Last week, I shared something very important with you.

It was a quote from analysts at Cowen & Co., which illustrated the very real threat that legal cannabis is having on the $1.2 trillion global alcohol market.

Here it is again:

While recreational cannabis has only limited availability, the rise of cannabis consumption more broadly looks to be weighing on alcoholic beverage consumption, where it is now in decline for men and higher income consumers.

The day after you read this, Molson Coors Brewing Company disclosed in its 2017 10-K filing that legal cannabis is now officially a “risk factor” for its beer business.

Check it out:

Although the ultimate impact is currently unknown, the emergence of legal cannabis in certain U.S. states and Canada may result in a shift of discretionary income away from our products or a change in consumer preferences away from beer.

As a result, a shift in consumer preferences away from our products or beer or a decline in the consumption of our products could result in a material adverse effect on our business and financial results.

This is Molson Coors, folks — not some microbrewery.

The company just posted net sales of $2.58 billion for its most recent quarter.

And these guys now see legal cannabis as a risk factor. And they’re not the only ones…

Brown-Forman Corporation, the makers of Jack Daniel’s, has indicated cannabis legalization as a risk factor, noting in its 2014 10-K report:

Consumer preferences and purchases may shift due to a host of factors, many of which are difficult to predict, including… the potential legalization of marijuana use on a more widespread basis within the United States…

Then there’s The Boston Beer Company, the maker of Samuel Adams, which stated in its 2015 annual filing that “legal marijuana usage could adversely impact the demand for the Company’s products.”

Of course, it should be noted that Boston Beer Company also made a land deal last year with a Colorado-based cannabis company AmeriCann, through which Boston Beer sold AmeriCann a 52-acre parcel of land in Massachusetts.

Boston Beer Company is a $2 billion company. Management isn’t stupid, and it likely sees the writing on the wall. Certainly, we do…

Crushing It!

While alcohol companies are citing legal cannabis as a risk to their businesses, some cannabis companies are actively making moves on alcohol companies.

Last week, it was announced that Aurora Cannabis (TSX: ACB) completed a $103.5 million investment in Liquor Stores N.A., which operates 231 retail liquor stores. This investment gives Aurora about 20% of the company.

Liquor Stores will use this cash to establish a new brand of cannabis retail outlets.

While this is a smart move for Liquor Stores, it’s a genius move on the part of Aurora. And that’s because Liquor Stores already has the infrastructure, logistics, and capacity to build and operate a large network of retail outlets, which Aurora now has a stake in.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Now, if you’ve been following the cannabis space for as long as I have, you already know that Aurora is a major player.

Members of my Green Chip Stocks investment community actually bought shares of this one less than four months ago at around $3 a share.

Here’s how that’s worked out so far:

And by the way, that’s just one of many big scores we’ve landed from the legal cannabis space.

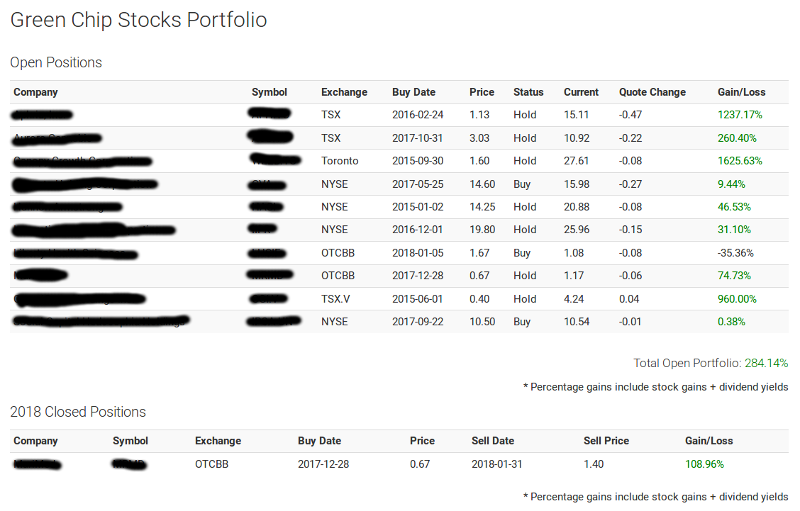

Take a look at where our portfolio sits right now:

And this, dear reader, is just the tip of the iceberg.

For legal cannabis stocks, 2018 will be its biggest year yet. And unless you hate money, you need to get some exposure to this space right now.

To help you get started, I put together this “Introduction to Cannabis Investing” video, which you can watch here.

You can also click here to get access to my best-selling e-book “A Beginner’s Guide to Investing in Cannabis.”

I strongly recommend that you don’t sit on the sidelines for this one, though.

Definitely make a move soon because, rest assured, the $1.2 trillion global alcohol industry is. And they don’t play to lose.

Get yourself a piece of this today.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter