You can’t say we weren’t warned.

A decade ago, the U.S. Department of Energy released a report highlighting the critical materials that would be key components for the development of clean technologies in the United States.

Buried in that report, however, was more than just projections. For materials such as lithium, cobalt, and rare earth elements, it was clear who was in control.

Just think…

In 2010, the world’s largest lithium producers were Chile, Australia, and China, with Chile holding approximately 76% of global reserves.

Not surprisingly, we imported roughly 98% of our lithium from Chile and Argentina and relied on these foreign sources for well over half of our lithium consumption.

Don’t beat yourself up if it didn’t catch your eye at the time; most people ignored it completely.

After all, in 2011, a little over 17,000 electric vehicles were sold in the United States.

The EV revolution was barely a blip on everyone’s radar.

We both know that was about to change.

Lithium Outlook 2020: Bottoming Prices Signal a Bullish Future

There should be one question on your mind: How close are we to the bottom?

You know the story just as well as I do.

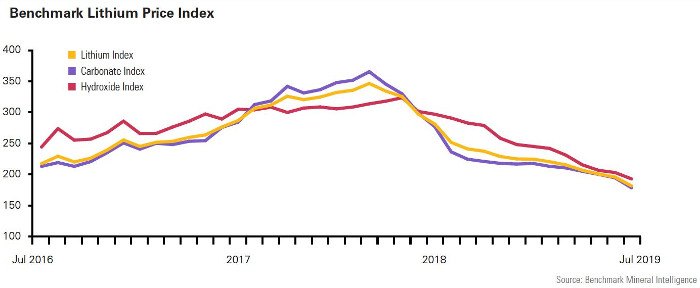

The hype over the EV sector sent speculators rushing into the lithium sector in 2016.

Now, even though EV sales in the U.S. jumped 81% in 2019, let’s talk about the real elephant in the room in this market: China.

Compared to the Middle Kingdom, sales in the U.S. are a drop in the bucket. Last year, EV sales topped 1.2 million cars in China, which includes both battery vehicles and plug-in hybrids.

The lithium boom has always been a demand story.

Take a look at EV sales projections in China between now and 2025:

In fact, the IEA reported earlier this year that the global fleet of electric vehicles is expected to triple by 2030, with demand growing at an average yearly pace of 24%.

Moreover, the world will require more than 10 new battery gigafactories by 2025.

The world’s largest automakers are stepping up to that challenge and plan on spending over $300 billion over the next 10 years investing in electric vehicle technology.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

And although I can show you incredible demand projections for lithium growth over the next decade, it’s imperative that investors also follow the supply side of the equation, too.

Right now, the world’s biggest superpowers are maneuvering to secure their own supply, preparing for the next phase of the EV revolution.

Except, of course, the United States.

War Over the Golden Triangle

It’s no secret who controls this market.

After last year’s $4 billion deal by Tianqi Lithium to become the second-largest shareholder in SQM, China officially took control of over half of the world’s lithium production.

Keep in mind that China has already locked down the cobalt and rare earth markets.

Even Russia is starting to secure its own supply.

Recently, Russia’s state-owned Rosatom made its move in Chile after inking an MOU with Wealth Minerals, which will ultimately give Russia 51% ownership in the Atacama lithium project.

Meanwhile, the U.S. still relies on foreign countries for more than half of its lithium supply. Between 2012 and 2015, we received nearly 60% of our lithium from Chile, with another 40% coming from Argentina.

In Argentina’s mining sector, China has more than $391 million committed to exploration project development.

Is a lithium shortage on the horizon?

After the scramble to expand operations and boost production due to surging prices in 2016 and 2017, some companies now find themselves looking to cut supplies as prices bottom out.

That’s setting us up for one wild ride higher when demand starts making an impact.

Stay tuned.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.