John Templeton, the father of emerging-market investing and one of the most successful stock pickers in history, once famously said, “The time of maximum pessimism is the best time to buy.”

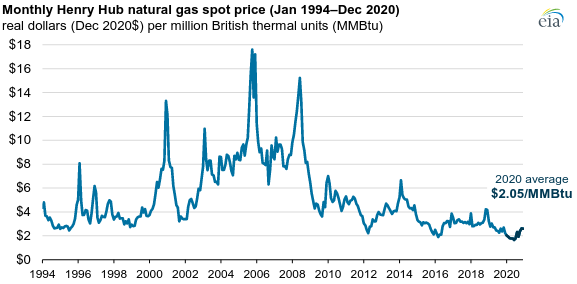

And in the aftermath of a global pandemic that obliterated demand for fuels, natural gas investors are getting very pessimistic indeed.

Source: https://www.eia.gov/todayinenergy/detail.php?id=46376

But a strong recovery is already taking shape. The U.S. Energy Information Administration projects that the U.S. will increase its generating capacity — a plurality of which is natural gas-based — by 52%–84% by 2050.

And it’s not just the U.S. that’s getting hungry for energy post-pandemic. According to Exxon Mobil Corp.’s Outlook for Energy, emerging markets will have a 65% rise in energy demand from 2010–2040.

Source: https://www.energyandcapital.com/resources/natural-gas-companies/51946

And among energy sources, natural gas is where the money is. Gas-fired power plants are the largest source of electricity in the U.S. as of 2020. Even OPEC is taking notice.

Petrostates Are Trying to Become… Natural-Gas-O-States?

I know. You thought OPEC was focused on oil — and it was — but it’s been losing the oil battle to U.S. shale producers.

What’s more, natural gas has emerged as the best bridge between renewables and fossil fuels.

The world is demanding more of it, with consumption reaching 203 trillion cubic feet per year by 2040.

Saudi Arabia has the sixth-biggest natural gas reserves in the world. However, the problem is that Saudi Arabia does not currently import or export natural gas, and therefore has no structures in place to start supplying it.

That may very well change in the future as Saudi Aramco shifts its focus and kick-starts more natural gas and liquefied natural gas (LNG) projects.

One thing we do know is that for OPEC’s natural gas ambitions to work, it’ll need to get Russia on board. After all, Russia is the world’s largest exporter of natural gas and the second-largest producer (behind the United States, of course).

And even though Russia is not a member of OPEC, the most recent cooperation to increase supply might be enough to start a dialogue between the two.

The U.S.’ Dizzying LNG Growth

U.S. natural gas production has grown by more than 10 quadrillion cubic feet per year in the past decade and shows no signs of slowing down.

Source: https://www.eia.gov/dnav/ng/hist/n9050us2a.htm

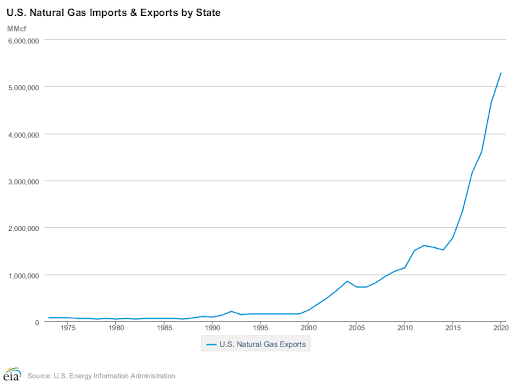

Now, the U.S. has been a top natural gas producer for years, but what it’s never been (until now) is a top gas exporter.

In fact, until 2016, the vast majority of U.S. gas went either to domestic consumption or exports via pipelines to Canada and Mexico.

This surplus supply, however, was salable in a different form…

LNG Over the Sea

Transportation options for natural gas are a bit limited. It can be sent in small amounts on tanker trucks or in larger quantities via pipeline.

But pipelines only work on land or through a reasonable amount of water.

To get the gas to customers across the ocean, you have to turn it into something else entirely.

LNG stands for liquefied natural gas. It’s gas that has been supercooled and stored in tankers, which can then carry it safely across the ocean.

Until 2016, the U.S. was not in the habit of exporting its gas this way.

That’s because until then, the country just didn’t have the infrastructure.

But that year, the first LNG export terminal in the Lower 48 came online and began collecting long-term contracts immediately. U.S. LNG has gone to customers in the Middle East, Asia, and Europe for the first time ever!

In April 2017, the U.S. finally became a net natural gas exporter.

It’s no wonder, given how quickly the country’s exports have grown in the last few years…

Source: https://www.eia.gov/dnav/ng/hist/n9050us2a.htm

This was a huge achievement, and it’s still only the beginning…

What’s interesting about the natural gas situation today is that unlike most logical commodity trades, low prices are actually a good sign!

So long as it’s cheaper than coal, countries will continue replacing coal capacity with gas.

And when the transition is too far to reverse, it won’t matter how high natural gas prices go. Once the recovery takes off in full, buyers will just keep buying this increasingly essential fuel.

