After moving 8% higher in just five days last week, the price of silver has cooled off a little bit.

And this short-term weakness will be opening up some exciting investment opportunities for us in the silver market.

So get your portfolio in order — do whatever you’ve got to do — it’s time to start looking at buying silver stocks again right now.

And I’ve got another killer silver play for you today that I think will see an easy short-term 30%–40% gain and much larger payouts over the long-term.

The bottom line is this…

Silver’s long-term fundamentals are solid. The demand for silver is expected to exceed global supplies this year, driven by a sharp contraction in mine supply.

I mentioned this to you the other day: Global silver supplies from mine production are expected to fall 5% this year.

This will be the first time global silver production has fallen in 15 years!

And going forward from there, the world’s silver production is expected to continue falling through 2019.

At last look, silver spot prices were at $15.68 an ounce. But you have to remember…

Silver sold for over $20 an ounce for nearly three solid years.

And it has the fundamentals to make it run.

It’s happening.

And we’re going to be there together to cash in.

As I mentioned, I have another silver mining company that I want you to take a look at.

I really like the way this company looks. But before you buy the stock right now, there are some things to consider.

First, let me tell you just a little about the company and its operations.

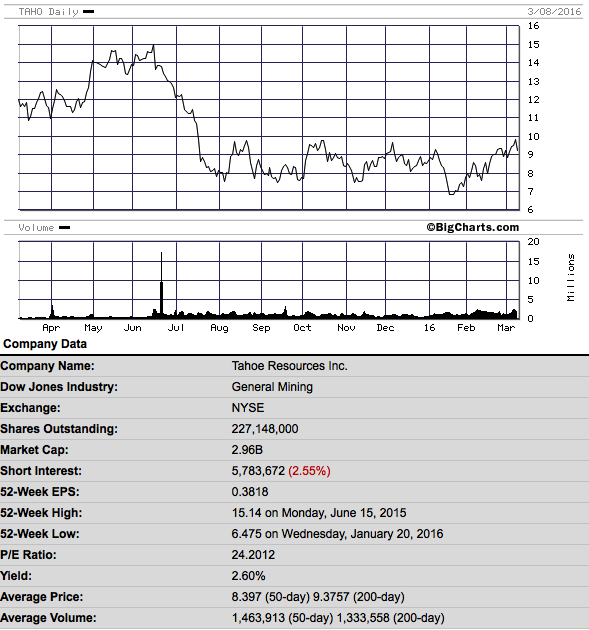

Tahoe Resources (NYSE: TAHO)

Tahoe Resources is a mid-tier mining, development, and exploration firm focusing on silver and gold production with three main assets in Guatemala and Peru. Let’s take a quick look at them…

The Escobal Mine (Guatemala)

Photo Credit: Tahoe Resources, Inc.

Photo Credit: Tahoe Resources, Inc.

The company’s flagship property and third largest silver mine in world. Let me say that again… it’s the third largest silver mine in the world!

Last year, Tahoe produced 20.4 million ounces of silver in concentrate from Escobal.

Not only is it one of the largest, but it’s also one of the lowest-cost silver mines around. During 3Q 2015, Tahoe reported AISC from the Escobal Mine at $9.72 an ounce. And that is in today’s market where an ASIC of $15.00 per silver ounce is considered “low-cost.”

The La Arena Mine (Peru)

Photo Credit: Tahoe Resources, Inc.

Photo Credit: Tahoe Resources, Inc.

A gold and copper mine with both oxide and sulfide mineralization. Tahoe is currently producing gold from the lower-cost oxide material. Last year, the company produced 230,000 gold ounces in doré from La Arena. During 3Q 2015, Tahoe reported AISC from La Arena at $729 per gold ounce.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

The Shahuindo Mine (Peru)

Photo Credit: Tahoe Resources, Inc.

Photo Credit: Tahoe Resources, Inc.

The company expects annual production to average over 150,000 ounces. In total, the project contains 1.91 million ounces of gold reserves plus an additional 2.28 million ounces in the “resource” categories.

In addition to these assets, Tahoe also owns interests in a few exploration projects; also located in Guatemala and Peru.

This year, Tahoe expects silver production to range between 18 million and 21 million ounces with an AISC ranging between $10 and $11.

The company also expects to produce 200,000 to 250,000 ounces of gold with AISC at $950 to $1,050 an ounce.

Tahoe is expected to release its FY 2015 financial statements today after market close. So we don’t have that information just yet.

Analysts expect earnings per share of $0.14 on revenue of $146 million. The consensus range is $0.08 to $0.21 for EPS on revenue of $140 million $153 million.

I think earnings could be on the lower side. Tahoe had $63 million in corporate goodwill in its 3Q 2015 financials, which the company may have had to write off for the fourth quarter. I suspect that some analysts may have overlooked this. And with silver prices down for the week so far, shares of TAHO could experience a bit of weakness following the earnings report.

That’s your time to pounce.

Despite any near-term weakness, I expect to see continued growth in silver prices throughout the year leading to significant y-o-y quarterly earnings growth for companies like Tahoe Resources.

Additionally, the launch of commercial production at Tahoe’s Shahuindo during 2Q will also likely bring more investor attention to the company. There’s no doubt that Tahoe will publicize achieving commercial production at the mine with a press release at the very least.

This is a stock that I personally just purchased myself.

I bought several hundred shares at $9.77 on Monday. And I would have bought more yesterday on the dip but I simply didn’t have the free capital in my account to make a purchase worth it.

I’m looking to take a 30% to 40% gain in three or four weeks on rising silver prices, bullish speculation on 1Q 2016 earnings, and excitement building around the launch of commercial production at Shahuindo. But over the long term, I do think the stock will see higher gains.

At last look, shares of Tahoe were trading at about $9.25. I’m going to try to pick up some more shares while the stock is under $9.50. I think you should too. I’ll keep you up-to-date on what I’m doing with my position.

As always, please do your own due diligence. Here is a link to Tahoe’s website. Or, to get a quick overview of the company and its operations, check out its latest corporate presentation.

Good Investing,

Luke Burgess

Energy and Capital