Gold looks set to post one of its worst-performing quarters in years.

The yellow metal started the year off strong, trading for over $1,900 an ounce. But rising U.S. Treasury yields and a stronger dollar served to depress gold prices over the past several weeks.

For the year, gold prices are now down about 10%.

Gold Price — 6 Months

Yet gold’s weakness is only temporary — and fleeting.

The government’s fiscal and monetary response to the COVID-19 pandemic has positioned gold to experience one of the greatest and most powerful bull markets in history.

Forget the run-up in gold prices back in 2011. We called that a “bull market” back then. The upcoming market for gold will make the 2011 gold bull market look minor in comparison.

And forget the gold bull market of the 1970s. Although it’s often venerated as the greatest bull market for gold ever, the 1970s gold bull will be measured as only second to what’s about to come next.

In the past, you’ve probably heard many gold analysts predicting $5,000… $10,000… or even $50,000-per-ounce gold prices. Back in 2011, there were guys even calling for $100,000 gold.

Of course, none of those predictions were correct. However, the market has also never put gold in such a strong position where it can absolutely skyrocket.

Here’s where we sit right now…

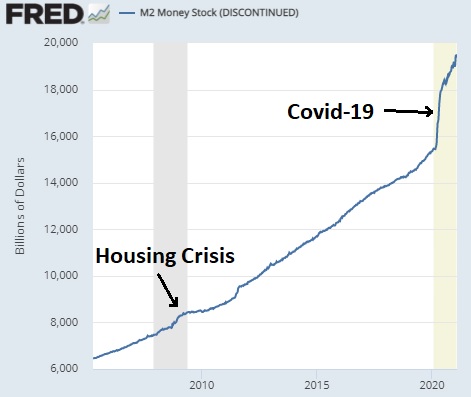

More than 25% of all U.S. dollars in circulation right now were printed in the past 12 months, as measured by M2.

By the broadest definition of money (M1), the Federal Reserve has increased the supply of greenbacks by 350% in the past year.

U.S. Dollar Supply (M2)

U.S. Dollar Supply (M1)

Despite this massive influx of new cash, the value of the U.S. dollar and long-term inflation rates have remained relatively stable throughout the COVID pandemic. That’s partly due to shutdowns and restrictions that hindered people’s ability to spend money and drive up the price of goods and services.

According to the U.S. Bureau of Economic Analysis, the U.S. personal saving rate skyrocketed to a record 32.2% back in April. Compare that with the 7.6% American personal saving rate in 2019. At the same time in April, consumer spending fell 12.6% as the economy slowed down and unemployment increased.

In short, fewer people were out and about spending money, so inflation in things like gasoline prices has remained low.

But that’s all going to change soon.

States all around the country are quickly returning to normal as local restrictions are repealed. More and more people are going to be going out and spending money like they did pre-COVID.

And what’s more, they even have savings to spend.

What I’m getting at is a significant rise in inflation is written on the wall. The Fed can use clever wording to keep the market calm about it for now, but serious inflation is coming.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

And gold is going to absolutely skyrocket as a result. Just consider this..

Back in 2008, the federal government began experimenting with quantitative easing for bailouts caused by the housing crisis. It did the same thing back then that it’s doing today: It printed new money to pay for bailouts.

The fallout for all that money printing caused the price of gold to rocket to an all-time high of over $1,900 an ounce.

But now, compare the amount of money the Fed had to create for that bailout with the amount of cash it just produced in the past year.

Do $5,000-per-ounce gold prices look so unlikely now?

Despite how high gold goes from here, it’s an easy bet going forward.

But not all gold investments are created equal.

Some gold investments are better than others. (Yeah, go ahead and cancel me.)

Investing in physical gold bullion is a safe option. But physical gold isn’t always immediately liquid, and it has limited upside potential.

Let’s say gold does go to $10,000 and you buy a bunch of gold at $1,750. That would net you a 470% gain, which is great. But it’s nothing compared with the quadruple-digit gains investors can make in the right gold stocks in the right market.

Back in 2006, there was company named Aurelian Resources that owned a high-grade project in Ecuador. After releasing impressive drill results, shares of Aurelian went from about $0.70 to nearly $40.00 — that’s a 5,600% gain. Every $1,000 invested would have turned into $57,000.

Last year, a group of mining and finance guys from Canada put together a new company, hoping to repeat that kind of success. They set out to explore a large gold project in Newfoundland with an ambitious drill program. They started drilling in August, and in October they reported the first drill results.

What they found was nothing less than incredible — amazingly high-grade gold intersected at substantial widths. The initial grades were as high at 93 grams per tonne (g/t) of gold.

To give that grade some perspective, gold ore for mining is generally considered high-grade if it has at least 10 grams per tonne. So what this company found right off the bat was super-high-grade material.

Then it did it again…

And again…

And again.

Through November and December, this company released news of several very high-grade drill results that ranged between 20 and 40 g/t gold.

Just a few days ago, it announced it’s hit a hole that graded over 200 g/t gold!

This small company is, without a doubt, the most exciting gold explorer on the planet right now. It’s still finding high-grade gold material, and it’s doing it at a time when gold prices are set to explode.

The problem right this second, though, is the gold market. There’s little interest in gold stocks right now. But as I mentioned, all that’s temporary.

In short, it’s the perfect time to start investing in gold — and this is the best-positioned gold stock on the market for massive gains.

By the way, some of the drill holes that helped the other company, Aurelian Resources, shoot 5,600% higher in 2006 included grades like:

- 38 g/t over 11 meters

- 97 g/t over 15 meters

- 149 g/t over 12 meters

- 24 g/t over 189 meters

So you can see why I’m so excited about this new small company now. I have recently put together a complete report that gives all the details of this small exploration company. You can access it here.

Gold is positioned to make its biggest moves in history. It’s an opportunity you’ll not want to miss.

Check out my new report, which could help you make the absolute most of this historic rally.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.