A new theme has emerged in the markets.

The rotation into value and defensive stocks is real, and the tech trade (aside from some undervalued names with good fundamentals) is dead.

It’s been a glorious year riding the semiconductor surge — as well as other innovative tech trends like the metaverse and spatial computing — to big money. But now we need to adjust. Market sentiment is souring on high-growth tech stocks, and folks and institutions alike are now looking for more value.

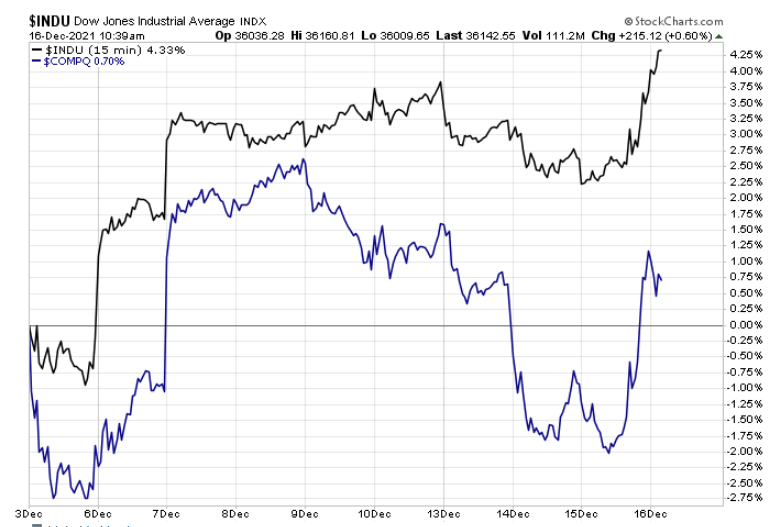

In an almost completely opposite move from what I expected, we’re seeing a stark contrast in the directions the Dow Jones Industrial Average (black line) and the tech-heavy Nasdaq (blue line) have taken.

We still need more data through December to confirm this action is a full-blown condemnation of the tech trade, but I think the evidence is certainly piling up.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Jerome Powell’s Final Notes

On Wednesday, the United States Federal Reserve gathered for its final meeting; in a press conference later that afternoon, Fed Chairman Jerome Powell outlined the central bank’s plan for 2022.

Based on the minutes provided to us, we know the following heading into the new year:

- Fed officials are much more concerned that inflation will be persistent.

- The Fed is expected to accelerate the tapering of its bond-buying campaign.

- The Fed is closer to its goals of maximum employment than expected.

- We will see three rate hikes in 2022.

Most of this was expected from the Fed’s last meeting, which I think is the root cause for the shift in market sentiment right now.

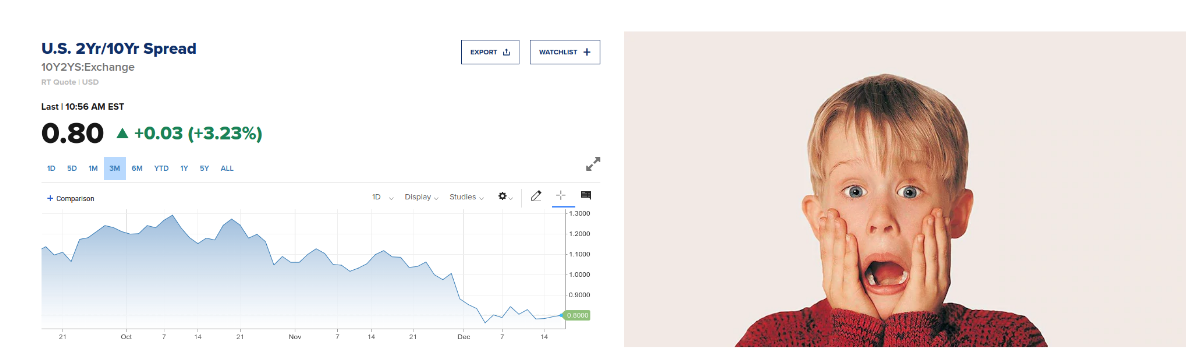

Further complicating matters are new concerns that the yield curve is flattening and may possibly invert. This could indicate a recession is coming in 2022.

As a report by Financial Times notes, the difference between long- and short-term yields has “narrowed drastically.”

Aaaaaaahhhhhh!

Consider These Three Sectors for Your First Trades of 2022

Sector rotation is the movement of money invested in stocks from one sector to another. It’s a signal that investors anticipate a new stage of the economic growth cycle. Right now, the rotation we are starting to see indicates investors expect rough times ahead for the U.S. economy.

As such, these three sectors and stocks are high on my radar:

- Utilities — The utilities sector is made up of companies that provide basic amenities, such as water, sewage services, electricity, dams, and natural gas. These private companies are part of the public service landscape and are heavily regulated. Investors typically treat utilities as long-term holdings and use them to generate a steady income for their portfolios — a defensive strategy when recession indicators start flashing. Consider a company like Southern Company (NYSE: SO). The company engages in various segments of electricity distribution in the U.S. and pays a strong 4% dividend.

- Consumer Defensive — The consumer defensive sector is made up of companies that manufacture food, beverages, household and personal products, and packaged goods. Many of the “sin stocks” that focus on alcohol and tobacco are included in this list, which also includes companies that provide services such as education and training. Love it or hate it, Walmart Inc. (NYSE: WMT) rules in the retail space. It has the chops to combat Amazon online, and its stores are always crowded, pandemic or not. I’m buying WMT shares and suggest you do too.

- Real Estate — The real estate sector is comprised of the residential real estate, commercial real estate, and industrial real estate segments. Within these segments, I believe the one with the best investment opportunities is industrial real estate. This segment is made up of properties used in manufacturing and/or producing goods and services. Classic examples include factories, plants, and warehouses. There’s a small sector of the industrial real estate industry that pays out a hefty dividend and could be a safe haven for folks and institutions fleeing the tech trade. Industrial REITs own and manage industrial facilities and rent space in those properties to tenants. One to consider is the U.S.’ largest cold-storage REIT, AmeriCold Realty Trust (NYSE: COLD). The company is the largest cold-storage property management company in the world and offers a near 3% dividend.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter