The first time I stepped into Alberta’s oil sands, it wasn’t the massive trucks that grabbed me by the collar.

Those Caterpillar 797Fs — each one a mobile mountain hauling 400 tons of bitumen-soaked ore — are hard to miss. And while their sheer size could make a grown man feel like a pocket-sized tourist in a sandbox of giants, that wasn’t what stuck in my mind.

Nor was it the unexpectedly pristine stretches of land that Suncor had meticulously restored to its pre-industrial state — a rebuke to anyone who pictures surface mining as a Mad Max wasteland.

No, what caught my attention wasn’t outside the mine at all, but rather in my hotel room.

It was 2006, and Fort McMurray was the kind of place where you checked your cell signal like a miner checks his canary.

Yet, the moment I checked into my room I immediately noticed something odd. Beside every object — the phone, the alarm clock, the television — sat a label written in both braille and Mandarin Chinese.

That’s right… Mandarin.

Remember, this was back around 2006. For my younger readers, you need to understand that China was nowhere in the picture at the time.

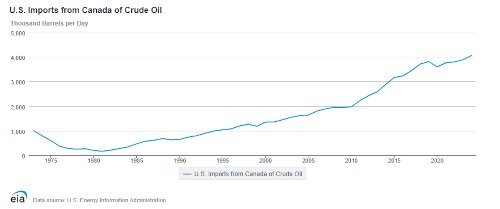

Back then, the United States accounted for approximately 99% of Canada’s crude oil exports, which came out to roughly 1.8 million barrels per day.

For decades, our thirst for heavier grades of crude has grown; think of the kind of crude that comes out of areas like Venezuela’s Orinoco Belt, or the more well-known Canadian oil sands.

Seems a little strange that virtually every drop of oil that is shipped out of Canada heads south to the U.S., yet there I was looking at the word ‘telephone’ written in Mandarin.

Naturally, our role as Canada’s top oil customer expanded dramatically since then. As you can see, we’ve bought more than 4 million barrels of oil per day in 2024:

What I saw that day in Fort Mcmurray wasn’t just some random abnormality, it was a portent of things to come. In fact, it wasn’t even the biggest warning sign that China was about to cut right into the United States’ most reliable supply of foreign oil.

It didn’t take long for it to come true, too.

In 2013, an application was submitted to expand the Trans Mountain pipeline, a pipeline that has been shipping a small crude from the oil sands in Alberta to the west coast in British Columbia.

Within five years, construction began. If it wasn’t clear by then that oil sands operators wanted to tap into Asian crude markets, it certainly was when the Trans Mountain Expansion Project became fully operational in May, 2024.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The moment that project came on-line it tripled the pipeline’s capacity to 890,000 barrels per day. Soon, the first barrels were loaded onto Aframax tankers like the Dubai Angel and set sail for China.

Just like that, Canadian oil exports went global in a major way.

But you’d be a fool to think that the ride for Canadian oil stocks is over.

You see, last week Alberta’s government announced that another major pipeline would soon be in the works. Right now they’re dotting the ‘i’s and crossing the ‘t’s for a formal application, and the province is committing C$14 million to the project.

Once completed, this new pipeline will transport an extra one million barrels per day of bitumen from the oil sands to be exported out of British Columbia.

I’d give you three guesses where that oil will end up, but I have a feeling my readers will only need one.

The media narrative may be oblivious to the idea that China is craving more Canadian crude, but that’s only because they’re locked in the narrative that China demand is collapsing.

Spoiler: It’s not!

At current rates, China is consuming more than 8.1 million barrels of crude every day. But you know just as well as I do that the biggest driver for global oil demand isn’t China — it’s India, a country whose demand is expected to grow more than 7% this year.

Now imagine how desperate they’ll be once all the cheap Russian crude they’ve been buying for the past two years dries up. Whether the bite of sanctions actually work, or a conflict resolution puts more Russian buyers into play, it doesn’t matter.

Of course, we’re not the only ones that recognize this value in the Canadian oil patch. And it’s really only a matter of time before some of the biggest investors on the planet catch on.

The real question is whether you’ll beat them to the punch.

Well, let me show you exactly how to do it.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.