A few weeks ago, I was enjoying the slow crawl of gasoline prices.

They inch up in the summer anyway, but it was also a clear show of oil’s slow but sure progress toward recovery.

And while I can’t really say I was glad to be paying more at the pump, the return of profits on my oil investments more than made up for it.

However, last week we hit a bit of a snag.

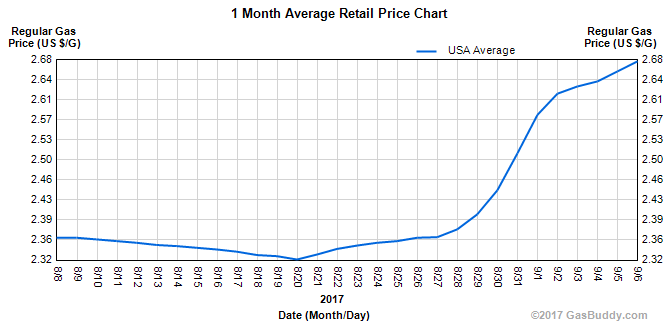

If you, too, are now paying as much as $20 extra to fill up the tank, you can thank our friend Harvey.

The hurricane that rampaged across southern Texas for the better part of a week left not only homes and dams flooded out, but also a large portion of the country’s oil refineries out of commission.

Nearly 30% of all U.S. refining capacity was right in the path of the monster storm…

Throughout the week, as much as 2.2 million barrels per day of capacity was cut off, and that oil was stranded inland.

That’s millions of barrels per day of refined petroleum products suddenly missing.

Even though product tankers headed to different ports were diverted to Texas, and the U.S. Strategic Petroleum Reserve was tapped into for as much as 500,000 barrels, gas prices around the country went up more than $0.30 on average.

The bottleneck in crude coming out of the most productive plays in Texas pushed oil prices back down under $50, though they’ve recovered a bit this week.

It’s not the kind of recovery situation we’d been hoping to see…

But at least it’s just a temporary one.

OPEC Founder Topples

The situation with OPEC, as you may have gathered, can’t be repaired quite as quickly.

Yet another OPEC-Russia output cut extension may be around the corner, but given the limited reaction to the first one, I don’t expect prices will jump the way these oil giants are hoping.

Besides, it looks like OPEC may be down a member any day now.

Venezuela, once one of the organization’s biggest members and home to the world’s largest oil reserves, has taken another blow that it may not ever bounce back from.

Yes, the same country that was a founding member of OPEC; the same country that holds a mind-blowing 300 billion barrels of crude oil in proved reserves — the largest on the planet!

That Venezuela.

Earlier this week, the head honcho of Venezuela’s state-owned PDVSA and eight other company executives were arrested and are now allegedly facing corruption probes.

This isn’t the first sign of trouble for the flailing oil company, either.

For years, the company has had a bad reputation for alleged corruption from its higher-ups.

In 2016, a congressional charge claimed that the company had lost as much as $11 billion between 2004 and 2014, none of which apparently had anything to do with the two-year oil price rout.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

This new drama has put Venezuela in an odd position as an OPEC member.

The country was already in turmoil under the rough political climate.

President Nicolas Maduro brought his own laundry list of scandals into office with him, and the drama hasn’t slowed one bit since he’s been in charge.

Unfortunately, his government relies on oil revenues to keep social programs and national budgets afloat.

And there’s been little enough oil revenue for the country in the past few years.

The country’s oil industry was slipping due to a lack of investment and poor project management long before prices took their plunge in 2014.

This scandal could be the final straw for a country already on the edge of revolution.

Down, Down, Down in a Burning Ring of Oil

Could PDVSA be shut down?

Would it matter if OPEC lost this producer?

I don’t think so, because for the most part, it already has.

Venezuelan production and exports have slipped drastically, as oil prices languished far below the price Venezuela needs to just break even on its operations.

This, coupled with the political skirmishes, took Venezuela out of the game long ago.

And the rest of OPEC is still struggling to make up the difference.

Meanwhile, U.S. shale is expected to bounce back from its own stormy situation pretty fast.

At the time of writing, WTI is already back up to $49, and Brent crude has risen to a record for the year at $54.

Which means, unfortunately, higher gas prices are here to stay.

But if you’ve been paying attention, you’ll have seen that there are plenty of ways to make that money back.

Refineries affected by Harvey are already coming back online and making up for lost time.

Oil will continue its progress higher throughout the year, and U.S. producers are already setting themselves up for a more profitable future.

We’ll be keeping an eye on our favorite picks, especially those in Texas’s own Permian Basin.

Stay tuned.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.