I am getting old. Perhaps I drank too much on vacation — those umbrella drinks at the tiki bar were brutal in hindsight. An honest Scotch is a better, more pure libation. Scotch will tell you right up front what it is about. There is no pussyfooting around like you’ll find in pink drinks near the water.

There is something about toes in the sand and girls in bikinis that makes the mind go soft. Perhaps that is what is wrong with this country, the markets, and life in general. After 10 years of a robust bull market, we’ve all gone fat in the middle.

What’s the point of common sense and hard work if foolishness and slacking pay just as well? This is why politicians on both sides spend like a sailor on shore leave. They don’t even pay lip service to a balanced budget anymore. Debts don’t matter, they tell us.

And they don’t until they do… What did Hemingway say about going broke? It happens two ways: gradually, then suddenly.

The national debt hit $22 trillion recently. That seems like a lot of money. More than you can really imagine. Best not to think about it.

John Maynard Keynes came up with the idea of deficit spending. He said you should borrow and spend during a downturn and pay it back during a boom. That seems to make sense, but everyone forgets the second part.

We are in the tail end of a historical boom, and the knuckleheads at the Federal Reserve are cutting rates, while the scum in Washington are boosting spending.

These are the thoughts that seep around the fortifications of palm trees and crystal blue waters and ruin a good vacation.

The First Week in September

It is late August. In late August, it doesn’t matter what happens in the markets. In two weeks, all of the overpaid brokers will be back from the Hamptons and worrying about their Christmas bonuses. They will jiggle their bellies with the back end of a pen, think abstractly about the gym, and then buy the stocks that have been going up.

But it is how September ends that is the rub. Since 1950, September has had 31 up years and 38 down years.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

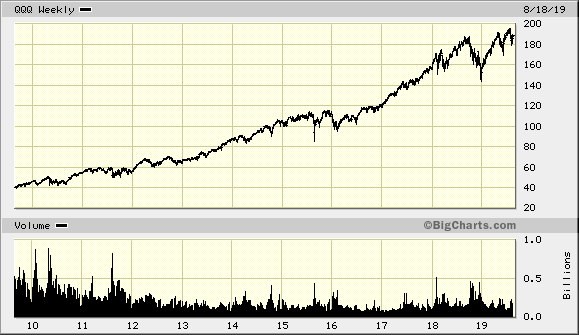

Here is the 10-year Nasdaq ETF, the QQQ.

It remains bullish, with higher highs and higher lows. We are up 30% year to date, though the year started at the bottom of the trend. The Nasdaq is basically at the same spot it was a year ago.

My prediction is that the recent winners will be bought up the first week in September. If we make new highs, look for another leg up. If not, we’ll retest those December lows.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.