Oil and gas investors cheered on Friday after getting a gift from President Trump.

The gift?

A reversal of the Obama administration’s ban on Arctic drilling.

Of course, this gift is really more of a friendly gesture than something that actually has any real value.

This isn’t a criticism, by the way. It’s merely an observation of truth, which is this…

Trump is just making good on his promise to alleviate regulatory hurdles put in place by President Obama. But those regulatory hurdles are not what’s keeping the Big Oil machine from going full force on Arctic drilling activity.

Peak Gasoline

When Rex Tillerson was chosen to serve as the U.S. Secretary of State, he was quickly accused of being nothing more than the new “inside guy” for ExxonMobil. And perhaps there’s some measure of truth to that. But even having a guy on the inside doesn’t mean the basic fundamentals of supply and demand become insignificant.

You see, we use oil primarily as a transportation fuel.

Sure, there are other uses for crude, but the bottom line is that our reliance on the internal combustion engine is what makes oil relevant. And that could soon change.

According to the IEA, global gasoline consumption for passenger vehicles will fall from 23 million barrels a day (2015) to 22.8 million barrels per day by 2020. That may not seem like much, but consider the fact that over the past 25 years, gasoline consumption grew by 20%.

Essentially, the latest data indicate that gasoline demand has peaked and will soon begin to decline.

Given that Arctic drilling is incredibly difficult and expensive, does it even matter that President Trump reversed Obama’s Arctic drilling ban?

Today, the oil market is oversupplied by as much as 500,000 barrels per day. Moreover, there’s a massive amount of oil in storage, and if crude does cross the $60 mark, the U.S. has a wealth of shale it can cut loose.

The fact is, the demand for oil today does not necessitate the need for new drilling operations in the Arctic. And it won’t in the future, either.

From Crude to Electrons

According to researchers at MIT, by 2030, electric vehicles will be a dominant mode of transport.

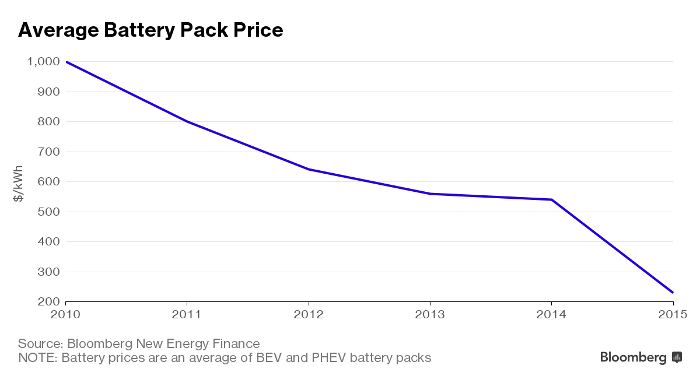

This is largely due to the speed at which lithium-ion battery prices are falling, which is resulting in more competitive pricing for electric vehicles.

Since 2010, the price of lithium-ion batteries for electric cars has plummeted 65% and will continue to fall even further.

Now, in 2013, the IEA estimated electric vehicles would reach cost parity with internal combustion vehicles when battery costs hit $300 per kWh. That prediction was set for 2020, but in 2016, those battery costs fell to $273 per kWh. And this is why we now have new 200-mile-range electric cars hitting the showrooms with price tags below $40,000.

Of course, this is just the beginning.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

By 2030, these batteries are expected to cost less than $120 per kWh, bringing the price of a 200-mile-range (minimum) electric car down to about $23,000 (in today’s dollars).

Now, if electric cars become the dominant choice for passenger travel in about 13 years, we’ll end up consuming less gasoline than we do today. This does not bode well for the oil industry. In an effort to stay in business, no oil company is going to spend the time and money to produce Arctic oil when that oil won’t even be needed in the future.

And by the way, it takes an extraordinary amount of time and money to drill in the Arctic. Just ask Shell, which burned through $7 billion in the Chukchi Sea before abandoning that Arctic drilling operation. And this is after the company discovered oil and gas in that region more than two decades ago.

Oddo & Cie analyst Ahmed Ben Salem hit the nail on the head when he opined on Shell’s failed Arctic operations, saying:

In a $50 oil-price environment it’s not so bad to abandon that search because it’s expensive. Shell has enough resources already.

So, yes, President Trump signed an executive order to open up the Arctic again to drilling. But it doesn’t really mean anything, at least not to energy investors.

We know the future of personal transportation will not continue to rely on an outdated internal combustion engine. We also know that while you can still make some money in the oil and gas game, the real money is in homegrown electrons, induction motors, and, of course, lithium-ion batteries.

Invest accordingly.

To a new way of life and a new generation of wealth…

Jeff Siegel

P.S. Having taken full advantage of the electric car movement — profiting handsomely along the way — I’ve used some of those gains to invest in an even more lucrative industry: legal cannabis. While this isn’t a play on energy, it is without a doubt the most lucrative investment opportunity for 2017. And I have the numbers to prove it. Click here to see for yourself.