Back in 1933, Americans queued at bank counters with one purpose in mind — to swap coins and bars for paper money.

Why on earth would they do that?

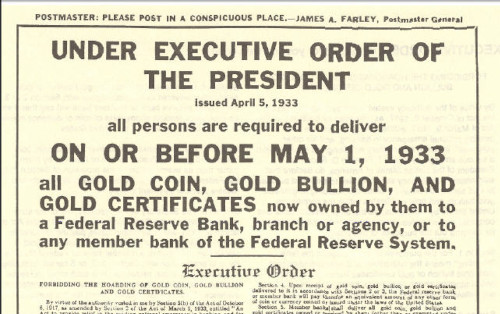

Well, it all has to do with Executive Order 6102.

With a single swipe of the Presidential pen, “Hoarding” became a federal offense overnight, with penalties that could reach $10,000 and ten years in prison.

That moment rewired our trust. Suddenly, gold stopped being the backbone of money and became subject to policy.

Nearly a century later, history is once again echoing itself.

This time, Italy is debating a one-off path to pull family bullion, coins, and jewelry into the formal economy… all with a comfy tax of 12.5%. Naturally, citizens only have a grace period of a few months to make this decision to declare their gold.

This isn’t confiscation, mind you. It’s just a little government coaxing — an administrative magnet to bring out assets long kept in the shadows.

Today, if you can’t show purchase records for your gold, sales can be hit with a 26% tax on the full value. It’s a loud signal that governments still care where the gold sits, how it’s counted, and how quickly it can be tapped.

It’s also happening at a time when gold prices are looking for support near the $4,000/oz line, sparking debates among investors as to whether we’re looking at a floor, or a launchpad.

We’re not talking about trivial numbers here, either. Current estimates put private Italian hoards of gold at roughly 4,500–5,000 tonnes, and lawmakers argue that certifying even a fraction of that wealth would deepen liquidity, improve transparency, and raise one-time revenue while reducing incentives for off-book trades.

To put a little perspective on that amount, Italy’s central bank sits on about 2,452 tonnes — the third largest stockpile among central banks — and repeated refusals to sell have paid off as prices climbed.

For the record, they could use that cash considering Italy’s debt is sitting at around $3.5 trillion.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Macro Gold Bull Hasn’t Left

Beyond Italy, we can see the structural bid within the data.

Zoom out a tiny bit and you’ll see this isn’t an anomaly.

The World Gold Council reported that total gold demand during the third quarter hit 1,313 tonnes, with central banks adding a net 220 tonnes.

In fact, central banks have expanded their collective reserves over the last decade and a half, turning gold into balance-sheet insurance that doesn’t depend on any single government’s promises.

That behavior sets a baseline that private flows can layer onto when headlines flare.

However, what changes now isn’t the metal.

Traditional gold investments still work: bars and coins for direct exposure, allocated vaulting for scale, miners and royalty companies for leverage, each with their own frictions and risks.

The question is whether gold can boost its attraction as the ultimate safe-haven asset by adding speed, portability, and traceability, all while preserving a clear link to the underlying metal.

That clear link that provides transparency is why blockchain technology has catapulted crypto to where it is today.

Now just imagine the value of gold if it were able to bridge that gap to modern technology.

The thing is… It has!

Owning This Golden Moment

Look, this cycle isn’t only about higher gold prices.

We both know that the bullish catalysts underlying gold’s multi-year historic run are firmly intact, with no signs of cracking.

This cycle is about the fundamental shift in HOW we take advantage of gold’s store of value with today’s technology. Moving from paper claims and weekend-closed vault slips to verifiable ownership that travels at network speed.

Gold’s structure is becoming just as important as its physical value.

Physicality still matters — the heft, the redemption, and the permanence of your golden assets. But gold is quickly moving towards its next evolution: NatGold.

Think of NatGold as the union of these worlds: vaulted, auditable gold married to modern blockchain infrastructure. The bar list and attestations anchor trust in metal; the token mechanics deliver instant transfer, 24/7 markets, and clean title.

You’re not replacing gold — you’re upgrading how it moves.

- Provenance: Serialized bar mapping with transparent attestations.

- Portability: Real-time transfers and pledge-ready liquidity.

- Redemption: Clear pathways from token to deliverable metal.

At $4,000/oz, discipline still rules — but ownership can finally match the moment.

And with NatGold, the asset is the same ancient collateral central banks favor.

That’s how the smart money is quietly gaining an edge in the next leg of this gold bull.

We’re not talking about more gold, but better gold — NatGold — owned in a way that fits how money actually moves today.

I believe this is an opportunity you need to see for yourself firsthand.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.

P.S. Silver's Breakout Could Turn $184 Into $1 Million (AGAIN!)

Silver ripped past $50 for the first time in 14 years — and the setup looks eerily similar to 1980, when one tiny miner turned a $184 stake into $1 million. With supply deficits mounting, AI and EV demand surging, and Washington declaring silver “critical,” the stage is set for another historic breakout. The biggest windfalls won’t come from coins — they’ll come from the right miners.