If you want the truth about gold, don’t watch the pundits.

No, dear reader, what you want to watch are the buyers who aren’t distracted giving interviews.

You see, central banks don’t chase trends. They don’t tweet, nor do they speculate for sport.

These heavy hitters buy gold for one reason only — when confidence in the system starts to fray, quietly and permanently.

That’s been the real story behind gold’s move this year. It wasn’t the mainstream headlines, nor the noisy debate raging over rate cuts.

What we saw was a steady, methodical accumulation by institutions whose job is to plan for when things go wrong.

So when gold paused around $4,000 an ounce earlier this year, the market treated it like a ceiling. Perhaps some saw it as a psychological limit where gravity was supposed to reassert itself and end the multi-year bullish trend.

Instead, it behaved like a pressure valve.

We saw prices consolidate as volatility cooled, and then gold did what it has always done when the buying was real — it started climbing higher!

Mind you, this wasn’t some buying frenzy, but more of a controlled advance hinting at accumulation rather than speculation.

That’s why the tone has shifted so quickly on Wall Street.

Not long ago, $5,000 gold was dismissed as hyperbolic fodder.

Now, this previously mocked forecast is showing up in bank research notes and projections.

JPMorgan, hardly known for fantasy pricing, now sees gold pushing beyond $5,000 an ounce by the end of 2026.

Again, that’s not a gold-bug blog whispering rumors into the ether; that’s one of the most systemically important banks on the planet recalibrating its expectations.

As always, the herd will be late.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Why Gold’s Floor Keeps Rising

Look, gold doesn’t surge for one reason alone.

And for a while now, we’ve been quietly cataloging those long-term catalysts that will finally drive gold above $5,000 an ounce.

The first pressure is monetary, and it’s structural.

The era of “higher for longer” has already done its damage, and rate cuts don’t need to happen overnight for the next move. The moment markets accept that policy tightening has peaked, gold starts repricing the next decade — not the next meeting.

Lower real rates (or even just capped real rates) remove the single biggest headwind bullion has faced since 2011.

However, that doesn’t even get into the supply side of the market, which rarely gets airtime because it’s inconvenient.

Gold production isn’t responding to higher prices the way textbooks say it should.

Why? Well, because grades are falling and permitting timelines are stretching.

Of course, that’s not to mention the fact that new discoveries have slowed to a trickle — no major gold discovery (greater than two million ounces) was made worldwide in 2023 and 2024!

Even with gold well above historical averages, global mine supply is barely growing. That means demand doesn’t need to explode for prices to grind higher, it just needs to persist.

And persist it has…

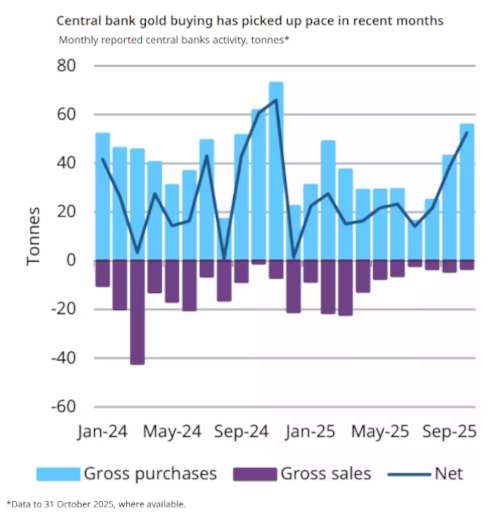

My readers know that central-bank buying hasn’t slowed this year, it’s accelerated.

What began as a post-2022 reaction to sanctions risk has evolved into a long-term reserve strategy.

Layer in geopolitics, and the bid becomes stickier still. Conflicts don’t need to escalate to matter; they only need to remain unresolved.

Fragmentation — trade, currency, energy, and technology — is inflationary by nature.

Gold thrives in systems that don’t trust themselves.

There’s a reason why the precious metal has been the ultimate safe haven for thousands of years.

Mark my words, the final nail in the coffin for $5,000/oz gold is fiscal reality.

When Gold Stops Being Heavy

Look, every gold bull market eventually runs into the same friction point.

Ownership gets awkward, and all that bullion needs vaults to store its immense wealth. Of course, coins need custodial care, and ETFs need trust in intermediaries that exist only as long as the system behaves.

And as gold prices march higher, so does the inconvenience of holding it the old way.

That’s where the next evolution quietly enters.

You and I both know what comes next, because true digital gold isn’t about replacing bullion, but rather bringing gold into the 21st century, complete with cutting-edge blockchain technology, verified ownership, fractional access, and of course… settlement without shipping trucks or trusting counterparties you’ve never met.

And trust me, the timing matters.

You see, gold is being re-monetized just as financial infrastructure is being rebuilt.

Tokenization isn’t a crypto gimmick anymore; it’s becoming the preferred rail for real assets; even treasuries are moving there.

Commodities are next.

In 2026, one such project plans to bring gold on-chain in a way that ties value directly to verified in-ground reserves, not speculation. No leverage. No promises. Just ownership modernized.

This, dear reader, is how the evolution of gold into the modern era will take place.

And those paying attention now aren’t chasing gold’s performance, they’re positioning early — before safe haven kings like NatGold stop being optional and start becoming expected.

The real question is whether you’ll be early enough to benefit when it does. That’s why you need to take just a moment and check out the full details for yourself here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.