Empires die on a cross of wars and debt.

For example, everyone knows that the Persian Empire was destroyed by Alexander the Great. But before the final blow, it was weakened by oppressive taxes, economic depression, and subsequent revolts. The elite hoarded gold and silver and kept it out of circulation. Workers stagnated, and markets failed. Alexander was able to divide and conquer an aged and decrepit state.

These days, we are too sophisticated to be worried about wealth hoarding. Wealth isn’t tied to gold and silver but rather to pieces of paper printed in zero and ones, wrapped in theories and bandied about by PhDs.

These digits are controlled by the Federal Reserve. After the big meeting, Jerome Powell pulls out his Macbook and adds a few zeros to the loan available to the commercial banks. All of a sudden, the $7 or $8 trillion in debt goes to $21 or $30 trillion.

What does it matter? It’s only numbers on a ledger, bits and bytes taking up a little space.

But these days, the numbers are growing too fast. Trump and Congress are spending. Businesses have been getting cheap loans and buying back shares.

The fear of inflation is on the creep. Inflation is always and everywhere a monetary problem, said the PhD Milton Friedman in 1956. We nod our heads sagely.

But wait a second — something is off…

The U.S. has been increasing debt, but the real money supply has been slowing down to 1.74% year-on-year versus the long-term trend of 4.5%.

You’ll notice the push of liquidity after the 2008/2009 crisis followed by lesser pumping:

Money is growing at a slower pace because the Fed says it fears inflation. But inflation hasn’t shown up. The CPI was even down last month:

So what gives? As I wrote last week, the Fed needs to hike rates so it can slow the boom times. This pulls away the proverbial punchbowl by reducing the money flow, causing a recession.

Then, as you can see by the chart below, it cuts rates! That’s because if the Fed can’t cut rates to make money cheaper, then it can’t save us from the recession it just created.

At the top, in 1980, the federal funds rate was above 20%. Now it is at 1.75% — about as cheap as it has ever been. Powell says he will continue to hike, one quarter-point hike at a time, until it is at 2.5%–2.75% by the end of the year.

Is that enough to cause a recession? Sure. Because everyone is leveraged to the hilt.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

First of all, Joe Sixpack hasn’t gotten a decent raise in 48 years.

But don’t worry, people are spending money like they are making bank. Second mortgages and cash-out refis are the hot new thing again.

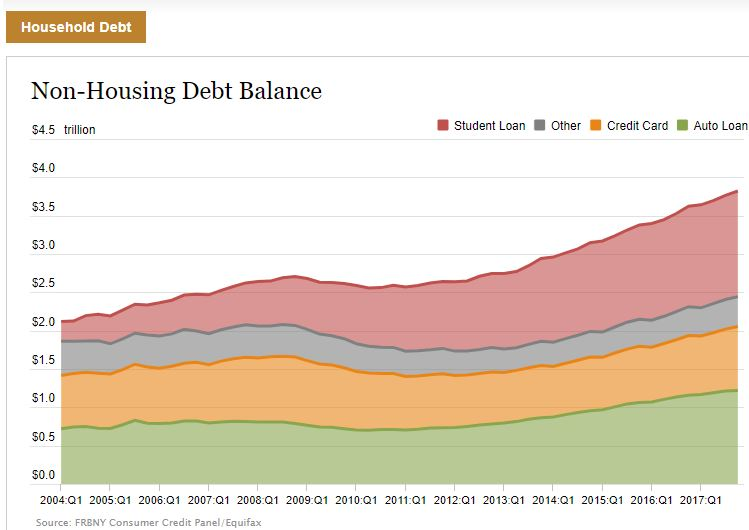

But it’s not just mortgage debt. All debts are kicking it into high gear, surpassing the highs of the Bush administration.

We are in the second-longest bull market of all time. Everyone who wants a job pretty much has one. The stock market has tripled since the 2009 bottom. Times are good in a relative way…

But our government can’t stop spending. Check out this chart put out by Goldman Sachs:

When unemployment is low, the government makes a lot of revenue through taxes. In the past, it used this money to balance the budget, or at least come close. This time the government is spending while the Fed is tightening.

It makes no sense, even to the PhDs. After the last crash, 7% of the housing stock in the country went to Wall Street, and another 7% of global wealth went to the one percent.

Heck, when Goldman Sachs is pointing out the fallacy of government largess, maybe it’s time you should be hoarding gold and silver.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.