It always seems to starts with a forecast, doesn’t it?

A shiny graph, or perhaps a PowerPoint slide from Paris. Last week, we talked a good bit about the IEA’s oil illusion that has been putting pressure on oil markets. And true to form, it’s a hallucination dressed in bullet points. According to them, the world will be flooded with oil in 2026 — with millions of new barrels sloshing through global inventories, nearly half of which will come directly from OPEC+.

Now, let’s give credit where credit is due. The unwinding of OPEC+ cuts this year, along with pessimistic economic outlooks in non-OECD countries like China and India due to President Trump’s tariffs, have been a huge driver for forecasts lately. Some analysts are even expecting the kind of supply surge that will push crude prices into the low-$50/bbl’s in the early months of 2026.

I can only assume that these forecasters don’t expect OPEC to react whatsoever should oil prices fall that hard, and certainly not for any sustained period of time.

We know better than that, don’t we, dear reader? We don’t have to flip back to the warning flashed earlier this year by the Dallas Fed suggesting that U.S. tight oil would collapse at prices that low (spoiler: they will):

The Dallas Fed survey laid it out clearly here: U.S. producers need oil in the mid-$60s just to breakeven; anything lower, and the collapse begins in earnest.

There are a few interesting points we see in global supply over the next few months.

The first, as I just mentioned, is that OPEC will remain a wild card with the ability to adjust production to suit market needs. After all, we saw the Saudis pump more oil for a few days when Israel and Iran started striking each other. Although these barrels didn’t technically make it into the market, you can bet the House of Saud would be quick to act to defend oil prices if they fell further.

Then we have the situation outside of OPEC to worry about, because the optimism over non-OPEC supply growth isn’t much grounded in reality.

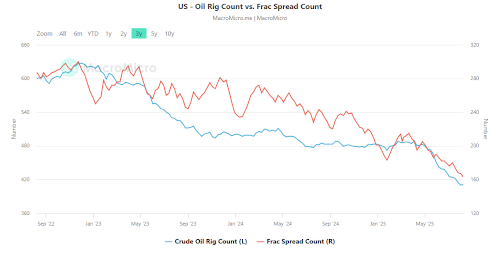

You see, while the IEA peddles their utopia of oversupply, the real world is telling a very different story. As the veteran members of our investment community here are fully aware, U.S. oil rig activity — the lifeblood of future production — has been in a long, slow bleed since late 2022.

After peaking at 627 rigs at the tail end of 2022, we’ve seen a 34% collapse to just 411 rigs today. It’s no better in the Permian Basin, where rig activity has dropped to 256 — a level we haven’t seen since the dog days of 2021.

That alone should be a giant red flag for anyone betting on growing U.S. production.

And it gets worse… why?

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Well, because even though a falling rig count is a sign that future output may be in jeopardy, it doesn’t tell you the whole story to our domestic production. Traditionally, all one had to do was see drillers deploying fewer rigs into the oil patch to recognize that production would soon fall and give a boost to crude prices.

But we aren’t living in the good old days anymore. Remember, U.S. oil production has grown substantially despite fewer rigs drilling into U.S. soil. As you know, companies are becoming more and more efficient at drilling and completing wells, which both lowers costs and boosts well productivity.

Make no mistake, that has been the single most important driver for U.S. oil production over the last few years.

And everyone should be wondering where the breaking point is.

It’s a new era for U.S. oil production. If you want to know where oil production is really headed, you can’t just look at how many wells are being drilled — you’ve got to pay attention to how many are being finished.

That’s where the frac spread count comes in.

Think of it like this: drilling a well is like baking a cake, but without frosting it, lighting the candles, and serving it up. It just sits there doing nothing. A frac crew is the team that finishes the cake. They're the ones who come in at the end, pump high-pressure fluid into the rock, and crack it open so the oil can flow.

No frac crew, no oil.

The frac spread count is simply a measure of how many of those oil-completing teams are out in the field working.

Each “spread” is a full set of equipment and crew that can complete a well. So when the number of active spreads drops, it means fewer wells are getting finished. And fewer finished wells mean less new oil coming online. It’s like having a kitchen full of half-baked cakes — all the ingredients are there, but no one’s around to finish the job.

Eventually, you run out of slices to serve.

So when we see the frac spread count falling — like it has been — it’s a blinking red light on the dashboard. It tells us oil production isn’t just going to slow down… it’s already running low on gas.

But hey, let me show you just how things have fallen off over the last three years:

At last check, only 167 frac crews were active across the country — the lowest since 2021.

In the Permian, it’s down more than 20% since March. Even the CEO of Diamondback Energy, one of the Permian’s top operators, recently admitted that U.S. production has probably peaked.

His reasoning? The steady decline in frac activity, the lack of drilling momentum, and the hard limits of what efficiency can deliver when capital spending tightens and crews vanish.

Never forget that efficiency has been the band-aid the U.S. shale patch has leaned on since the first round of oil price collapsed in 2015. When the rig count fell, operators made each well better — longer laterals, better spacing, smarter fracs.

It worked, for a while. Production kept rising, even with fewer rigs.

Now that magic trick is showing signs of fatigue, and productivity gains are plateauing. Costs are rising again. And with both rigs and frac crews disappearing, the ability to hide behind “efficiency” is running out.

To make matters worse, oilfield service companies are getting hammered. ProPetro, a bellwether for the completion business, recently reported that frac demand is slipping so fast that nearly 30% of their fleet is now idle. With fewer completions, output has nowhere to go but down.

The market just hasn’t realized it yet.

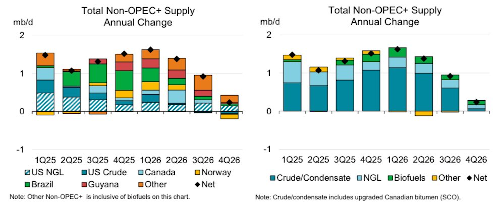

And yet the IEA continues its delusion, projecting an oversupplied market just around the corner — and it won’t come on the back of U.S. production. Below, you can see that the IEA believes the weight of supply growth will be carried by countries like Brazil, Guyana, and Norway:

That’s a lot of wishful thinking, which brings us to the only place worth watching — the companies that can thrive in spite of this mess.

The truth is, the next evolution of U.S. oil production won’t come from throwing more rigs in the field or re-running the same shale playbook. It’s going to come from companies that are already experimenting with the next wave of completion and drilling technologies — the ones that can get more oil out of tight rock faster, cheaper, and with fewer moving parts.

Just as horizontal drilling and hydraulic fracturing turned the U.S. into the world’s top producer a decade ago, a new generation of engineering breakthroughs will determine who survives the coming shakeout.

Of course, these are the companies Big Oil will be circling like vultures — or suitors — depending on your point of view. And for individual investors like us that have been paying attention up until this point, the upside is immense.

We’ve seen this story before. We know how it ends. The only question is who’s paying attention this time around.

Let me show you where to start your search right here.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.