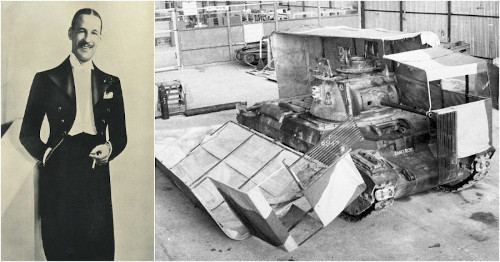

In World War II, a British magician named Jasper Maskelyne allegedly pulled off one of the greatest illusions in modern military history.

They said he made the Suez Canal disappear.

Using lights, mirrors, and a little psychological sleight of hand, he tricked enemy pilots into bombing the wrong targets. Entire cities were camouflaged. Battleships were “cloned” with plywood. He didn’t just fool the eye — he rewired perception.

The illusion became stronger than reality.

Now, that same trick is being played out again right before our very eyes.

Only this time, it’s not German bombers flying overhead. It’s Wall Street. And the illusionists aren’t stage magicians — they’re blind, number-crunching desk jockeys.

The IEA and EIA, two of the most closely watched institutions in the energy world, just dropped their latest monthly outlooks… and the sleight of hand they’re pulling off for this oil mirage is nothing short of spectacular.

The IEA, ever the bearer of bearish gospel, forecast a growing oil glut heading into 2026.

Their model now shows global inventories swelling by nearly 3 million barrels per day — an oversupply so large it would crush prices and vaporize any hope of tightness in the physical market.

Of course, swelling inventories and a mind-boggling prediction of U.S. output rising to 13.6 million barrels per day — despite the fact that drilling activity continues to lag — will cause WTI prices to fall to $58 per barrel during the fourth quarter of 2025.

As if that weren’t enough of an act, the EIA’s encore cut its 2026 price forecast for Brent down to $51 per barrel.

If you listen to nothing else in my crude rants, always remember that $50 oil is a myth. At that price, new exploration would shrivel up and die. Nothing seems to move the EIA data crunchers, not the falling rig count, nor the tighter capital budgets that are popping up across the sector.

Both the EIA and IEA are also putting a lot of weight on non-OECD growth slowing, with Trump’s tariffs doing a lot of heavy lifting to bring down economic growth in China, Brazil, and India.

But if OPEC turns out to be right on this one — and I’ll note that they’ve been much closer to reality than the other two — then everyone is in for a big surprise, especially if President Trump starts closing major trade deals like he has.

So as always, we’re stuck in the middle of this never-ending narrative war waged between OPEC and the IEA.

OPEC plays the optimist, and the IEA plays the undertaker.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

But here’s the problem, dear reader: The market keeps buying the excessively bearish illusion.

And let’s not hold back any shots here: The IEA has a history of getting it wrong.

Last May’s “bombshell” revision — where they quietly admitted to overstating inventories and missing real-world demand by a mile — should have been the wake-up call.

Instead, the market hit snooze.

And that’s where the opportunity lies for regular investors like us.

It’s no coincidence that every time oil prices begin to stir, a bearish IEA report drags them back down. The market reacts, traders reprice, and the illusion gets another day to breathe.

But just like Maskelyne’s disappearing canal, the oil market's image has been distorted beyond recognition.

Because on the ground, the numbers tell a different story.

Rig counts are falling. U.S. completions are slowing. Even the most efficient producers are facing steep costs and declining tier-one acreage.

Yes, well productivity IS STILL RISING … for now; but even that comes with a shelf life. You can’t outrun depletion forever with less exploration, and you can’t drill your way into margin while the capital dries up.

Remember the Dallas Fed’s most recent survey? Nearly 70% of shale operators admit they’ll scale back if oil stays near $60.

Make no mistake, they’re NOT bluffing.

Oil at this level isn’t just cheap — it’s unsustainable.

That’s the core of the oil illusion buried in this week’s forecasts.

The IEA assumes the U.S. can grow without reinvesting; that Russia will keep producing at current levels under sanctions; that OPEC will sit on its hands while prices languish.

It all hinges on non-OPEC supply growing steadily, as if cost, geology, and geopolitics aren’t real factors.

And the EIA, for all its internal data, clings to the fantasy that productivity alone can hold production steady, even as the industry quietly sheds rigs and cancels development plans.

Eventually, this house of cards will collapse.

When it does, oil doesn’t trickle higher, it’ll snap. Inventories won’t swell — they’ll shrink.

And Big Oil, which hasn’t grown production through the drillbit in years, will do what it’s always done when faced with a growth issue — they’ll pop open their war chests and M&A activity will surge.

Exxon doesn’t grow through the drillbit. It’ll buy the barrels it needs, just like it did when it shelled out $60 billion for Pioneer Natural Resources.

That’s when the spotlight will suddenly turn toward the drillers that no one’s watching right now.

The ones still growing output efficiently while maintaining fiscal discipline. Those are the oil players getting more from each well, not by magic, but through better geology, better tech, and better discipline.

That’s where OUR leverage lies.

Except, these companies won’t stay hidden for long.

When the illusion fails and crude reclaims $80, $90, even $100, they’ll be first in line for revaluation. Not because they changed — but because the market finally caught up to where the fundamentals always were.

And when the illusion finally vanishes, and oil’s true tightness is revealed, these names won’t just rise — they’ll roar.

Maybe it’s time you see this opportunity for yourself right here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.

P.S. Trump just launched the biggest payout program in U.S. history — and everyday Americans could start collecting $21,307 windfalls from a brand-new national investment fund that’s replacing the IRS. No more tax bills, no more audits… just direct payments from the government to you. But the early movers are already cashing in — and your window to claim a share is closing fast.