 40 years, quietly producing 20% of our nation’s electricity while contributing absolutely nothing to our emissions.

And now, with electric power demand surging and the grid starting to wobble under the growing weight of the AI boom, we suddenly remember that maybe — just maybe — shutting them all down wasn’t the brightest idea (someone might want to tell the EU that, too).

Like it or not, these are the only tools in the box sturdy enough to handle what’s coming. Battery storage is nowhere near ready. Transmission projects take a decade, if they ever get approved. And small modular reactors, for all their promise, are still chasing paperwork and prototypes. In the meantime, AI keeps eating. The power grid needs grown-ups in the room. And right now, only gas and legacy nuclear are wearing suits.

For us, the path forward isn’t just about what kind of energy powers the AI age — that’s half the battle. Another critical factor is where that power is coming from.

The market could be flooded with stories about clean electrons, green grids, and tomorrow’s miracle technologies, but none of that matters if the power can’t get to where it’s needed today.

Remember, these data centers aren’t being built in the middle of nowhere. They’re springing up in places like Virginia, Central Ohio, West Texas, and Arizona — places with access to gigawatts of reliable juice and, just as importantly, the political will to use it.

That’s where the real edge lies.

Of course, most of the herd won’t figure this out until they’re reading about it on the front page of their Twitter feed. By then, the value will already be priced in and the opportunity long gone. There’s a reason why we call the “smart money” for what it is, and the next step is obvious for them.

Why don’t you take a quick look for yourself.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.