William Hart’s 27-foot natural gas well — the world’s first — was drilled in Fredonia, New York, during the 1820s, giving its operator the nickname “the father of natural gas.”

But there’s another figure oft forgotten in the origin story of this critical energy source…

It’s more likely than not you’ve never heard of Preston Barmore.

Years earlier, Barmore was drilling less than a mile away from Hart’s gas well.

Even though his well was a little over 100 feet deep, he decided to drop a small 8-pound charge of gunpowder down the well to fracture the rock. The explosion marked the first time someone fractured rock in order to increase the flow of gas from a well…

And things haven’t been the same for this sector since.

Shale Gas 101

Before running through the various U.S. shale plays, let’s be clear as to why we’re focusing on shale gas in the first place.

Just how important is shale gas to our overall energy supply? Well, this should give you a good idea:

Breaking down the numbers further, we can pinpoint how critical shale gas is to the overall scene (click table to enlarge):

Above, you can see production from shale gas wells jumped 327% between 2007 and 2011. Meanwhile, output from non-shale gas wells tapered off by nearly 20%.

In 2011 shale gas was being blamed for the supply glut, but for good reason, with plays like the Marcellus shale doubling production to approximately 7 billion cubic feet per day!

Shale Gas Investing

You might think of natural gas for use in heating or electricity…

But we’re talking about more than just electrical generation here.

Sit up and take notice, because more stories are popping up across the media spectrum every day.

Many companies are converting their vehicles to run on natural gas.

Natural gas powers more than 23 million vehicles globally and over 175,000 in the U.S. alone. Natural gas is being used to power planes, trains, and power plants, and demand for it is increasing.

U.S Exports

The U.S. became a net exporter of natural gas in November 2016.

It has been more than 60 years since we began exporting more than we import, but a few big changes put us back on the map.

With the combination of hydraulic fracturing and horizontal drilling, we were able to drill for oil and natural gas that had been in difficult-to-reach spots.

Shale boomed.

Between 2005 and 2015, U.S. natural gas production jumped by 51% as the U.S. extracted more than 28.7 trillion cubic feet of natural gas… thanks to those big shale plays.

Of course, it was one thing to extract the gas but another to sell it globally. You see, for a long time, the U.S. was only able to use pipelines and sell to a regional market.

But with the advent of a terminal for LNG (liquified natural gas) in Louisiana, we began exporting to Brazil, Argentina, India, and China.

If you need any other reason to stay bullish on natural gas, here’s another…

Natural gas is where the money is.

We’re not the only ones saying this — even OPEC is taking notice.

I know. You thought OPEC was focused on oil… and it was… but it’s been losing the oil battle to U.S. shale producers.

Here’s the situation: Certain U.S. shale producers can still make a profit when crude prices are trading between $40–$50 per barrel (WTI crude is currently $77.68 a barrel).

OPEC? Not so much. It’s not that it can’t pull it out of the ground more cheaply — it can. It’s that it’s the only source of revenue, and without generous payouts to its citizens, it faces revolution.

It just can’t keep up anymore.

And there’s a good chance that it knows it too, which is why we may see OPEC try to take control of natural gas.

Natural gas has emerged as the best bridge between renewables and fossil fuels, and even OPEC is waking up to it.

The world is demanding more of it, with consumption set to reach 203 trillion cubic feet per year by 2040.

Saudi Arabia has the sixth-biggest natural gas reserves in the world. However, the problem is that Saudi Arabia does not currently import or export natural gas and therefore has no structures in place to start supplying it.

That may very well change in the future as Saudi Aramco shifts its focus and kick-starts more natural gas/LNG projects.

For OPEC’s natural gas ambitions to work, it’ll need to get Russia on board. After all, Russia is the world’s largest exporter of natural gas and the second-largest producer (behind the United States, of course).

Prices Will Rise

And now that natural gas prices are on the rise, it’s time to take a look at a shale play that could end up being quite profitable…

U.S. Shale Formations

But it’s not enough to simply recognize that natural gas prices are making a comeback, or that major players like ExxonMobil are paying a hefty price for their own piece of the shale profits…

For individual investors, knowing the difference between the various shale formations is critical when separating the good, the bad, and the downright profitable.

The Good, the Bad, and the Downright Profitable

Where to begin?

We can pinpoint the start of the shale boom with a technological breakthrough George Mitchell used to tap the Barnett shale play back in the 1980s…

The Barnett Shale

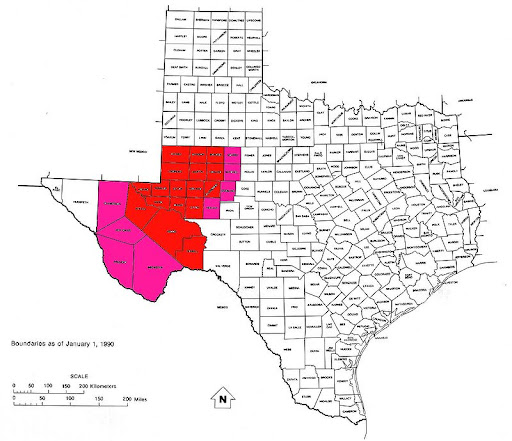

The formation lies beneath nearly two dozen Texas counties, spanning roughly 5,000 square miles.

