Strange things are afoot at the EIA.

Just a month ago, things had hit a feverish pitch for oil prices, and WTI crude soared to over $120 per barrel — a price level not seen since oil surged higher after Russia rolled its tanks into Ukraine.

If you’re like me, you probably breathed a little sigh of relief lately as gas prices finally started coming down as crude oil lost momentum in recent weeks, sliding back below $100 per barrel for the first time in months.

But now comes the crucial question for every investor: Where is oil headed from here?

Well, I have some good and bad news for you, both of which will help you in this volatile market.

The Beginning of the End for Oil’s Bull Run?

My veteran readers are well aware that there is just ONE thing that can truly push oil prices lower — demand destruction.

You know the saying “High oil prices are the cure for high oil prices.”

I know the excuses are out there. It’s neither some brutal Putin gas tax nor Biden’s inability to kick-start drilling on federal lands.

So long as there’s strong demand, prices will remain in heartbreaking territory.

Now here, dear reader, is where something peculiar appeared in the EIA’s latest Weekly Petroleum Status Report.

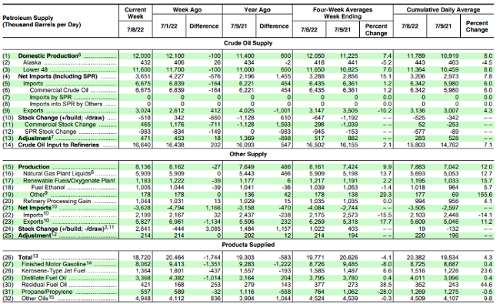

Take a quick look below and tell me if you notice anything unusual:

No, it’s not the fact that domestic production declined by 100,000 barrels over the previous week.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Look a little lower. Do you see the sharp drop in gasoline demand? According to this report, gasoline demand fell by 1.351 million barrels per day compared with the week prior. In fact, total demand for petroleum products dropped by 1.744 million barrels per day.

For the record, demand for petroleum products during the week of July Fourth hasn’t been this low in about 26 years!

Strange things indeed.

Now, there are plenty of reasons why oil prices would be correcting.

The monster inflation report that came out recently showed that the Consumer Price Index, a solid measure of the everyday cost of living, jumped 9.1% in June.

Dig a little deeper, and you’ll see that it was exorbitantly high energy prices that have driven inflation higher over the last year. In the Labor Department’s report, it showed that the energy index has risen 41.6% over the last 12 months, with gasoline of all types increasing by 98.5% during the same period.

That demand, however, isn’t going to carry on too much longer, especially with the end of the summer driving season approaching.

If you’re looking for another culprit for why crude prices crashed below $100 per barrel, take another look at the chart above, and you’ll see that we released nearly 1 million barrels per day from the Strategic Petroleum Reserve (SPR) last week.

As we talked about before, one of the few things the Biden administration can do to directly affect crude supply is tap into the SPR.

Throw all these factors together, and you can understand why someone might be bearish on oil over the long term.

But before you start dismissing oil altogether, I think we’re going to see crude prices rally at least one more time before the legs of this bull give out.

You see, I’m not entirely convinced that demand destruction has officially set in.

And that unusually sharp drop in gasoline demand you can see above is a more normal phenomenon that the investment herd understands.

That makes the harsh sell-off in oil stocks ripe for a rebound.

If we see a demand move back into a normal range, a move higher for prices isn’t too far out of the picture.

In other words, there’s a window of opportunity right now for the right oil plays. Fortunately, my readers and I already nailed down three must-own oil stocks before the bear market sets in.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.