Oil is cheap again.

No, I’m not talking about the “fill up your truck for twenty bucks” kind of cheap, but cheap enough that the market is acting like it’s found some magical, self-replenishing barrel of black gold in the backyard.

At around $64/bbl a pop, you’d think the world had stumbled into an oil surplus so vast that producers can’t even give it away. And yet, if you listen closely, you can hear the machinery straining, and demand is humming louder than it ever has.

Yet just off of the market’s periphery, future supply is fraying at the edges, and the balance that’s kept prices in check is starting to wobble like a bad ceiling fan.

This is the kind of setup markets get wrong all the time. The investment herd takes one quick glance at WTI prices in the low-$60s and mistakes it for stability, when in fact we’re in the opening act of a much longer, far more profitable story.

Look, oil demand isn’t just strong — it’s accelerating.

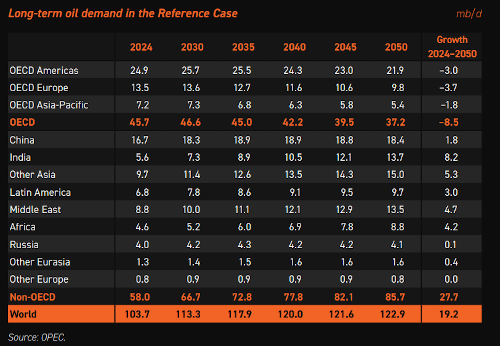

But dig a little deeper, and you’ll see that ALL of this growth will come from outside of the OECD. In fact, crude consumption in the U.S., EU, and Asia-Pacific is expected to fall slightly between now and 2050. At least, that’s how the number crunchers at OPEC see this situation unfolding in its latest World Oil Outlook 2025.

Go ahead and take a look for yourself:

Perhaps you can see now why it’s so important that President Trump ink those energy trade deals now, before the real momentum picks up in countries like India.

India, the Middle East, Africa — these are not markets easing off the throttle.

Granted, OPEC has always been on the optimistic side of the fence when it comes to its projections, which balances out the more bearish projections from the IEA. However, it seems lately as if the IEA has been the one to recently go back and say, “my bad, we got that wrong.”

Some of you might remember last May when the IEA dropped its bombshell confession and made a few historical revisions that showed just how wrong their projections were.

But we’re not going to blame them for those bad calls. No matter how you look at the numbers, if OPEC’s oil report is anywhere close to accurate, we’re in for a wild ride. In their report OPEC predicted that global demand will rise from roughly 103.7 million barrels per day last year, to almost 123 million by 2050.

Here’s the problem — meeting that surge won’t be as simple as drilling a few more holes.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

According to them, it’ll require $18.2 trillion in cumulative investment just to keep production from collapsing under its own decline rates.

Of course, nearly all of that money has to go upstream, into the hard, expensive work of pulling crude from an increasingly stubborn rock.

The catch is that almost nobody is investing that kind of cash right now. Certainly not in the U.S., where drillers are slashing capital expenditures and idling their rigs; keep that in mind when you see media headlines touting record U.S. oil production today… it’s not gonna last.

You see, the situation is more precarious in the U.S. than most people realize. Production might still be hovering near record highs, but at $60-something oil, tight oil producers are walking a financial tightrope.

For many, these prices barely cover costs. That means fewer rigs turning, fewer wells drilled, and a future production profile that’s a lot shakier than the headline numbers suggest.

But tight oil’s decline curves don’t care about the media’s optimism — they’ll keep chewing through output whether investors pay attention or not.

Cheap oil has a funny way of lulling the market to sleep right before it slaps them awake.

As I just mentioned, at first glance the numbers look good. It’s only upon closer inspection that you start to see the cracks. The last time $60/bbl oil was flirting with a dip that’d take prices in the $50s, I told you that oil was a screaming buy.

The media calls this stability, but I call it a countdown clock.

Right now, the only question you should be asking is where to find value in oil stocks. Remember, the game is no longer about debt-fueled drilling frenzies that have companies trying to put as many wells in the ground as possible.

Today, it’s all about one thing: Efficiency.

The veteran members of our investment community here recognize that even Big Oil sees this shift in the oil sector, and that the future belongs to drillers who understand that pumping more is not the same as making more. We’ve already seen this firsthand from major players like Chevron, who are using a “triple-frac” technique to boost drilling efficiency. By fracking three wells at once from the same pad, they’ve cut per-well costs by double digits and sped up completions by roughly 25%.

That’s not just operational flair — it’s a competitive moat. Faster completions mean wells start producing sooner, which is critical when every barrel’s value is measured not just in dollars, but in time. And Chevron has rolled this method out to more than half its Permian wells in just a year.

This shift toward smarter, leaner production is exactly where the U.S. oil patch is headed (or is already there, depending on whom you’re talking to), and we can officially say that the era of “drill baby drill” is over.

What’s replacing it is more disciplined, more inventive, and more likely to survive when prices dip. Let me be absolutely clear here — the companies that embrace this shift will be positioned not just to ride the next price surge, but to dominate it.

The irony is that investors aren’t paying attention… at least, not yet.

They’re fixated on today’s prices, ignoring the supply crunch building beneath their feet. Demand isn’t going anywhere. OPEC’s own forecasts see no peak through 2050. The only question is which producers will still be standing — and thriving — when the market wakes up to the gap between what’s needed and what’s available.

Let me show you exactly where Big Oil will be looking to get ahead in this new era for U.S. oil.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.