This is especially true in the LNG trade, which is inherently more expensive than traditional pipeline transmission for several reasons. Essentially, selling LNG as opposed to regular natural gas is like selling refined oil products rather than freshly produced crude: Consumers are paying for the extra work it took to transform the fuel.

Then there’s the cost of actually transporting the LNG across the ocean. Tankers are often contracted for years at a time, which makes it easier for exporters to sell at higher futures prices.

Right now, there are only five operational LNG export terminals in the U.S. Several more are under construction. Those five terminals give the country 10.8 billion cubic feet per day of natural gas export capacity, up from less than 1 billion in 2015.

With all of this new capacity, the U.S. is expected to be on par with the world’s biggest LNG exporters within the decade.

And as you can see, every major power in the world of energy is fighting over pieces of the natural gas market. To that end, a diversified portfolio of global natural gas stocks can help investors take advantage of this fast-growing industry…

Cheniere Energy (NYSE: LNG)

Founded in 1996 and based in Houston, Cheniere Energy is America’s leading LNG producer — and its first exporter. It built the country’s first LNG terminal, the Sabine Pass facility in Port Arthur, Texas.

It has since used that facility to sell LNG to European, Asian, and Middle Eastern buyers on long-term contracts, giving its revenue a degree of stability that is uncommon among its peers.

That steady revenue growth was on display in the most recent quarter, when Cheniere increased earnings by 4.8% on a 23% increase in revenue.

Shares have risen considerably in the last year, but the firm still has a relatively low price-to-earnings (P/E) ratio of 16.22, suggesting that the stock has much further to climb from here.

Gazprom (OTC: OGZPY)

No list of natural gas stocks would be complete without the largest gas company in the world — even though it only trades over the counter in the U.S.

Founded in 1989 and based in St. Petersburg, Gazprom is not only the world’s largest gas company — it’s also Russia’s largest company by revenue, bringing in more than $120 billion in 2019.

Gazprom recently won a major international legal victory when the U.S. dropped its objection to the construction of its Nord Stream 2 pipeline in July 2021. That pipeline will allow the firm to sell its gas directly to lucrative western European markets, saving it billions of dollars in trans-European shipment costs over the next few years.

If that good news wasn’t enough, Gazprom posted solid revenue growth in the most recent quarter, boosting its intake by 31.3% year over year.

The firm also has an insanely low P/E ratio of 9.74 and pays a 4.47% dividend. Shares may be up in the last year, but they have much further to go from here.

Clean Energy Fuels (NASDAQ: CLNE)

Founded in 2001 and based in Newport Beach, California, Clean Energy Fuels has come to prominence in the last year as a “meme stock” promoted by Reddit’s r/WallStreetBets trading community. And it’s one instance in which the Redditors might be onto something.

The firm is the U.S.’ largest operator of natural gas fueling stations for vehicles. Its network of more than 500 fueling stations provides natural gas to more than 35,000 vehicles every day, giving it a competitive moat that few other natural gas firms can match. What’s more, analysts expect it to post steady sales growth of between 10% and 20% annually through 2022.

It’s also profitable on an earnings basis and has a comfortably low debt-to-equity ratio of 24.14%. The recent sell-off gives investors a great entry point into this justifiably popular stock.

Cabot Oil & Gas (NYSE: COG)

Founded in 1989 and based in Houston, Cabot Oil & Gas is, despite its name, almost a natural gas exploration pure-play — all of its proven reserves are gaseous.

In May 2021, it merged with Cimarex Energy — another “oil and gas” exploration firm whose proven reserves consist almost entirely of gas — to form one of America’s largest gas exploration giants.

In the most recent quarter, the newly merged Cabot posted strong revenue growth of 42.8% year over year.

It also has a relatively modest P/E ratio of 23.53 and pays a 2.54% dividend. Shares have sold off in the year leading up to the Cimarex merger, giving new investors a perfect buy-in point for their recovery.

EQT (NYSE: EQT)

Founded in 1888 and based in Pittsburgh, EQT is another mostly gas exploration firm (95% of its proven energy reserves are gaseous) and the oldest firm on this list.

Despite its age, EQT has gained prominence recently as a pioneer in a fast-growing segment of the natural gas industry: responsibly sourced natural gas (RSG), or natural gas whose production has a minimal carbon footprint.

To that end, EQT is a popular hedge fund holding; the number of private funds that own it increased from 39 to 43 in the most recent quarter.

The firm also recently posted incredible year-over-year revenue growth of 117.8% and pays a modest 0.17% dividend. It’s no wonder shares have climbed in the last year, but it’s a good bet that they’ll keep going from here.

These five stocks can give you broad exposure to the biggest names in the natural gas industry. But in truth, they’re unlikely to yield the biggest returns in the industry.

Those returns are more likely to come from smaller, more obscure natural gas firms — the type only seasoned energy analysts know about.

Keith Kohl is one such energy analyst — and his Energy Investor subscribers have scored an average gain of 23.54% on his trades. Click here to learn more.