You’ve probably never heard of the J.H. McCleskey No. 1 well.

Why should you? Whenever someone thinks back to the early days of the Texas oil boom, their minds immediately go to the Lucas gusher at Spindletop, or even the famous Santa Maria No. 1 well that kickstarted the Permian Basin’s oil wealth.

But don’t beat yourself up too badly. Few people know about the “Roaring Ranger” that played a vital role refueling the Allied effort in World War I.

In October of 1917, a drill bit bored into the red clay under Eastland County, Texas turned the gamble of a small town into a global headline.

That’s when the J.H. McCleskey No. 1 well at Ranger, Texas erupted from 3,432 ft, producing thousands of barrels a day and transforming a quiet farming community into a petroleum boomtown.

Production surged, stock prices soared, and the world finally took notice of the Ranger oil boom.

But even though there aren’t many market watchers that have heard of this story, the lesson is timeless — when supply dynamics shift quietly beneath the surface, the mainstream narrative always gets blindsided.

Today the headlines insist we’re swimming in oil.

We’re fed a story of a massive supply glut, with global storage tanks overflowing.

However, the numbers tell a different story, and it couldn’t come at a more dangerous time due to the 106 million barrels of oil the world consumes on a daily basis.

Tick-tock goes the oil clock.

OPEC and its allies pulled an interesting move recently — they approved a modest increase for December 2025, then opted to pause any further hikes through the first quarter of 2026.

That pause isn’t panic, by the way.

It’s control.

You see, the cartel knows what the media still denies, that the supply-glut narrative is dissolving.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Here in the U.S., our stockpiles of crude oil rose slightly last week, but they remain 4% below the five-year average, and product stocks (gasoline, diesel) are being drawn down.

At the same time, rig counts are down by 39 compared with a year ago (I’ll get into why this is a huge problem in a second), and that’s before we factor in steep decline rates of tight-oil wells.

Anyone running with the idea that the tight oil boom will go on forever is about to experience a crude awakening.

If the Ranger boom taught us that a single discovery can rewrite expectations, then the same is true of the inverse… and the world is starting to realize that supply is never assured, because decline curves bite, demand defies expectations, and the window to buy “cheap oil” is narrowing.

Demand Surprise and Production Reality

Believe it or not, global demand is deceptively strong.

According to the latest tallies, consumption sits north of 106 m bbl/d. For the record, OPEC expects demand growth this year to climb 1.3 million barrels per day.

But hey, OPEC is always optimistic, right? What’s interesting is that the perma-bears (like the IEA) are starting to admit their pessimistic projections aren’t becoming reality.

Get ready for a real wake-up call…

When the IEA publishes its next World Energy Outlook next week, the herd is going to see what we’ve known all along — supply is tighter than most believe, and demand is surprisingly strong.

When I mentioned that the lower rig count is going to have a much bigger impact than the market expects, let me explain what I mean.

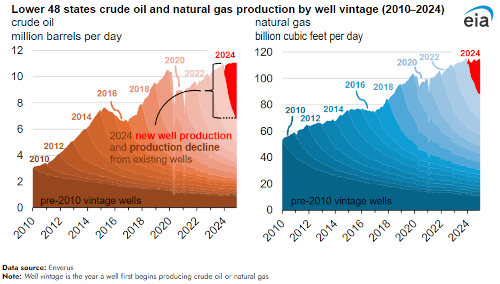

It’s no secret that tight oil wells dominate U.S. new supply growth. Last year, production from new wells accounted for around 40% of our output:

Here’s the problem: In order to maintain or grow output, companies must drill more wells at a breakneck pace.

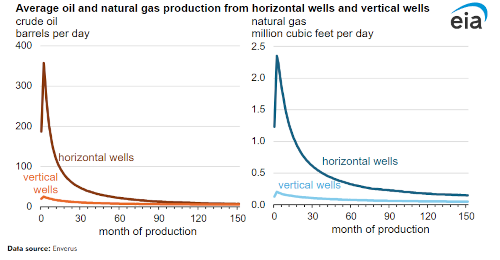

Why? My readers are well aware of the fact that tight oil wells come with one huge caveat — initial decline rates are incredibly steep compared to conventional wells.

Go ahead and take a look for yourself:

That’s a problem, folks.

OPEC+ isn’t reacting — they’re anticipating.

Think of this moment like the Ranger boom in reverse. Instead of a surprise discovery, we’re looking at the complete opposite.

That’s what makes finding those small investment gems in the U.S. oil patch so crucial to individual investors like us, but that window of opportunity won’t stay open much longer.

Let me show you the first place I’m looking at for when prices meet reality.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.

P.S. Gold’s Catching Its Breath Before the Leap

Every bull market pauses before it roars, and every dip in gold prices is a gift. Gold’s latest pullback isn’t a retreat — it’s a reload.

Behind the charts, central banks are still hoarding, inflation’s simmering, and currencies are cracking under their own weight. That pressure has one release valve: higher gold.

NatGold lets you ride that move smarter — a blockchain-backed token tied to verified, in-ground gold reserves. It’s gold you can actually own, without vaults, banks, or middlemen.

The next surge is coming.

Reserve your NatGold tokens now — before gold breaks its silence and shatters new records.