Well, it’s been a heck of a year. The S&P 500 went from a low of 2,350 in December back up to around 2,800 in an attempt to break though some stubborn resistance.

This is known as a short-covering sucker’s rally.

Meanwhile, the price-to-earnings ratio dropped from 26.5 to 21.35. It is still well above the mean P/E of 14.75 but not quite as stratospheric as it has been.

Was it only 10 years ago that it was bouncing off the bottom at 666?

Remember those wistful days of Lehman Brothers and liar loans? There was much pulling of hair and rending of shirts, as seemingly half the population lost their house, wife, and job at the same time. Roughly 8.7 million jobs were shed from February 2008 to February 2010, and GDP contracted by 5.1%.

American household net worth fell from a pre-recession peak of $68 trillion in Q3 2007 to $55 trillion by Q1 2009. At the same time, real median household income fell from $56,436 in 2007 to $51,758 by 2012.

Real estate foreclosures climbed from 239K in 2007 to over 932K per quarter in 2009.

I’m sure you knew many people who lost their fortunes. One young couple I knew was trapped owning two houses and a bridge loan at a time when they could afford neither.

But somehow it all worked out, and here we are again. As Johnny Cash would say, we are doing mighty fine in our streak of lightning cars and our fancy clothes.

But now the stock market is bouncing around a little bit. The clarity is less crystal.

Real estate, which had been on fire, is now cause for concern. Something feels a bit off…

Contrarians know the bad times inevitably follow the good. Humans have known about this for thousands of years, which is why Joseph spoke about seven years of fat, followed by seven years of lean.

Ole Joe was a contrarian, always buying low. If you remember your Sunday school, Joseph wisely saved 20% of the harvested grain during the good times and was able to save not only Egypt during the famine but the surrounding nations as well.

A Time to Sell and a Time to Buy

There is something in human nature that pushes optimism to the extreme, leverages up, goes into debt, gets knocked down, retrenches, and then starts the cycle all over. Your humble editor thinks this has something to do with short memories and a new crop of young people who were too young to remember.

Oddly enough, seven years is about the average length of a bull market. The current run higher is the longest bull market in history and has been extending its record every day since August 22, 2018.

Here are some charts that show some cracks in the facade of Wall Street.

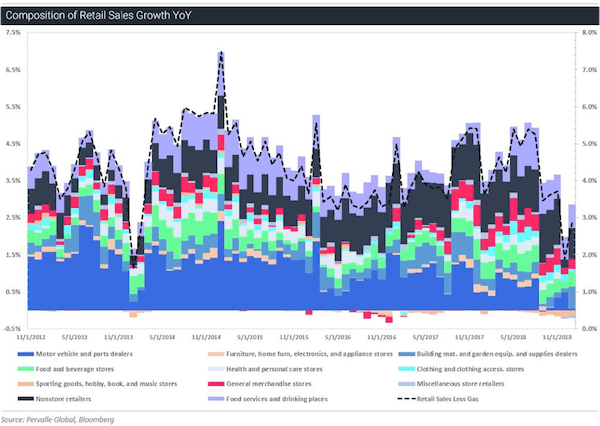

This chart shows that retail sales have dropped, with sporting goods and furniture in the negative. One theory is that the video game Fortnight has destroyed sales of baseball gloves and the like.

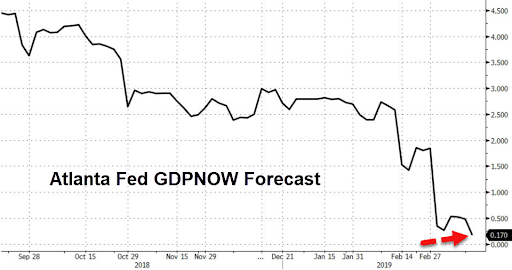

The Atlanta Fed, in its benevolent wisdom, is forecasting a sharp slowdown in GDP.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Tide of Cash

The driver of the past few years has been the repatriation of money held abroad by United States corporations. This was an offshoot of the Trump tax cuts. That wave is over; most of the money that is coming back already has come back.

U.S. debt-to-GDP is poised to surpass the record levels reached in 1946 in the aftermath of mass spending to fund the war. From 2020 to 2029, the nation is expected to spend $7 trillion on interest expenses alone.

Interest is already moving higher during a period of low interest rates. High interest rates will push payments to crisis levels.

But I’ll end on some good news: Those people who own a house now have more equity than they did at the top of the last market cycle.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.