I bailed once I saw the writing on the wall …

Oil fell below $80, and the static between the U.S. and Saudi Arabia was amplifying. Something sketchy was going on, and I wanted no part of it.

That’s not to say I ran out and jumped on the short train. Although I wish I did. The VelocityShares 3x Inverse Crude Oil ETN (NYSE: DWTI) would’ve been one hell of a play. Could’ve turned $25,000 into more than $100,000 in about two months.

Now maybe that ship has not yet sailed. Some say we could float around $40 for the next six months.

I don’t know if that’s true or not, but I do know one thing …

Oil Prices will Rebound

Right now there’s a gaggle of American car buyers sitting high on their brand new SUVs, laughing at all those “stupid Prius owners,” and getting very comfortable with $2.00 gas.

But mark my words, the reality of this brief respite in high oil prices will leave them confused, pissed-off, and a little bit poorer.

I know this gravy train of “cheap” oil won’t last long. Six months, maybe a year? Can’t say with absolute certainty. But the reality is that both Saudi Arabia and the U.S. won’t be able to continue this battle forever. And when the white flags are raised, oil prices will inch back up. I’m looking to make a sizable chunk of change when that happens.

Although I don’t tend to be a huge risk-taker, when it comes to oil and gas, I’ve been very successful at playing leveraged ETFs. Most recently I saw shares of my VelocityShares 3x Long Natural Gas ETN (NYSE: UGAZ) pop more than 25% in single day.

Of course, while oil and gas is often set inside the same boat, both don’t always flow in the same direction. In other words, I haven’t staked my claim to a leveraged oil ETF yet. But I’m going to.

Easy Doubles

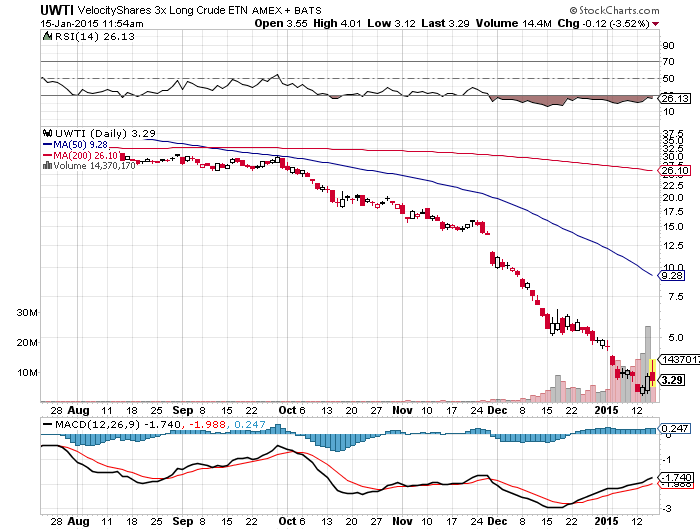

There are two leveraged oil ETFs that are easy doubles once the black stuff gets moving again. They are at record lows right now, and when oil comes back, these to will absolutely crush it. Check out these potential bargains …

VelocityShares 3x Long Crude ETN (NYSE: UWTI)

ProShares Ultra Bloomberg Crude Oil (NSE: UCO)

Just be careful. If not timed right, these leveraged ETFs can really fu$k you. But if timed right, you can easily cash out a double in a matter of hours. High risk, high reward. It’s the name of the game, and not suitable for those with low risk tolerance.