There are any number of reasons one could suggest why Apple has been so successful all these years.

But I maintain that it’s always boiled down to ingenuity and creativity.

The iPhone, the iPad, all the accessories.

The design advantages, the retail presence.

Say what you want about Steve Jobs, but that guy was always one step ahead, and he didn’t just create a brand, he created a lifestyle.

Apple loyalists are the real deal.

So when I read that Apple was launching a high-yield savings account, I wasn’t surprised at all.

It’s all a part of providing its loyal customer base with everything it could possibly need to live in today’s modern world. Not just a phone or a computer. And this latest move to a savings account is pretty damn brilliant because it’s not just a savings account. It also allows Apple card users to put their credit card rewards into this savings account, which is paying 4.15%. That far exceeds what most savings accounts pay.

The savings account can also be directly connected to an apple wallet, which users already use for online payments. Being that Apple has a base of more than 2 billion devices in its stable, this new savings account should not be trivialized.

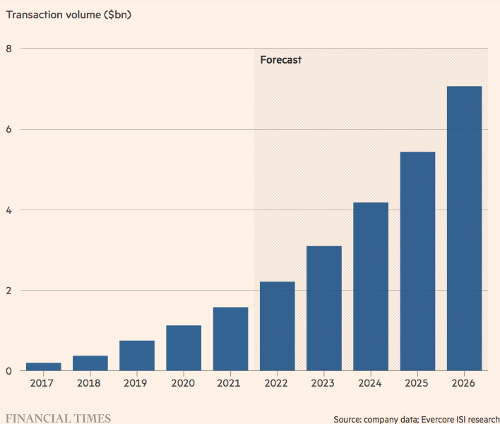

The increase in ApplePay transactions should also not be trivialized.

Check this out …

The interesting question about all of this, though, is should traditional banks be worried?

Financial Times’ analysts Patrick McGee and Joshua Franklin opined on this, writing …

The question for banks and other providers of financial services is how worried they should be about a tech company with 1.2bn iPhone users, a $2.6tn market cap and a history of disruptive innovation making moves on to their territory.

Apple’s scale makes even the world’s largest banks look little. Its services division alone, where it earns recurring subscriber revenues and App Store payments, generated $55bn in profit last year — higher than JPMorgan and Citi combined. But it makes up just one-fifth of its total revenues.

And the company hasn’t been shy about its ambitions in this space. Current job ads speak of “transforming the industry in payments, transit and identity”. And Jennifer Bailey, head of Apple Pay, said back in 2016 that Apple was on “a good, long journey, for us to replace the wallet”.

Of course, it’s still early to tell how realistic the threat of Big Tech could be to the banks, but one thing Apple has that the big banks don’t is iPhone user data.

This data could be used to assess credit risk in a way that could be superior to traditional credit risk assessments currently used by the banks.

I believe this is the direction in which Apple is heading. Make no mistake, the company’s acquisition of Credit Kudos, an open banking startup that provides credit assessments, was no coincidence.