It’s the 182nd day of the COVID lockdown. My wife has bought everything Wayfair has to sell and we are doing even more projects.

My first project was to restore a 1968 Folbot sailing kayak, which I wrote about in Energy and Capital back in March.

It is looking Bristol, as the old salts say.

This week we’ve been redoing the floor in the basement of our Maryland house, replacing some weathered carpet with Italian ceramic tile we picked up from the local builders auction.

Builder auctions are great bargains these days as no wants to wade through the cumbersome websites or show up in person.

The exact opposite is happening on the Chicago Mercantile Exchange. Lumber futures’ prices quadrupled to over $1,000 per 1,000 board feet before crashing back down last week to $567.

For those bad at math, that is $1 per square foot for rough-cut wood. Those are outrageous prices. Even after the massive sell-off due to seasonal futures contract rollover, the price remains 70% above the price last September.

Experts Were Wrong Again

Lumber is so expensive because all of the experts got it wrong. They thought COVID would wipe out housing. Unemployment would surge and people would mail in their keys just like it was 2009 all over again.

So the sawmills, remembering what happened just 11 years ago, started to conserve cash flow. They furloughed workers, ended shifts, and shut mills.

But the exact opposite happened. Folks were spending all of their time at home. They started projects. In addition, the people with means wanted to move out of the city to flee the pandemic. They bought new houses. On top of this, the Federal Reserve cut interest rates to the bone, spurring new demand.

Furthermore, there was pent-up demand from millennials as housing production has been well below average for the past 10 years. Toss in some record-setting wildfires, a couple hurricanes, a falling dollar, growing inflation, Fed printing, and rampant speculation…

And you get a crazy chart like this:

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

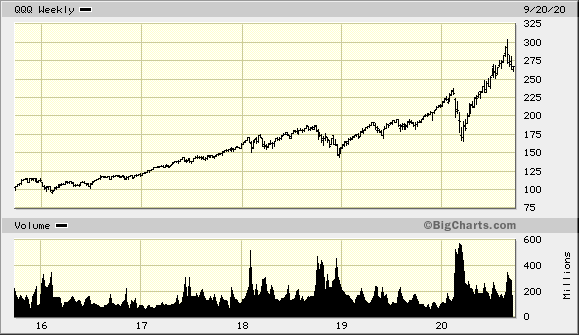

And then there are equities. Here is the Nasdaq’s QQQ ETF, which follows the top 100 Nasdaq stocks by market value:

From the March lows to the September highs, the QQQs went up 84%. That’s an incredible run. The same sort of thing drove the tech stock as drove lumber prices.

The experts got it wrong. Companies like Amazon, Teledoc, and Wayfair did gangbusters. Speculators with no sports betting, large unemployment payouts, and nothing better to do drove the market higher. The Fed pumped billions into the markets, cut interest rates, and screamed, “Buy, buy, buy…”

It was fun while it lasted. Now the real work begins.

The extra unemployment cash has run out and Congress won’t put out another cash giveaway until after the election.

Earnings season is coming up. This is when we will figure out whether the last six months have simply pulled forward two years’ worth of growth or if it is sustainable.

Either way, the market got ahead of itself. We are due for some consolidation. A retest of the February 19 peak of 238 on the QQQs is very possible. If you’ve been waiting to buy, you will get your chance over the next few months. Patience is a virtue.

Also remember, once the selling starts in earnest, people will get hit with margin calls. This will take gold and silver down, as well as everything else. It is after this happens that the precious metals act like a rocket ship.

In 2009, I recommended three gold companies that traded less than the cash they had in the bank. Each of these companies went up over 2,000% over the next two years. Bargains will show up — make sure you have some cash to buy them when they do.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.