Gold and silver are running. Overnight gold hit $1,974 an ounce, and silver hit a high of $26.27 an ounce.

Silver hit a low of $11.76 on March 15 before going on an epic 123% run over the next four months. This morning the precious metal duo has pulled back to $1,922 and $23.75, respectively.

Here are five reasons to buy the dip:

- Yesterday, the U.S. Mint said it has reduced gold and silver coin supplies to authorized purchasers as the coronavirus pandemic slows production.

From Bloomberg:

The Mint’s West Point complex in New York is taking measures to prevent the virus from spreading among its employees, and that will probably slow coin production there for the next 12–18 months, the document shows. The facility is no longer able to produce gold and silver coins at the same time, forcing it to choose one metal over the other.

The San Francisco Mint is running on reduced production after partially reopening in May.

It looks like there is a perfect storm brewing that will thrust the malleable metal higher.

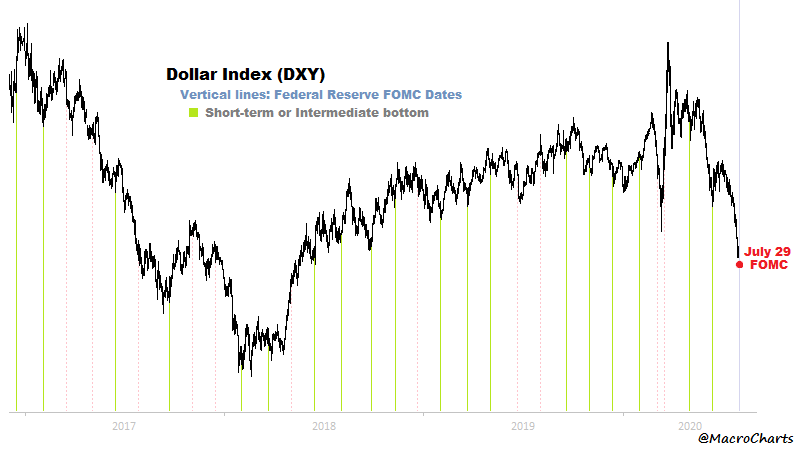

2. The dollar is falling, has broken support, and looks to be heading back to 2011 lows.

The Federal Reserve and most central banks are printing currency. Over the last 13 years, global debt has almost doubled from $140 trillion in 2007 to close to $260 trillion today. This is around 300% of global GDP.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

3. There is a second stimulus bill working its way through the marbled halls of Congress. The Republicans are still arguing about fiscal responsibility as if that ship had not sailed with its hold full of shame and concern for the common welfare.

No, those days are gone. The new stimulus will add another trillion dollars or so and line the graft-filled pockets of political insiders and their lobbyists.

Print money, buy gold

4. If you need another reason to buy gold, just look at bond yields. If they aren’t negative in the U.S. yet, they are negative after adjusting for inflation.

One historic anti-gold argument has always been that it doesn’t pay a dividend. Yes, but no dividend is better than investing in a bond that loses money.

5. And your last reason to buy gold and silver is because the charts look good. Silver has established a new uptrend and gold is hitting all-time highs.

Assets that hit new high prices tend to continue to hit new high prices. In the Bull and Bust Report we are up 150%, 177%, and 121% in Newmont, Royal Gold, and Sandstorm Gold. Our silver play has gone from $0.30 to $1.10 in the past three months.

But forget about those — here are three gold stocks you should buy now.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.