Oil prices are climbing back to alarming levels. And consumers are just now really starting to feel it at the pump.

How much was gas the last time you fueled up?

AAA reports the national average for gasoline right now is $2.95 per gallon. But that’s just the average. In some places, premium is already over $5 a gallon. And as we begin the summer driving season this weekend, it’s likely gas prices are only headed higher in the short term.

That’s going to mean a lot of upset drivers shelling out more than they want at the gas station.

And it means someone is going to catch the blame for the jump in oil prices.

That someone is most likely President Trump. He’s the biggest and easiest target.

Democrats have already begun pointing the finger at Trump for the increase in oil prices and urging him to do something to contain rising crude costs.

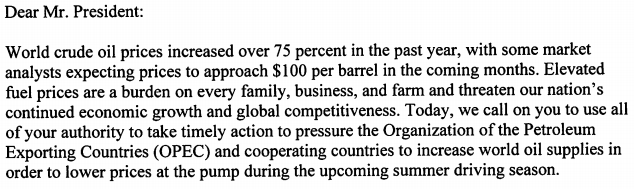

Last week, Senate Democrat leader Chuck Schumer and three other leading senators sent a letter to President Trump persuading him to take action against OPEC. Here’s an excerpt:

So what will Trump do about swelling oil prices?

Well, probably very little.

Truth is, there’s very little President Trump can do about rising fuel costs.

Some believe Trump’s recent decision to pull out of the Iran deal has led to higher oil prices and that a renegotiation of the deal would help ease crude prices. But backpedaling on the Iran deal now would make the Trump administration look weak. And it’s probably not something Trump is going to do anyway.

Other analysts believe Trump could help ease oil prices by selling some of America’s Strategic Petroleum Reserves.

The SPR currently holds about 670 million barrels of oil and is frequently used. Back in March, the U.S. Department of Energy sold 7 million barrels of sweet crude oil from the SPR to comply with a 2015 law to assist with federal funding.

But 670 million barrels of oil isn’t really a whole lot in the bigger picture. The U.S. consumes almost 20 million barrels of oil per day. That means the SPR only holds about a month’s worth of oil reserves for America.

So even if Trump did decide to sell some of the SPR, it probably wouldn’t make much of a fundamental difference. At best, a decision to sell some of the SPR might prompt investors to short oil for a week.

Still, I think Trump has to respond to rising oil and gas prices in some way. He’s going to get blamed for it anyway.

So what will Trump actually do about rising oil prices?

Probably tweet about it more.

Back in April, Trump pinned the blame (rightfully) on rising oil prices on OPEC:

As oil and gas prices continue to rise, we can probably expect more tweets like this.

The truth is, Trump isn’t responsible for rising oil prices. Back in 2017 Russia, OPEC, and other leading oil nations got together and collaborated to cut global crude supplies in an effort to decrease a supply glut and support prices. As a result, the price of oil has been increasing steadily for more than 12 months.

So there’s little Trump can — and there’s likely little he will — do about rising oil prices, other than spouting rhetoric over Twitter. And really, that’s probably for the best.

Trump’s Twitter game is strong. His tweets can affect markets. The above tweet about OPEC did work to depress oil prices for a very short time — with little to no long-term consequence.

More of Trump’s rhetoric may again help to briefly ease oil prices. But there’s nothing major the man can do to stop oil prices from powering higher.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.

A former CBOE insider exposes an age-old hedge fund secret used by the wealthy 1%… that could make you really rich.

Before today, this secret system was only available to an elite group of investors with a minimum investment requirement of $1 million.

Now, for the first time ever, you can use this powerful wealth-building secret and turn a $10,000 nest egg into $1.1 million.