This time last year, cobalt was the hottest metal on the planet.

It was everywhere. You couldn’t go a day without reading about cobalt in the financial news.

Now?

Nothing. You barely hear about it, if ever.

What happened?

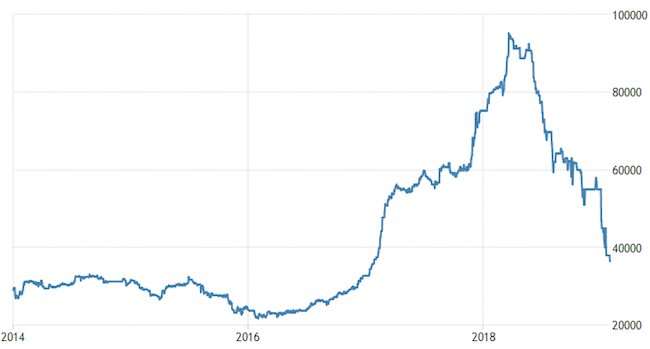

Well, much of the financial chatter centered on cobalt prices. Back in March 2018, the price of cobalt reached an all-time high of $95,000 per metric tonne. Prices had increased nearly 300% over the previous 24 months.

Since then, however, the price of cobalt has pulled back significantly. At last look, cobalt was trading at $36,500 per tonne, over 60% lower than its high back in March 2018.

Leading up to record prices was rapidly increasing demand from lithium-ion battery makers.

See, lithium-ion batteries aren’t simply hunks of lithium. There are other key metals required to produce them, and one of those vital metals is cobalt.

Ever wonder what the “-ion” of “lithium-ion” is?

Well, rechargeable lithium-ion batteries are named for their active ingredients. Inside each is a lithium compound that acts as the battery’s cathode material. The most common lithium compound used today is lithium cobalt oxide, or LiCoO2.

Skipping the chemistry lesson, the cobalt in a rechargeable Li-cobalt battery is what makes the battery rechargeable. And that’s pretty important.

Battery chemists also use other metals such as manganese and nickel to make compounds that serve the same purpose. But lithium cobalt oxide remains the preferred compound today.

Now, unless you live under a rock, you know we need lithium-ion batteries for almost everything these days. They’re in electric vehicles, smartphones, laptops, power tools… you name it. If it has a battery, it’s probably a lithium-ion battery.

But the demand for lithium-ion batteries is still growing at an incredible clip. Projections estimate that the global lithium-ion battery market will grow at more than a 10% CAGR between 2016 and 2024 to reach over $50 billion.

And lithium-ion batteries need a lot of cobalt. Roughly three out of every four lithium-ion EV batteries contain cobalt — a lot of it. And on average, a single lithium-ion EV battery contains over 30 pounds of it.

That means we’re going to need a lot of cobalt.

With conservative projections of a 20-fold increase in global EV demand, forecasts show a whopping 4,500% surge in demand for cobalt between now and 2030.

But here’s the thing: There aren’t enough cobalt mines in the world to meet demand.

Even if electric vehicles account for 30% of global automobile sales, an estimated 314,000 metric tonnes of cobalt will be required for the batteries.

But right now, annual global cobalt production is under 120,000 tonnes.

So we’re going to either have to find new cobalt mines or increase production at existing facilities. But both of those are going to be a problem.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

See, cobalt isn’t necessarily rare. What’s rare are economically feasible cobalt mines.

In other words, there is plenty of cobalt on Earth. But it’s not concentrated in enough areas that make it economically feasible to mine to meet the world’s demand.

And as it turns out, the majority of the world’s cobalt is located in one of the worst places to mine anything: the Democratic Republic of the Congo.

Over 50% of the world’s cobalt resources are located in the DRC. And currently, the DRC accounts for over 50% of global production of cobalt.

But the Democratic Republic of the Congo hosts a mountain of issues that constantly threaten (and frequently halt) mining output.

On top of that, the DRC cobalt industry is still under harsh scrutiny for child labor and human rights violations. It’s a royal mess.

Despite all these supply concerns, the world is still going to need cobalt…

And that’s what many folks were thinking when they pushed prices up to nearly $100K per tonne.

Electric vehicle battery makers like Tesla and electronic manufacturers like Apple ended up all scrambling to secure future supplies, leading to skyrocketing prices.

As you’ve seen, the price of cobalt has pulled back quite a bit.

But the fact remains: The world is still going to need cobalt.

That’s why we think the pullback (and general lack of hype surrounding cobalt right now) makes it a great time for new investors to open cobalt positions and for existing investors to double down.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.