Ever since Congress lifted the ban on U.S. oil exports a few years ago, it’s been no surprise that our tight oil resources have accounted for the lion’s share of growth.

To be perfectly clear, 6 out of every 10 barrels of oil extracted from beneath U.S. soil comes from just one of three oil regions.

Again, it’s not shocking that we’ve gotten to this point.

We’ve been banging this drum for more than a decade, and the veteran members of our investment community know the kind of opportunity that lies ahead.

You see, we’ve gone far, far beyond a simple oil boom.

We’re now transitioning into a global energy powerhouse.

Call it what it truly is: a perfect storm for investors!

Let me show you why…

Texas Goes Global

Last week, we talked a little bit about the 47 barrels of oil being extracted from the Permian Basin EVERY SECOND!

But I want you to fully understand the kind of output we’re talking about here.

At that rate, more than 4.1 million barrels of crude are flowing out of Permian wells each day.

In April, output in West Texas is projected to climb another 40,000 barrels per day.

By the time the summer driving season kicks into high gear in a few short months, the Permian Basin could be supplying well over 4.3 million barrels per day.

That’s MORE crude oil than the entire United States was producing in September of 2005!

Prior to 2015, this flood of crude oil coming on-line came with some benefits.

Between 2005 and 2015, our crude oil imports plummeted by nearly one-third.

Specifically, our imports from OPEC plunged by almost one-half.

Then came December 2015.

That’s when Congress lifted the 40-year ban on oil exports, and the game changed dramatically.

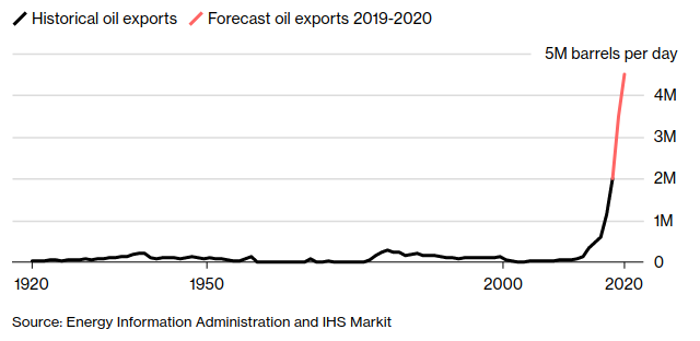

At first, only a small trickle of crude started flowing out of the United States.

A week ago, the EIA reported that U.S. oil exports averaged 2 million barrels per day in 2018.

And our list of oil clientele grew to 42.

Of course, six of our 10 largest buyers were in Asia.

Things get even better for the Lone Star State, too…

By 2020, U.S. exports of crude oil are projected to more than double to 5 million barrels per day!

The IEA is even projecting U.S. oil exports to top 9 million barrels per day by the mid-2020s.

For the record, only the Saudis would be able to put more crude on the global market.

But there’s one slight catch to this story.

In order for oil companies to achieve this goal, the industry is going to have to spend billions improving one critical piece to this oil boom.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

On Land or Sea or Pipe!

Patience is a virtue, especially when it comes to investing.

Sometimes you have to play the long game to come out on top.

And that’s precisely how a small group of investors is taking advantage of Texas’ energy boom.

A recent report by IHS Market concluded that in order for Texas to hit its full potential for oil and gas production growth, nearly 11,000 miles of new, unplanned pipeline will need to be built over the next 30 years.

In case you’re counting, that’s roughly 20 new projects that need to come on-line.

Falling short of those targets could curtail oil and gas production growth by 9% and 24%, respectively.

But we’re talking more than pipelines, dear reader.

If drillers in West Texas have any shot of boosting production to 5.5 million barrels per day over the next 10 years, a host of new infrastructure will need to be put in place — from refineries to more ports along the Gulf of Mexico.

Consider it the greatest U.S. energy build-out in history.

You’re not going to want to sit on the sidelines for this one, trust me.

All that’s left is targeting the right opportunities.

Well, the good news is that we’ve already uncovered a group of investments that are going to mint a small fortune for individual investors like us who have the patience to see these infrastructure profits through the long run.

And they’re already lining my readers’ pockets with something even more valuable for investors: regular payouts of cold, hard cash.

Don’t take my word for it; you have to see this one for yourself.

It’s time you joined them.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.