We are seeing a tale of two oil forecasts playing out once again.

Don’t act too surprised. After all, there has been a battle raging between OPEC+ and the IEA to control the oil narrative for years. At times, this showdown has gotten downright brutal.

Given how crude prices have languished all year as hype over a supply glut was pushed to new levels, it’s clear that the bears have been in the driver’s seat of this market for a long time.

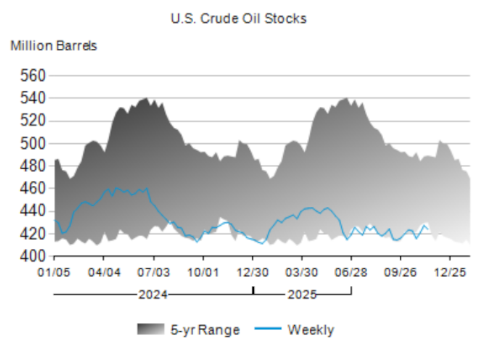

Here’s the catch… that supply glut has yet to materialize in the United States. Perhaps the IEA can take a quick look on this chart of U.S. crude stockpiles and show us where that glut is:

After a 3.4 million-barrel draw reported for last week, U.S. commercial crude oil inventories (excluding the SPR) are currently sitting at 424.2 million barrels — roughly 5% below the 5-year average.

To put a little perspective on this amount, that’s about 1.4% lower than where it was a year ago, and approximately 5.3% lower than it was two years ago.

Granted, we’re not counting the additions to our strategic reserve due to the fact that the Biden administration halved it in a desperate attempt to lower surging oil prices back in 2022 after Russian tanks rolled into Ukraine.

Keep in mind that U.S. demand for petroleum products hasn’t stalled — it’s still climbing, slow and steady.

Now here’s the interesting part…

You and I both know that crude prices simply cannot sustain themselves below $60 per barrel. Crude this cheap is well below the average breakeven price for drillers in the Permian Basin, which has been the dominant driver for U.S. oil production growth.

So we have healthy demand, dirt-cheap prices that discourage new drilling across the sector — I’ll let you take a guess where this will lead us in 2026.

Looking at the latest Short-Term Energy Outlook out of the EIA, U.S. domestic oil output is expected to remain flat next year at 13.6 million barrels per day. This is on the back of several strong years that saw our crude production grow from 12.9 million barrels per day in 2023 to 13.8 million barrels per day earlier this year.

Current projections from the EIA are that U.S. oil production will average 13.6 million barrels per day in both 2025 and 2026.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Folks, the cracks that we’ve been waiting for in U.S. supply growth are finally starting to emerge in 2026.

Why is that so important? Well, it’s because major forecasts like the one out of the IEA are relying on U.S. tight oil production to play a significant role in non-OPEC supply growth.

Remember, the IEA just admitted that its previous assertion that global oil demand would peak by 2030 was nothing more than a lie. The permabears at the IEA went even further to state that global oil demand would continue growing to 2050 — and they’re still underestimating things!

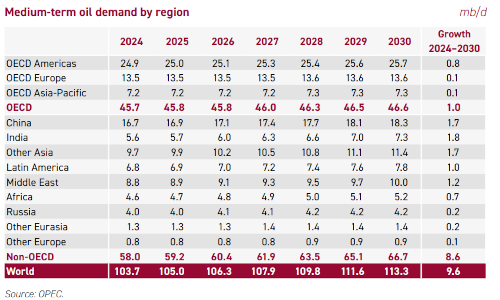

Shifting to OPEC’s most recent oil outlook, the group now sees strong global demand growth over the medium-term. Here’s a look at those projections, which have global oil demand rising to 113.3 million barrels per day through 2030:

Is OPEC a bit too bullish in their forecast? Perhaps, but their bullish sentiment feels more realistic than the IEA’s bearish one.

Supply-side shocks are looking far more likely in 2026.

But hey, don’t worry, OPEC and its allies are more than willing to take control of the global supply once again.

The supply/demand picture isn’t the only bullish driver ahead for oil prices, either. Next time, we’re going to dive right into the the other volatile part of the oil equation for 2026.

P.S. Trump Just Triggered 70% Gains Overnight

Trump’s new strategy of taking direct equity stakes in U.S. resource companies is minting overnight millionaires — and one tiny rare earths stock could be next. After a leaked report of a 10% Trump stake sent Lithium Americas up 70% in hours, investors are watching closely for his next move. With federal recognition, Pentagon ties, and the largest rare earth deposit in America, this small-cap miner could soar 50%–200% overnight once Trump signs the deal.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.