There is an old Wall Street indicator called the hot waitress economic index.

According to Investopedia:

The hot waitress economic index is an informal measure of the state of the economy that is compiled by counting the number of attractive people working as waiters/waitresses. According to the hot waitress index, the higher the number of good looking servers, the weaker the current state of the economy. It is assumed that attractive individuals do not tend to have trouble finding high-paying jobs during good economics times. During poor economic times, these jobs will be more difficult to find and therefore more attractive people will be forced to work in lower paying jobs such as being waiters/waitresses. The hot waitress index was first articulated by Hugo Lindgren in a piece for New York Magazine.

I went out to eat twice over the weekend, and not only were the servers homely, but they were also slow and stupid — though, ironically, the food was fantastic.

This indicator falls among those other Wall Street indicators such as Wharton School professor George Taylor’s hem length indicator, the skyscraper index, getting stock tips from shoeshine boys, and which team wins the Super Bowl.

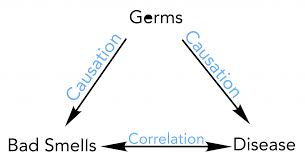

As anyone who suffered through a statistics class will tell you, correlation doesn’t equal causation.

That said, you should pay attention to such things, as they could equal profits.

To these indicators, I will add the Christian DeHaemer overpriced, dilapidated boat index as an indicator of where we are in the boom and bust cycle.

I am currently selling a 27-foot sailboat that I’ve owned for the better part of a decade. The boat has grown tired, and I’m selling below market value because I’ve grown tired of it as well.

It was thus that I came across one of those old happy guys you find in a boatyard in the springtime. He was 70, with a mouth full of cantilevered teeth and ragged wisps of white hair that blew past his ball cap.

There was a gale force wind slicing up the bay as he poked around the boat, telling stories of pulling two-stroke Volvos out of small engine compartments with nothing more than a “come-along” and an overhanging oak limb.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

He mentioned, as he tapped on the bilge with the backside of a scraper, that he bought a flooded house on the Choptank for $6,800 at auction and pulled it back 100 yards with his F-250 and some logs.

He kept talking and inspecting, spilling the genoa out of the sail bag, the wind taking most of what he said: “building a new boat, but need something to sail while I’m at it…”

“These are good sails.” All of this while a hundred metal halyards banged against a hundred aluminum masts in a 25-knot blow.

“Well, there’s nothing here that would cause me to say no. I’ll let you know by Wednesday,” he said with a firm handshake and a wave of a green flannel arm dancing off like a Chesapeake will-o-wisp.

The point of this is that I priced too low. All of the boats, the Tartans, Beneteaus, and Ericsons that have languished in the boatyard since the last recession, have sold. People have money to spend and are spending it.

This correlates with tops, not bottoms. Of course, tops tend to go on much longer than one thinks. Prices get silly. Old Mustangs sell for $200K. Leonardo da Vinci’s Salvator Mundi sells for $450 million. Pseudo-taxi cab companies that lose money and will always lose money IPO at $25 billion.

Yes, the yield curve has inverted. We are late in the game, and the sun is setting over the western shore. In markets, it becomes the crazy time. People go all in. They say things like, “This time is different.” And anyone can get rich.

For myself, I’m buying solid, high-growth dividend stocks, and after the next recession I’ll get my retirement sailboat at half the price.

If you are looking for a recession-proof stock that pays near 10%, click here.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.