In case you were wondering, this is what started it all…

In short order, the Barnett became the largest onshore natural gas field in the U.S., with an estimated 40 trillion cubic feet in the ground. For the last twenty years, the formation has produced more than 12 trillion cubic feet of natural gas, and today there are over 16,000 gas wells on record in the Barnett.

However, low-price natural gas environment in 2012 took its toll, and despite hitting new production highs in 2011, the Barnett’s success led a rush for companies to develop new shale plays across the lower 48 states — including a shale play sitting over 200 miles directly east of Fort Worth…

The Haynesville Shale

Consisting mostly of sedimentary rock, the Haynesville Shale play is found roughly 10,000 feet below parts of northwestern Louisiana, Arkansas, and Texas’ eastern border.

If you had a dime in shale investments back in 2008, you would have made a solid profit on companies drilling in the play. The buzz over the Haynesville rose at a feverish pace.

Output quickly skyrocketed as drillers frantically tried to extract the 60 trillion cubic feet held tightly within the rock… and they were extremely successful.

According to data from the Energy Information Administration, the Haynesville overtook the Barnett as the country’s highest-producing shale gas deposit back in March 2011:

Unfortunately, 2013 was a frustrating year for Haynesville operators. It was next to impossible for output to increase after watching drilling activity diminish over the year.

Both Haynesville and Barnett are tapped out… and right now, we don’t recommend them… But I can tell you something that we do recommend…

The Marcellus Formation

This formation, in particular, has the legs to last.

Marcellus Shale is still one of the hottest unconventional plays in the U.S.

This formation stretches across five states, from New York to West Virginia, with the vast majority in Pennsylvania.

Marcellus has been one of the largest contributors to natural gas production over the last decade, although another play could overtake it in the near future (more on that in a moment).

Fracking operators have been exploiting the Marcellus Formation for nearly 20 years, but like the Haynesville and Barnett formations, Marcellus production has sometimes wavered in recent years. Since January 2020, it has experienced a string of month-over-month decreases in production. It’s not quite the most exciting natural gas play available to investors today.

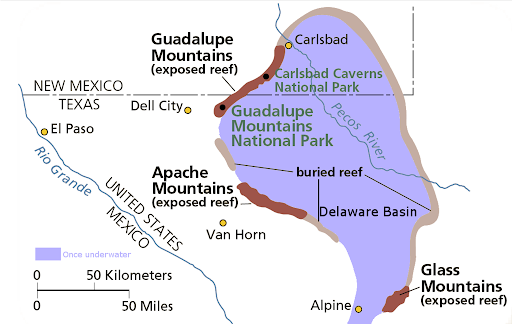

The Delaware Basin

West Texas’ Permian Basin is the largest petroleum-producing basin in the United States, having produced a cumulative 28.9 billion barrels of oil and 75 trillion cubic feet of natural gas.

It contains the aforementioned Barnett Shale, but its most potentially lucrative shale play is the less-exploited Delaware Basin, which is estimated to contain some 280 trillion cubic feet of natural gas.

The Delaware Basin also sidesteps some of the geological and political hurdles that threaten production in the other formations we’ve discussed.

For one thing, most of its reserves are located at a depth of less than 10,000 feet — meaning extraction there is less energy- and equipment-intensive than at deeper shale plays like the Marcellus.

For another, only a small portion of the Delaware Basin is located on federal land — an important consideration given the Biden administration’s campaign promise to ban fracking on federal land.

One particular energy major has recently become dominant in Delaware Basin production, giving investors easy access to the profits from this massive gas play…

Our Top Shale Play: ConocoPhillips (NYSE: COP)

Founded in 1875 and based in Houston, ConocoPhillips is one of the largest producers of oil and natural gas in the United States, with proven hydrocarbon reserves equivalent to 5.26 billion barrels of oil.

Last October, ConocoPhillips struck a deal that could make those reserves much bigger: It acquired Delaware Basin producer Concho Resources in an all-stock transaction worth $9.7 billion.

In the process, it increased its reserves to 23 billion barrels of oil-equivalent at an average cost of supply below $30 per barrel-equivalent. At current prices, that means each barrel-equivalent can be sold for over a 100% profit before selling, general, and administrative expenses.

What’s more, less than 20% of the Concho-ConocoPhillips Delaware Basin acreage is on federal land, meaning that ConocoPhillips’ gas assets are some of the safest of any producer from Washington’s anti-fracking agenda.

In the most recent quarter, ConocoPhillips grew earnings per share (EPS) by an astounding 704.2% on a 243.1% increase in revenue.

The firm also has a debt-to-equity ratio below 50% and pays a $1.71 dividend — equal to a yield of 2.39% at the time of writing.

As you can see above, shares have roughly doubled this year — but as the true economic potential of the Delaware Basin emerges, they could go much higher still in the years ahead.