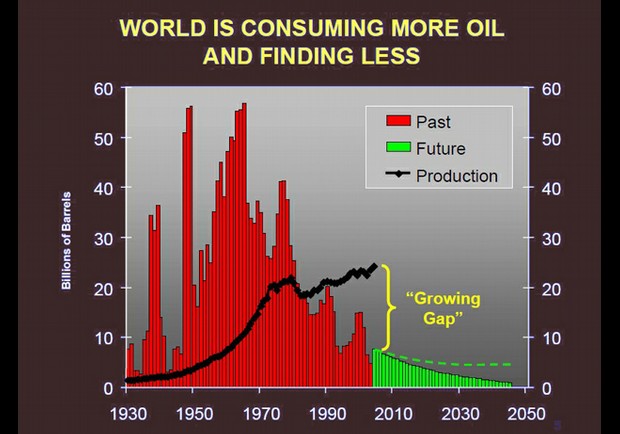

Peak oil has reached the non-OPEC world. Oil prices to rise even more in the future.

Some of the world’s larger oil companies did not perform as well as usual in the second quarter of 2011. Company earnings remained great though. Exxon posted making $10.7 billion, Royal Dutch Shell brought in $8 billion, and Brent crude sold for $120 per barrel. The problem was not with the amount of money being made but with the barrels of oil being produced.

Petroleum production is continuing to decline. Fourteen out of sixteen U.S. and European oil companies studied by Deutsche Bank analyst Paul Sankey, saw their petroleum decline in the quarter. All together this decline totaled 12 percent fewer total liquids volumes. The average output for the quarter was around 14.67 million bpd.

Exxon and Shell were the only two companies that experienced volume gains, both averaging a 1 percent liquid gain.

Most other producers saw their output fall 4 percent.

In contrast to Sankey’s findings, OPEC volumes were up 2 percent in the quarter.

The question has now been asked, is peak oil now in the non-OPEC part of the word? Sankey writes, “The concentration of remaining (abundant) oil reserves into OPEC hands derives an obvious corollary: the end of growth from non-OPEC supply.”

Big oil fields can expect to struggle with staying big. Big oil fields naturally decline about 5 percent a year.

Christophe de Margerie, the pragmatic chief executive of French giant Total, believes that the global peak of oil will hit within five years.

Eventually, only OPEC will be able to meet the oil demands of the consumer. When only OPEC can supply oil needs then oil prices will continue to get higher.

Sankey recommends that investors buy shares in oil companies. Oil will be a resource people continue to rely on, and a resource that has potential to only become more expensive.

Until next time,

Cori