It’s an incredibly unloved stock.

Perhaps that’s why I like it so much.

Supreme Cannabis (TSX: FIRE)(OTCBB: SPRWF), a Canadian cannabis player, announced earnings last week and absolutely crushed it.

The company narrowed losses, improved margins, and boasted a revenue increase of 359%.

But investors yawned. Or rather, they were preoccupied with two other cannabis companies that were also announcing earnings last week.

Those companies were Aurora Cannabis (NYSE: ACB) and Canopy Growth Corporation (NYSE: CGC) — both absolute giants in the world of cannabis, to be sure, but both also releasing earnings that showed a clear shrinking of margins.

Both companies increased revenues, but the “cost of doing business” was a bit more than analysts were expecting. Not that it mattered. Both stocks still sailed along smoothly, while shares of Supreme slightly fell.

So what does this mean?

Simple…

In a world of overvalued stocks in the cannabis sector, only a few are actually trading at levels that make sense. And those stocks represent a huge buying opportunity for those who actually pay attention to details.

Why I Love Unloved Stocks

I’ve been very successful over the years by buying unloved stocks. Particularly in the cannabis space.

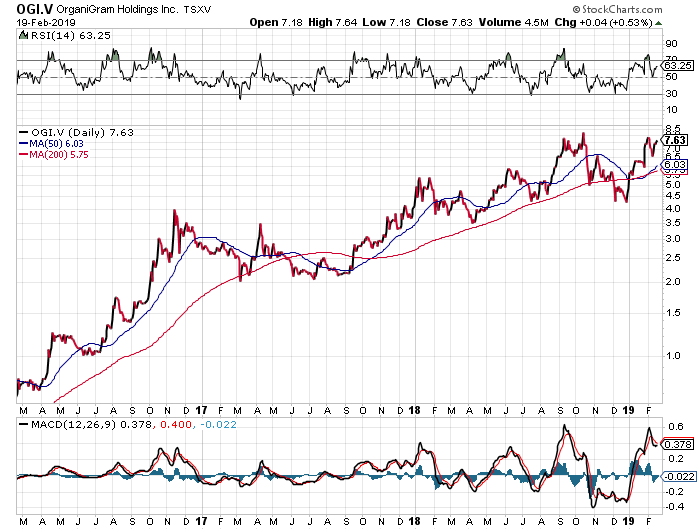

In fact, when I first recommended OrganiGram Holdings (TSX-V: OGI) to members of my Green Chip Stocks private investment community, mainstream analysts wouldn’t even look at it. And the ones who did tore it apart.

But I did my research, and I knew there was something there. And anytime the stock dipped, I reinforced my call to load up the boat.

My original buy recommendation was at $0.40. Last week, the stock hit a new high of $8.55 a share.

That’s a gain of 2,037%.

And that, my friend, is just one of many examples of former unloved pot stocks that are now major players.

Now, it’s still not certain that Supreme Cannabis (TSX: FIRE)(OTCBB: SPRWF) will be a major player, but looking at the numbers and all the headway the company has made over the past six months, it’s becoming increasingly clear that this stock is significantly undervalued and ripe for some serious growth in 2019.

Especially now that the stock has uplisted to the TSX and has recently expanded its domestic distribution to eight provinces.

Today, the stock is trading around $1.85. I think it’ll be at $3.00 within the next few months, which would represent a gain of 62.2%.

Of course, compared to some of the cannabis stocks that are currently in the Green Chip Stocks portfolio, 62% is peanuts.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

A Quick Double

Last week, I recommended a new cannabis stock to the Green Chip Stocks community.

It’s a relatively small player, but it has very deep pockets and a lock on nine cannabis operations in Florida as well as another one in the burgeoning Ohio medical cannabis market.

Motley Fool listed it as one of the top pot stock buys for 2019, and Canaccord Genuity has a $2.00 price tag on it. But you can buy it today for less than $0.90. At $2.00, you’re looking at a potential gain of more than 122%.

I’ve done my own due diligence on this one and have come to the same conclusion. So I added it to our portfolio, which you can access by becoming a member today.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter