California had everything going for it in 1985.

But it wasn’t because of a few historical events that took place that made The Golden State so great that year. It wasn’t the fact that the police finally arrested Richard Ramirez, the “Night Stalker” killer, nor was it because that was the year that California established its 911 emergency system that soon became the model to what we use today.

Want a hint? Well, it had to do with the fact that California’s economy was on an unstoppable run in the 1980s, with companies in the state experiencing incredible growth, even outperforming the national economy.

I’d give you three guesses as to what helped drive California’s prosperity, but I know my readers only need one — cheap, abundant energy.

In 1985, California oil companies were pumping more than a million barrels per day, and it was the third-largest oil-producing state in the country, second only to Alaska and Texas. Hell, it was even extracting more oil from beneath the soil than the former Gulf of Mexico.

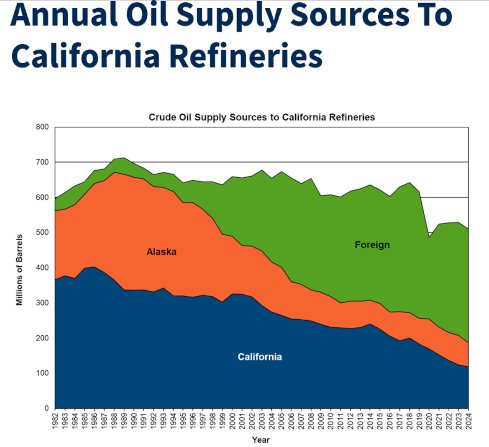

In fact, California’s oil output was meeting nearly 62% of refinery demand, with another one-third of that demand getting shipped in from Alaska. Things were so good that its refineries only relied on the rest of the country for 5.5% of demand.

Then, everything suddenly went to hell.

Oh, the warning signs were all there, dear reader. However, the state mistook them for virtues.

What was hailed as environmental leadership was, in truth, the slow and deliberate dismantling of one of the most valuable industries in the state’s history.

If you want to know just how bad things have gotten for the state’s oil industry, look no further than this:

California’s ability to supply its own refiners with oil plummeted since 1985. As you can see, the numbers have completely flipped today, with California only supplying around 23% of its own oil. Refiners in the state now rely on outside imports for nearly 64% of its demand.

The state has become energy dependent by design, not by necessity, and its residents have felt the pain of high energy prices thanks to its harsh regulatory environment.

You see, those increasingly strict regulations have led to the near collapse of the state’s oil output. Remember when I said that the state’s crude production was at the top of the nation?

During the first six months of 2025, California’s oil production averaged just 264,000 barrels per day — a 73.6% decline from its 1985 peak.

The decline didn’t come from geology, and despite being both conventional and costlier heavy oil reserves, California’s basins are still packed with crude, especially in Kern County, which has dominated the state’s oil production for more than a century.

No, this production death spiral was political.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

A moratorium on offshore drilling in the 1960s sealed away billions of barrels beneath the Pacific, and getting a new drilling permit was like pulling teeth. This wasn’t an overnight process, mind you.

Over the last few years, the number of new drilling permits plummeted by the thousands, with just 86 permits issued last year (only 25 were issued in 2023, too).

For the record, THAT’S how you kill your state’s oil industry.

Of course, when horizontal drilling and hydraulic fracturing were rewriting the story of American energy independence over the last two decades, California was nowhere to be found.

The state that once sat atop its own throne of oil had deliberately sidelined itself from the very boom that turned the U.S. into the largest producer of crude on earth.

The self-inflicting punishment has been brutal, and things are about to get worse.

Oil companies still willing to fight through California’s labyrinth of permits and lawsuits face higher costs than anywhere else in the country… but even Big Oil is packing up and leaving town.

Chevron, once Standard Oil of California and arguably the very company that built the state’s industrial foundation, has packed up its headquarters and moved to Texas. Phillips 66 shut its Los Angeles refinery recently, and now Valero is preparing to close its Benicia refinery by 2026.

California is bleeding energy assets, and no amount of slick press releases from Sacramento will patch the wound.

This is where hypocrisy comes into play.

Unfortunately, politics are at the center of the new push to reform California’s energy policies, and with an eye on the 2028 presidential election, Governor Newsom now trumpets a new bill meant to reassure Californians that energy affordability is within reach.

The problem is that his bill is little more than smoke and mirrors.

After decades of choking the oil industry with suffocating restrictions, the promise of “increased drilling permits” is like throwing someone who’s starving a crumb and calling it a feast.

Any promise of a drilling revival while oil companies are locking the doors and leaving the state entirely will fall on deaf ears.

How does that saying go?

Fool me once, shame on you, fool me twice, shame on me.

Meanwhile, the broader contradiction grows sharper by the day.

You see, California is still one of the top consumers of gasoline and diesel in the nation. Its highways teem with cars, its ports bustle with fuel-hungry ships, and its airports rank among the busiest in the world.

Someone remind me how soon the state legislature plans on phasing out new gasoline-powered cars… 2035?

And yet, as California fades, oil profits will continue to grow.

Production in the United States is still strong, but the cracks are starting to show. It’s only a matter of time before U.S. output plateaus and starts to decline, especially considering how the low oil price environment has deterred E&P spending.

The oil boom that transformed America into a global energy powerhouse cannot continue without new investment — something that has dried up this year. Remember, decline rates in these tight oil wells are steep, requiring constant reinvestment just to keep production flat.

That’s the storm brewing on the horizon right now, and the investment herd still hasn’t recognized how fragile U.S. supply really is.

The difference is that in places like Texas and the Permian Basin, operators have the technology and efficiency gains to keep drilling profitably even at lower prices — that’s where the smart money will flow.

And while California shuts down its refineries and sues its producers, companies in the Permian are quietly perfecting the drilling technologies that squeeze more barrels from every well at lower costs.

New completion techniques, smarter drilling, and data-driven optimization have extended the life of our tight oil production far beyond what even the optimists believed a decade ago.

That’s where the real value lies for us today.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.