Over the next six months, the U.S. Federal Reserve will suck over $1 trillion in liquid assets from the markets.

This isn’t a maybe, and this isn’t fear-mongering.

It’s a fact this will occur — and the biggest cash drain conducted by the Fed in 40 years has already begun!

Think I’m kidding?

This comes directly from the U.S. Federal Reserve: "The Committee intends to reduce the Federal Reserve's securities" starting on June 1.

There is no need to speculate. The Fed will drain $30 billion worth of Treasury securities a month for the next three months and then increase this drainage to $60 billion per month, i.e., by September!

On top of that, the central bank will also reduce its mortgage-backed securities holdings by $17.5 billion and then in September raise that to $35 billion a month in liquidity erasures.

That’s over $1 trillion in assets off the books and out of the economy in six months!

The Results Could Be Catastrophic

In the first 12 days of May, the S&P 500 fell almost 9%.

Over the following week from May 12 to May 17, the index shot up 4% — in just five days!

But then in a span of just three days from May 17 to May 20, the index spiraled down again and lost almost 5%.

And last week, we saw a face-ripping relief rally that pumped the S&P up nearly 7% to finally break a long-standing weekly losing streak for the index.

The Dow followed closely, and the Nasdaq performed even better.

In broad strokes, this action indicates something is amiss.

Even though I’m a proponent of the argument that a new paradigm of tech-fueled 24-hour trading has changed the very nature of trading and investing, it's unnatural when markets rise and fall with such violent moves.

This is a clear sign that fear and uncertainty have taken over.

The next leg down could be extra painful too.

Let’s Go to the Charts!

Starting with the tech-heavy Nasdaq, providing we cannot break through the current ceiling at 12,050 (blue line), which the index is currently testing, the next breakdown is back down to just under 11,025 (black line), which could equal a loss of about 8.5%.

From there it gets even worse, with a real risk that the Nasdaq finds a bottom between 10,500 and 10,250 (red area). That would be a nearly 15% drop from current levels!

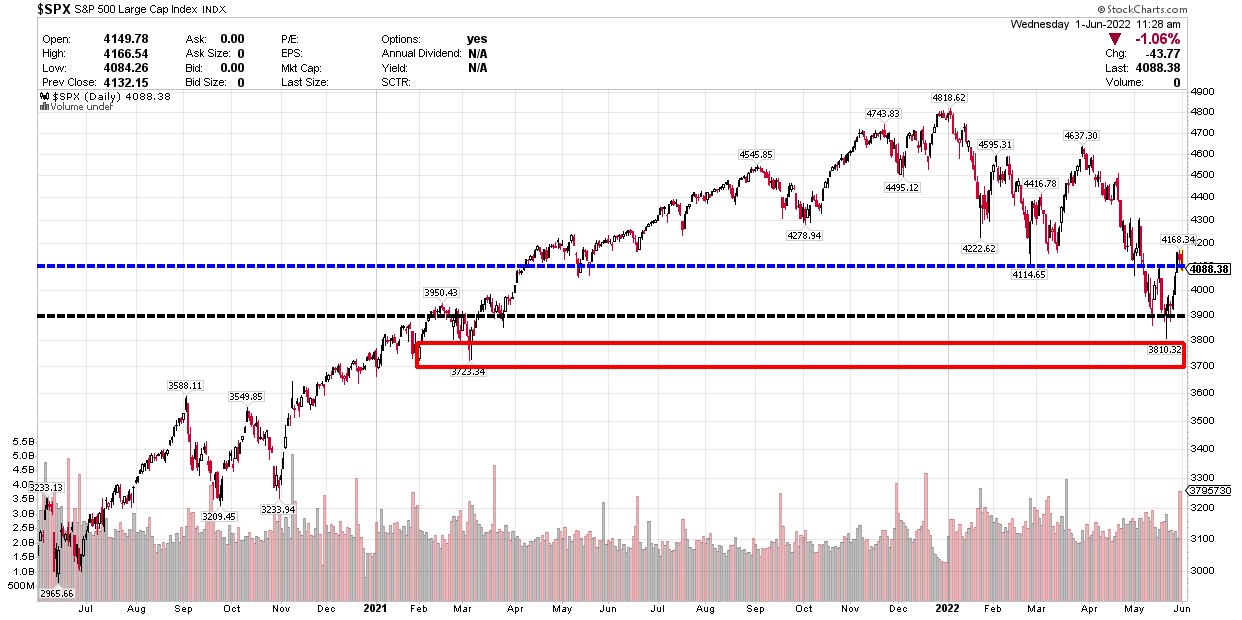

Looking at the S&P 500, we can see the same thing. The index is currently trying (but so far failing) to break through its ceiling and hold above 4,100 (blue line). If the index fails to pass this key technical level, the next leg down is to about 3,900. This would be about a 5% decline.

Again, it gets even worse from there with a strong likelihood that if the first breakdown I mentioned occurs, the second breakdown to about 3,750 (red area) will as well. This is nearly a 9% drop from current levels!

And remember, more rate hikes, more quantitative tightening (QT), and more crushing inflation are also in the forecast.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

With that in mind, let’s look at the Dow Jones Industrial Average. Again, we’re witnessing the index test but not break through its current ceiling at around 32,600 (black line), indicating the next leg down is almost certainly going to be a decline to 31,250 for a 4% loss.

But again, from here, considering the aforementioned headwinds, the true bottom could be all the way down around 30,000. This would represent an 8% loss from current levels.

Meaning…

If you thought 2022’s descent toward bear market territory over the past six months was rough, you haven't seen anything yet!

Just wait until the QT mentioned above starts to hold.

For many, the drawdown in stocks will be catastrophic, calamitous, and downright wealth-destroying.

For others, it will be a chance to prove their mettle and actually have one heck of a trading year.

How can I be so confident?

Because I’m seeing it happen with my own two eyes every day.

I’ll admit that it hasn’t been easy by any stretch of the imagination, but the community of traders we've created has proven beyond a reasonable doubt that even in a tumultuous bear market, people just like you and me can preserve their wealth and even grow it significantly — all when most folks are in panic mode.

I won’t gloat and read off all the great double- and triple-digit returns our trading community has scored this year…

But I will say the one big difference between the Naked Trades faithful and the traders getting crushed in the market is the ability to admit that everyone — even the smartest, savviest traders — needs a little help sometimes.

We can beat the bear together.

To your wealth, Sean McCloskey After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

Editor, Energy and Capital

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter