As oil falls to new lows, and winter slowly tightens its grip on us, it’s time to change focus to natural gas.

The next wave of investment in natural gas is going to come as soon as November, and by December prices could spike to unreal levels on the market much like we saw last year.

And that’s just the short term; For the long term, check this out…

In his State of the Union Address this year, President Obama called natural gas “the bridge fuel that can power our economy with less of the carbon pollution that causes climate change.”

Also, Hillary Clinton, typically offers this boilerplate response when goaded on natural gas: “This is a great economic advantage, a competitive advantage for us. … We don’t want to give that up.”

So, the current president and a big contender for 2016 clearly support natural gas as a fuel that appeals to both sides of the political spectrum.

Environmentalists prefer it over coal since it emits less carbon dioxide when burned, while fossil fuel producers make a lot of money from its production and sale.

And, all politics aside, investors have to see that a big change in policy is coming because of climate change, and based on the words of two influential politicians, it looks like natural gas will be the base of our future energy grid.

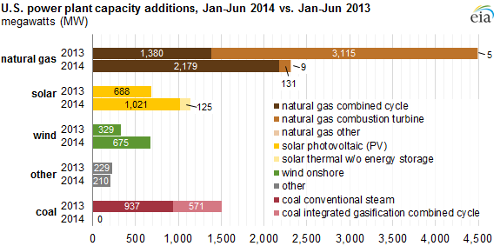

Even now natural gas is taking over the next wave of power plant additions…

Because we at Energy and Capital have made it our job to find energy investments with big growth potential, it’s imperative that you understand the possibilities here.

Buying the Industry

Now, you could get online and go to your brokerage and buy some natural gas drilling stocks… say something like Rosetta Resources, or Dominion Energy.

While these stocks could offer you some fair returns, I’d suggest taking a more diversified approach by including something many investors choose to ignore.

It’s another fuel that is derived form the production of natural gas, and is nearly ubiquitous.

Unfortunately, unlike most ubiquitous products, investors have largely forgotten that this fuel is a $20 billion a year industry in North America alone.

I’m talking about a fuel that powers your gas grill, runs forklifts for most major retailers and warehouses, and even powers 13 million vehicles worldwide.

I’m talking about propane.

You see, propane, although often confused with natural gas, is an important fuel not just in the U.S. but the rest of the world.

What’s even more crucial for us is that as natural gas production rises so too will propane production, and the market will find new ways to exploit propane to the benefit of investors.

When natural gas is harvested it has to be processed in order to remove liquid petroleum gases (LP gases) or else they will freeze and block the flow of pipelines.

One of the LP gases that comes out of this process is propane, and it has turned out to be quite the useful (and profitable) discovery.

If you remember last winter, harsh temperatures plagued most of North America, and heating bills exploded higher.

Natural gas went from under $4 a cubic foot to well above $6. Propane too, saw an increase in price since it is also used as a heating fuel for homes throughout the country.

And prospects for propane and natural gas are about to heat up again…

Winter’s Profit

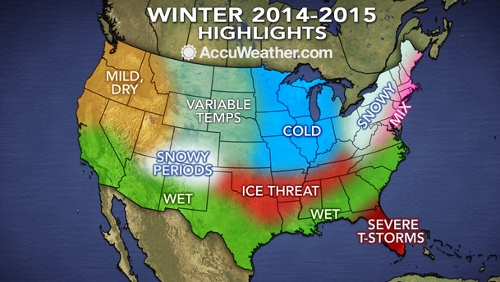

Check out this headline from the Washington Post: “Polar vortex will likely make a return this winter, says Accuweather”

And if they’re right, we may see some of the same frigid temperatures and heavy snows we saw last winter, although, they admit, these harsh conditions may not last as long as they did then.

Still, once the price spikes for natural gas and propane hit the herd’s eyes the price of stocks throughout the industry are going to hit unreal heights just as they did last year.

As you can see, the Midwest, Northeast, mid-Atlantic, and even parts of the south are going to face colder than normal temperatures, and, in response, these commodities will hit new heights.

At time of writing the price of natural gas is $3.82 while the price of propane is $3.08.

Now, once investors see the record low temps this winter, the time to buy will be long gone, but as you saw in that chart I showed you earlier the big spike has mostly declined over the summer, so we can confidently suggest that you buy the dip now if you’d like to make some money.

Once you do you’ll be able to sit back and wait for the natural gas bulls to show up in December and watch the value of your investment spike.

Then once the rest of the crowd rushes in amid the throes of the polar vortex in January and February, you can watch the value of your investments go even higher.

As for where to invest for this upcoming spike, keep your eyes on our website and weekly mailings as we look forward to suggesting some great opportunities in both natural gas and propane.

Good Investing,

Alex Martinelli